Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Economy

Trade group expects US chemical rebound in 2022

Chemical industry might take off if it is able to leave logistical woes behind

by Alexander H. Tullo

December 8, 2021

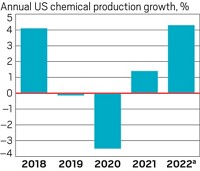

Supply chain constraints in 2021 held back what should have been a healthy recovery from the 2020 pandemic doldrums for the US chemical sector. But the logistics snarls may be easing, meaning 2022 should be the year when an unfettered industry rebounds strongly, according to a year-end report from the American Chemistry Council (ACC), a trade group.

Forecast

1.4%

Increase in US chemical production in 2021

4.3%

Expected increase in US chemical production in 2022

Source: American Chemistry Council.

The US chemical industry saw production volumes decline 3.5% in 2020, the year when the COVID-19 pandemic shut down broad swaths of the economy for months, including key chemical markets such as car manufacturing. The ACC expects the industry to finish 2021 with 1.4% production growth and then expand by a healthy 4.3% in 2022.

A year ago, the ACC forecast that the industry would enjoy a 3.9% rebound this year. However, the economy has faced issues such as congested ports and shortages of truck drivers and other workers.

“You have this big surge of demand, and the existing supply-chain networks are inadequate to meet that demand,” ACC chief economist Martha Moore told reporters at a Dec. 7 press conference to discuss the report.

In addition, certain industries were hit by their own troubles. A winter freeze in Texas earlier this year and storms such as Hurricane Ida in August sidelined oil, gas, and petrochemical production for months.

And one big chemical user—the auto industry—has had trouble getting moving again due to shortages of microchips it needs to build cars. The US auto industry sold 15.3 million vehicles in 2021, an improvement over the 14.5 million sold the year before, but still below 2019’s 17.0 million mark.

Moore noted encouraging supply-chain trends, such as increased chemical tanker traffic through the Port of Houston. “We are seeing signs that things are starting to loosen up,” she said.

But if they don’t, the rosy 2022 forecast could be in jeopardy. “There is a risk that those supply-chain constraints continue to present headwinds to any number of industries,” Moore said. Other risks include a new surge of coronavirus cases from strains like Omicron.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter