Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Consumer Products

Pfizer and GlaxoSmithKline combine consumer health care businesses

New venture will operate as a separate company owned by GSK

by Rick Mullin

December 19, 2018

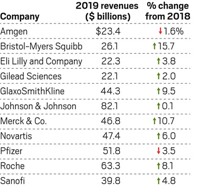

Pfizer and GlaxoSmithKline plan to merge their consumer health products divisions into a joint venture in which GSK will hold a 68% stake. The deal, continuing a trend in the shuffling of over-the-counter (OTC) drug businesses between big drug companies, will effectively merge Pfizer’s consumer health business with GSK’s, after which GSK will operate as two separate companies.

With combined sales of $12.7 billion in 2017, the new venture will be the largest consumer health business with leading positions in categories including pain and respiratory relief, vitamin and mineral supplements, digestive and skin health, and therapeutic oral health.

Brian McNamara, current head the company’s consumer health care business, will be CEO of the new joint venture.

The announcement follows GSK’s acquisition of Novartis’s stake in their consumer health venture, a deal that transpired in April, a week after GSK dropped out of the bidding for Pfizer’s consumer health care business. More recently, the company acquired the cancer drug firm Tesaro for $5.1 billion.

Emma Walmsley, CEO of GSK, says the deal with Pfizer will advance GSK’s current program of prioritizing R&D programs, presenting “a clear pathway forward for GSK to create a new global pharmaceuticals-vaccines company, with an R&D approach focused on science related to the immune system, use of genetics and advanced technologies, and a new world-leading consumer health care company.”

Albert Bourla, chief operating officer and incoming CEO at Pfizer says the combined OTC businesses, “will be more sustainable and broader in scope than either company individually.”

John LaMattina, senior partner at the health care venture firm PureTech and former head of research at Pfizer, notes that Pfizer has sold off consumer products businesses several times over the last 20 years. “Pfizer clearly feels that a consumer business unit is a distraction to its core pharmaceuticals business,” he told C&EN.

Large pharma companies are split in their current take on OTC operations, with Merck KGaA selling its consumer health business to Procter & Gamble earlier this year for $4.2 billion. Johnson & Johnson, with flagship brands such as Tylenol and Benadryl remains an OTC stalwart, and Sanofi has made significant acquisitions of OTC businesses, including Chattem in 2010 and Boehringer Ingelheim’s operation in 2014.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter