Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

World Chemical Outlook 2019: Major Markets

by C&EN Staff

January 14, 2019

| A version of this story appeared in

Volume 97, Issue 2

Credit: Will Ludwig/C&EN/Shutterstock

World Chemical Outlook 2019

Major Markets

It’s a difficult time to be a farmer, particularly in the US. Farm incomes will continue their downward slope this year, according to the US Department of Agriculture. Costs for everything—crop protection chemicals, seeds, energy, and labor—are up.

Takeaways

Trade tensions are increasing farmers’ input costs.

Big agriculture firms are looking at start-ups to help fill their technology pipelines.

Farmers are investing in tools to protect crops from extreme weather and climate change.

And the trade war with China has cast a shadow over the farm belt. China imports 90 million metric tons (t) of soybeans every year. In 2019, more of those beans will come from Brazil.

The USDA expects Brazil’s soybean exports to soar to 10.4 million t, a 240% increase from last year. In contrast, it expects US farmers to reduce land devoted to soybeans by 7.4%.

What’s more, the Trump administration has threatened to double tariffs on chemicals and fertilizers imported from China. Those tariffs would raise the price of farm staples such as generic versions of the weed killer glyphosate.

Meanwhile, the big three crop input and seed companies—Bayer, ChemChina/Syngenta, and DowDuPont’s Corteva Agriscience—are investing both inside and outside their walls on technologies to help farmers do more with less.

For example, from its own labs, Bayer will launch a new insecticide called Vayego to control caterpillars on rice, corn, and specialty crops. The active ingredient is tetraniliprole, a carboxamide.

From outside, Bayer has new digital technologies thanks to its acquisition of Monsanto. That deal brought the Climate Corporation, a Monsanto subsidiary active in precision agriculture—the fast-growing business of collecting and analyzing field, crop, and weather data to create customized agronomic recommendations.

Monsanto bought the Climate Corporation in 2013, kicking off an important and ongoing trend of interest in so-called agtech. Monsanto and other established agriculture firms will pursue innovation by acquiring promising technology start-ups, according to an analysis by Finistere Ventures, which funds food and agriculture companies, and the data tracker PitchBook Data.

Indeed, corporate and venture investment in agriculture start-ups reached $1.9 billion last year and shows no sign of slowing. Most investor dollars have gone to data-driven and other precision farming tools. That leaves plenty of investment opportunity in more capital-intensive segments, such as plant science and animal technology, Finistere says.

Trade tensions among the US, Europe, and China will escalate and lead to shifts in global supply chains, say analysts at the credit ratings agency Moody’s Investors Service. Those tensions have already been felt in the automotive sector, where the outlook is for marginal increases in sales of cars and light trucks.

Takeaways

A slowdown in vehicle sales will hurt chemical makers.

A no-deal Brexit will lead to lower UK vehicle sales and cut output.

Tariffs will increase consumer costs.

The slowing growth will have a trickle-down effect on chemical makers. BASF, for instance, says its business with the automotive sector has been slipping since the third quarter of 2018. In particular, demand from customers in China slowed “significantly,” the world’s largest chemical maker says. A major factor in the slowdown, BASF says, is the trade conflict now underway between the US and China.

Overall, analysts at Moody’s are forecasting that global light-vehicle sales will increase 1.3% in 2019, down from 1.5% this year. China, which experienced double-digit sales growth as recently as 2016, saw sales drop in 2018 and may see little growth in 2019.

The UK’s approaching Brexit from the European Union could cost the UK car industry $10 billion in annual revenue, according to the consulting firm LMC Automotive. Light-vehicle production could fall to 1.4 million units in 2019 from 1.6 million in 2018 if tariffs rise under a no-deal Brexit scenario, LMC says.

500,000 fewer cars

US auto sales are projected to slip 3% to 16.7 million compared with 17.2 million in 2018.

Sources: Cox Automotive.

In the US, vehicle sales are likely to fall as tariffs and talk of a downturn spook the economy, despite current good conditions. Cox Automotive, an Atlanta-based auto research service, says US car sales will drop to about 16.7 million units this year from 17.2 million in 2018. The threat of new tariffs influenced consumers to purchase vehicles in 2018 rather than postpone to 2019, the firm concludes. Higher interest rates and stock market volatility are likely to contribute to this year’s decline, Cox adds.

Economists at the American Chemistry Council (ACC), which represents major US chemical producers, acknowledge that US auto production is set to fall in 2019, but they point out that the plastic and chemical content of vehicles is rising as the use of steel continues to decline. That trend will somewhat mute the impact of vehicle sales declines on chemical makers.

According to the ACC, each vehicle built in the US represents over $3,250 in chemical content, up from $2,664 in 2008. That content includes adhesives, coatings, fibers, plastic resins, rubber-processing chemicals, and synthetic fluids.

Complicating matters for both chemical makers and automakers are tariffs that the US and China have imposed on chemicals and other goods imported from each other. “Tariffs raise prices,” points out Ray Will, a director at the consulting firm IHS Markit. “The list of items from China subject to tariffs is staggering,” he says. For example, US auto-part makers that use fluoropolymers imported from China were hurt because of the tariffs, he notes.

US makers of the polymers, used in under-hood seals, benefited because they could raise prices, Will says. But in the end, he notes, consumers will have to bear the increased costs.

The US petrochemical expansion is in full swing because of low-cost feedstocks from shale gas. The past year has seen Dow Chemical, ExxonMobil, and Chevron Phillips Chemical ramp up massive new ethylene cracker complexes on the US Gulf Coast. Several more projects will come on line later this year.

Takeaways

Prices for the ethylene feedstock ethane have spiked in the US.

The spike is due to a shortage of capacity to fractionate natural gas liquids.

Experts see the market staying snug this year.

However, the buildup has hit a snag: the ethane needed to feed the additional capacity is in short supply.

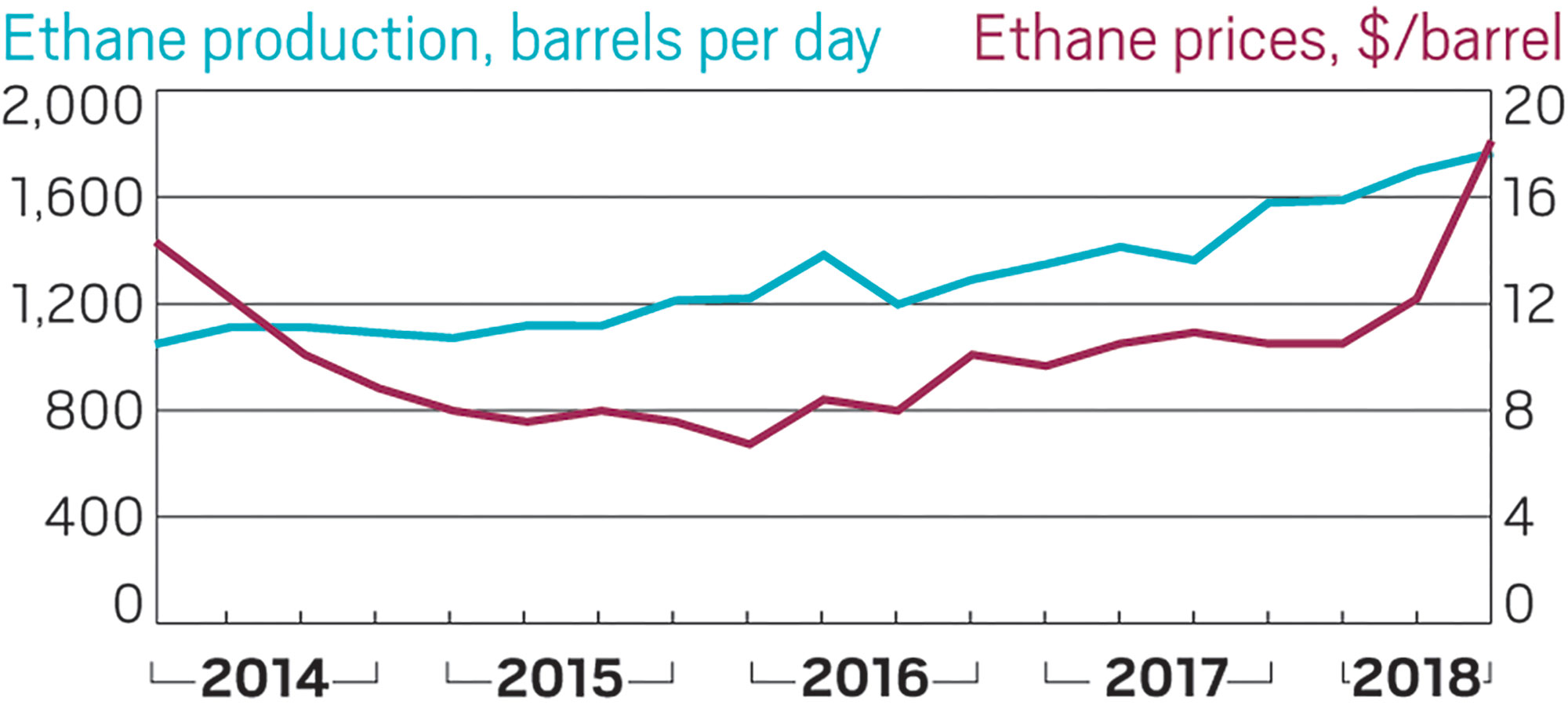

Ethane prices have risen from about $11 per barrel at the beginning of 2018 to over $18 in the third quarter. According to the chemical consulting firm IHS Markit, they spiked to an average of $22 in September.

Yanyu He, executive director and head of natural gas liquids pricing at IHS, says gas production is strong. The problem is that midstream oil- and gas-processing companies have yet to build enough capacity to fractionate natural gas liquids—a mixture of hydrocarbons such as ethane, propane, and butane—into their constituent parts for final sale.

Ethane prices shot up in 2018 as production continued steady gains.

“The energy industry tries to be all in sync,” He says. “But due to vast investment cycle differences in the different parts of the long industry value chain, every now and then there is a disconnect.”

The petrochemical plants have been in the works for five years or longer, so why weren’t midstream companies ready with capacity?

Todd Dina, IHS’s executive director of light olefins, explains that midstream companies don’t build capacity for downstream users; they build to accommodate production coming out of upstream gas fields. When oil and gas prices slumped in 2015 and 2016, exploration declined, and midstream players pulled back.

Oil and gas fields are producing again, but as DCP Midstream CEO Wouter van Kempen pointed out in a recent conference call, energy firms can ramp up natural gas production faster than companies like his can build infrastructure to process it. “Building long-haul pipelines, fractionators, and gas-processing plants takes much, much more time,” he said.

Companies are building fractionators that will start up this year and in 2020, Dina says. But until then, the market will be tight. Dina estimates that this year the industry will face a shortfall of up to 250,000 barrels of ethane per day, about enough to run three new ethylene crackers.

The pharmaceutical chemical services sector may show signs of peaking in 2019 after a near-10-year streak of double-digit growth. But a greater concern for the year ahead is China, which poses both problems and opportunities for contract development and manufacturing organizations (CDMOs).

Takeaways

China’s environmental crackdown will continue to threaten raw material supply.

Contract development and manufacturing organizations are heartened by a fast-growing market for APIs in China.

A long upswing in profitability may peak.

Sources agree that the Chinese government’s environmental crackdown, launched last year, will continue to disrupt raw material supplies, increasing costs for Western producers.

On the other hand, that disruption will boost production of intermediates and even generic-drug active pharmaceutical ingredients (APIs) in the US and Europe.

“Right now, it’s problematic for CDMOs using Chinese starting materials,” says Shawn P. Cavanagh, chief operating officer of US-based Cambrex. “I don’t think the end is close. But there has also been an opportunity, especially on the generic side, where we are taking advantage of customers moving away from China.”

Companies with API plants in China have other considerations. Marianne Späne, head of business development at Siegfried, a Swiss CDMO, says her company’s European business will continue to be affected by erratic supply of raw materials from China.

However, she also sees opportunity to serve burgeoning pharmaceutical development there. Späne says Siegfried’s API facility in China is poised for growth in business from both Chinese firms and Western firms pursuing the Chinese market. “We really think that in the future these companies will see an advantage to having everything produced in China,” she says.

Lee Newton, vice president of API development at Lonza, another Swiss CDMO, agrees. The plant closures in China last year “were a bump in the road,” he says. “But I think it will be full speed ahead. I believe in China as a place to do manufacturing.”

James Bruno, president of the consulting firm Chemical and Pharmaceutical Solutions, doubts the sector will hit a new peak in 2019. Although US drug approvals hit a record in 2018, many were for rare or small-population diseases with modest API needs. “I think it will be a slow, gradual decline, though, before we hit bottom,” he says. “That would be five years rather than two years away.”

Scientific instrument users can expect helium shortages throughout 2019. In fact, the shortages are likely to continue into 2020 and beyond, predicts Phil Kornbluth, a consultant who previously ran helium operations at BOC and Matheson Tri-Gas.

Takeaways

Helium shortages will persist throughout 2019 and beyond.

More price increases are on the way.

Three big Russian projects could provide relief after 2027.

Costs for the noble gas, used to cool nuclear magnetic resonance magnets and as a carrier in gas chromatography and mass spectrometry, are also likely to go up dramatically, Kornbluth notes. “Expect double-digit percent increases,” he says.

The aggressive price increases are not likely to free up much gas, Kornbluth cautions. In situations where substituting or recycling is possible, people have already largely done so, he says. In some cases, mass spectrometry users have substituted hydrogen for helium. In other cases, NMR operators have installed helium-recycling systems.

Over the past decade, regular US auctions of government stockpiles have supplied about 20% of global helium demand. However, the government held its last helium auction at the end of August 2018, and remaining stockpiles are reserved for federal users. In the meantime, only a few new sources are coming on line.

Kornbluth points to a few small projects that will provide some relief. Over the next 6–12 months, Praxair will regain access to about 3 million m3 of crude helium annually from a supplier whose plant had been damaged in a fire, he says. Another small helium supplier, Shiprock Helium, will bring on about 2 million m3 of new capacity—a drop in the bucket compared with global helium production of 160 million m3.

The next big helium project likely to come on line is from Qatar. The 12-million-m3-per-year facility, originally expected to start up in 2018, is now likely to open in 2020, Kornbluth says. Repairs to an undersea pipeline that will feed the facility have taken longer than expected. “It’s a big project,” he says.

Gazprom’s Amur gas-processing project in eastern Siberia is expected to add three 19 million m3 helium increments to global supplies in 2021, 2022, and 2025–27. The additional helium will end shortages—at least for a while.

Artificial intelligence will increase in importance in pharmaceutical research in 2019, though most labs will still be discovering the limitations of a technology that fosters both high expectations and high anxiety.

Takeaways

Molecular synthesis techniques are on the to-do list.

Data management remains an ongoing challenge.

Artificial intelligence remains in a hype cycle as researchers find its level in the lab.

AI tools for property prediction and materials synthesis developed by a consortium of drug companies and information technology suppliers have already begun to show results, says Regina Barzilay, a professor of computer sciences at the Massachusetts Institute of Technology and codirector of the consortium. The group, Machine Learning for Pharmaceutical Discovery and Synthesis Consortium, is eager to get to work this year on tools for designing synthesizable molecules with particular properties, also called molecular generation, she says.

Hugo Ceulemans, scientific director of discovery data science at Janssen in Beerse, Belgium, says his company saw AI enable research in “a few niches” in 2018, including compound activity prediction. He anticipates “expansion to a much broader coverage of chemistry and chemical reactions, predicting how well reactions can occur and how you can initiate them.”

In 2019 Janssen will seek to advance machine learning—the ability of data analysis tools to improve after exposure to information—to incorporate not only stored data but also force-field analysis and quantum mechanics in molecular modeling, he says.

The company will also work on getting its data in order. “But what we can’t do is keep waiting to get the data in order, because just as you get it, more comes in,” says Anastasia Christianson, vice president of R&D IT at Janssen. “I am of the opinion that if you wait to get all the data in order, you are never going to do good analysis.”

Consultant Michael Elliott, CEO of Atrium Research & Consulting, says AI will continue to work through a typical IT “hype cycle” as it finds its level in laboratories. Many companies have gotten off to a bad start, he notes, amassing “data teams that end up searching for a problem to solve.”

Scott Spangler, chief data scientist for life sciences with IBM, concedes that vendors “kind of led people to believe you just ask the question and the system will give you the answer.” AI, he says, is based on a “partnership” between the researcher and the machine.

“This is not a technology that you just sort of whip out and get the benefit,” he says. “You have to change the way you are doing science now, and that is not going to happen overnight.”

Economy

Economic expectations that will influence the business of chemistry in 2019

by Business Department

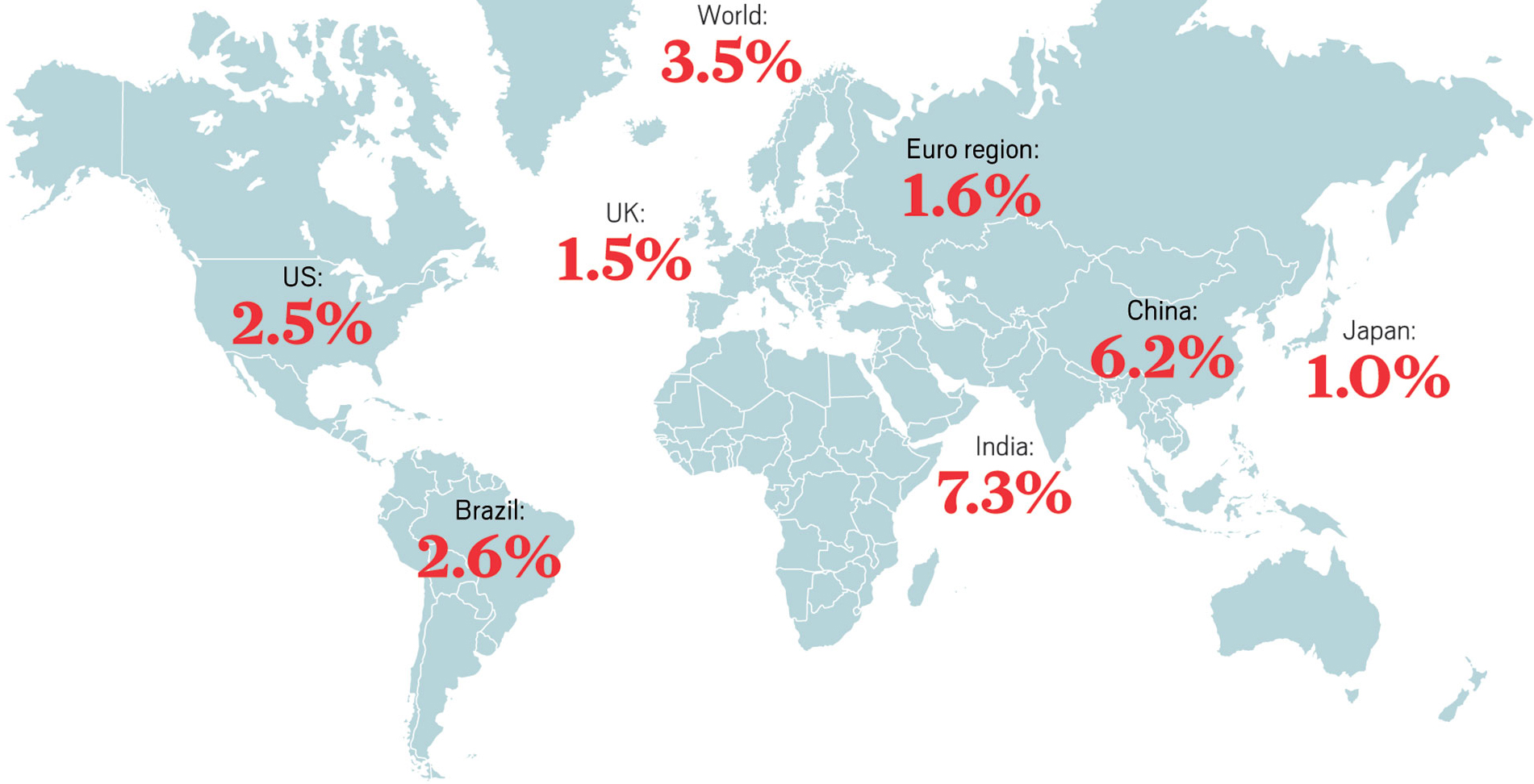

GDP growth

Source: Goldman Sachs. Credit: C&EN/Shutterstock

US chemical output growth

3.6%

Source: American Chemistry Council.

Note: Excludes pharmaceuticals.

US wage growth

3.25–3.50%

Source: Goldman Sachs.

US crop acreage change

Corn:

3.3%

Soybeans:

–7.4%

Source: US Department of Agriculture.

US manufacturing revenue growth

5.7%

Source: Institute for Supply Management.

US inflation

2.3%

Source: Kiplinger.

US oil production

12.1 million barrels per day, up 11%

Average US oil price

$54.19 per barrel, down 17%

Average US natural gas price

$3.11 per million Btu, down 2%

Source: US Energy Information Administration.

World

3.5%

US

2.5%

Japan

1.0%

Euro region

1.6%

UK

1.5%

China

6.2%

India

7.3%

Brazil

2.6%

Source: Goldman Sachs.

US chemical output growth

3.6%

Source: American Chemistry Council.

Note: Excludes pharmaceuticals.

US wage growth

3.25–3.50%

Source: Goldman Sachs.

US crop acreage change

Corn:

3.3%

Soybeans:

–7.4%

Source: US Department of Agriculture.

US manufacturing revenue growth

5.7%

Source: Institute for Supply Management.

US inflation

2.3%

Source: Kiplinger.

US oil production

12.1 million barrels per day, up 11%

Average US oil price

$54.19 per barrel, down 17%

Average US natural gas price

$3.11 per million Btu, down 2%

Source: US Energy Information Administration.

Note: Percentages reflect expected changes from 2018 to 2019.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter