Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

C&EN's Global Top 50 chemical firms for 2021

The chemical industry is recovering from the COVID-19 pandemic

by Alexander H. Tullo

July 26, 2021

| A version of this story appeared in

Volume 99, Issue 27

Credit: C&EN/Shutterstock

Update

To read the current Global Top 50 Chemical Companies article please click here

Global Top 50 interactive table

Global Top 50 Interactive Table

Click through an interactive look at the Global Top 50 with complete data going back to 2007. Be sure to also check out our US Top 50 information presented in the same interactive format.

Downloads

PDF of C&EN’s Global Top 50 chemical companies for 2020

Previous Coverage

Top 50 US chemical producers of 2021

The global chemical industry made it through the worst of the COVID-19 pandemic with scratches and abrasions but few broken bones.

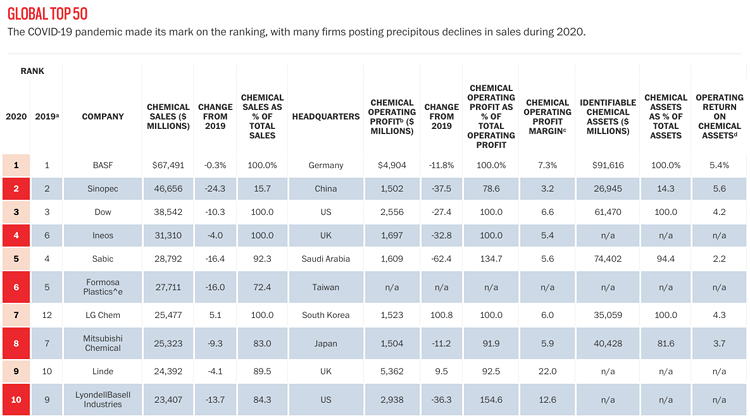

According to data from C&EN’s Global Top 50 survey, the world’s largest chemical firms posted a 7.1% decline in chemical sales from 2019, to $795.8 billion in 2020, the fiscal year on which the survey is based.

It’s not a bad result, considering that economies around the world were shut down early last year to stem the global health crisis. The 50 firms that appeared in C&EN’s previous survey, which was mostly based on performance in prepandemic 2019, posted a 5.0% decline in chemical sales.

And although 2020 chemical earnings fell 22.6% for the 44 of the 50 firms that disclose chemical profits, they fell more—28.2%—in 2019 for the 46 companies disclosing profits on the list, when business in many major markets and economies was beginning to slow.

According to the European Chemical Industry Council, a trade association, global chemical output declined by 0.1% in 2020. The industry basically ended up where it started.

Oil prices tell some of the story. Early last year, as the economy froze up and people stayed home, crude prices crashed, dragging chemical prices down with them. Petrochemical volumes, however, were relatively strong because some products, such as polyethylene, saw an uptick in demand.

Indeed, COVID-19 affected the chemical industry unevenly. For instance, chemical companies that sell materials to aerospace and automotive customers were hit hard. But suppliers of materials for food packaging and personal protective equipment saw strong sales.

COVID-19 wasn’t the only theme for the year. Another one, not reflected in the data, was sustainability. Almost all chemical firms are focused far more on environmental performance than they were just a few years ago.

For instance, more than a dozen members of the Global Top 50 have major plastics recycling initiatives. A similar number of companies are looking to make ammonia and hydrogen via water electrolysis rather than from natural gas. Still others are overhauling basic petrochemical processes to make them more energy efficient. Dow, Shell, Sabic, and BASF, for example, are developing ethylene crackers that run on renewable electricity.

Despite the year’s volatility, the survey was marked by few changes. Companies heavily laden with petrochemical operations generally saw declines in sales and fell in the ranking. Companies that make industrial gases or agricultural chemicals tended to rise.

Three companies in the Global Top 50 a year ago didn’t make it this year. Ecolab fell off the list because it divested an oil-field chemical business. SK Innovation and PTT Global Chemical were both victims of declines in petrochemical sales.

Now that it is breaking out chemical sales again, Shell rejoins the Global Top 50 this year after a 5-year hiatus. Rongsheng Petrochemical, which makes polyester chemicals, debuts this year. The former DowDuPont agricultural chemical business, Corteva Agriscience, made the cut as well.

1

BASF

2020 chemical sales: $67.5 billion

For the second year in a row, BASF leads the Global Top 50 as the world’s largest chemical maker. And because it managed, despite the COVID-19 pandemic, to avoid a big decline in sales, the German chemical company widened its sales lead over the number 2, Sinopec, from about $5 billion in 2019 to nearly $21 billion in 2020. Though BASF is an industry leader, its greenhouse gas emission goal—released in 2019—had been relatively modest: keep its carbon dioxide output level as it grows throughout the 2020s. This year, BASF changed course and unveiled a more ambitious target: a drop of 25% compared with 2018 emissions by the end of the decade. Because BASF is building a major complex in China, the new goal means the firm will need to halve emissions from its current operations. BASF is working on technologies that will help it meet the ambitious target. It is testing renewable energy–powered electric heaters in steam crackers, as opposed to fossil-fueled furnaces, and it plans to use electrolysis to generate hydrogen. The German company trimmed its portfolio recently. In June, it completed the sale of its pigment business to Japan’s DIC for $1.4 billion. And BASF and Clayton, Dubilier & Rice are selling their Solenis water treatment chemical joint venture to the private equity firm Platinum Equity in a deal valued at $5.25 billion.

2

Sinopec

2020 chemical sales: $46.7 billion

Being China’s largest chemical maker, Sinopec was hit by the COVID-19 pandemic before most of the world’s other large chemical companies. Indeed, the company saw a 24% decline in chemical revenues last year. It also experienced a 38% slump in operating profit. Despite the setback, Sinopec is focused on long-term growth and has a more ambitious capital expansion program than most large chemical companies. For instance, Sinopec will complete construction of new ethylene cracker complexes this year and in the next 2 years in Zhenhai, Hainan, and Tianjin, China. Additionally, it will begin construction next year on a large propane dehydrogenation plant in Zhenhai that it hopes to finish in 2025.

3

Dow

2020 chemical sales: $38.5 billion

Tightening its belt in the face of the COVID pandemic, Dow launched a cost-cutting program last July. The firm said it was reducing its workforce by 6%—about 2,200 jobs—in an effort to save more than $300 million annually by the end of 2021. The program is also hitting manufacturing: the company is shutting down amine and solvent plants in the US and Europe and closing small polyurethane plants and coatings reactors. Dow also divested terminal and rail assets in 2020. Amid the cuts, the company is making investments. For example, Dow plans to build a $250 million specialty chemical plant in Zhanjiang, China. Initially, the plan will focus on new specialty polyurethane and alkoxylate facilities. Dow says it may launch additional projects at the site in the future.

4

Ineos

2020 chemical sales: $31.3 billion

The British chemical maker Ineos reunited most of the old BP Chemicals in January when it completed its $5 billion purchase of BP’s aromatics business. The business, which generated sales of about $3.6 billion in 2020, is one of the world’s largest producers of purified terephthalic acid, a polyethylene terephthalate raw material. The business is also a large acetic acid producer. It will join BP’s former olefin and polyolefin business, which Ineos acquired in 2005 for $9 billion. In a smaller purchase last year, Ineos bought out its partner Sasol’s 50% interest in Gemini HDPE, a high-density polyethylene joint venture in La Porte, Texas. The partners completed the plant, housed at an Ineos site, in 2017. When it isn’t making acquisitions, Ineos is investing in sustainability. At its Rafnes site in Norway, the firm is installing a 20 MW electrolyzer to make hydrogen from water. And its Ineos Styrolution unit is planning a plant in France that will depolymerize polystyrene into its raw material, styrene.

5

Sabic

2020 chemical sales: $28.8 billion

Saudi Arabia’s state oil company, Saudi Aramco, completed its purchase of a 70% stake in the petrochemical maker Sabic in June 2020. The purchase was meant to diversify Aramco, which today depends heavily on oil and gas. But soon after the deal closed, the firms announced they were reevaluating the scope of a planned complex that was to convert 400,000 barrels per day of crude oil into 9 million metric tons (t) per year of petrochemicals. Their new, more modest plan is to build an ethylene cracker and derivatives units that will be integrated with existing Aramco refineries. In another instance of Sabic and Aramco working together, the companies shipped 40 t of ammonia to a power plant in Japan last September. The ammonia is considered “blue” because carbon dioxide emitted during its manufacture was captured and used for enhanced oil recovery and methanol production in Saudi Arabia. In another strategic move, Sabic carved out a stand-alone business that includes its polyphenylene oxide, polyetherimide, and compounding units. The company got the businesses with its purchase of GE Plastics in 2007. Sabic had sought to combine them with Clariant’s masterbatch business, but those talks broke down in 2019.

6

Formosa Plastics

2020 chemical sales: $27.7 billion

Advertisement

The $9.4 billion petrochemical complex that Formosa Plastics is planning in St. James Parish, Louisiana, is in hot water. It faces fierce opposition both locally from community organizations worried about pollution and nationally from environmental groups that wish to stop the mounting production of plastics. Sharon Lavigne, head of the local group Rise St. James, recently received the prestigious Goldman Environmental Prize for her efforts, a sign that the Formosa project has high-profile opposition. The project also faces practical hurdles. Notably, the US Army Corps of Engineers suspended a permit for the facility in November. Formosa Plastics had better luck in Point Comfort, Texas, where it started up an ethylene cracker and low-density polyethylene unit last year.

7

LG Chem

2020 chemical sales: $25.5 billion

LG Chem and another South Korean firm, SK Innovation, settled a battery technology dispute in April that threatened to snarl US production of electric vehicles. LG had accused SK of trade secret theft and will now get a $1.8 billion cash payment and future royalties. SK nearly abandoned plans to produce batteries in Georgia over the conflict. The settlement was important enough that US president Joe Biden weighed in, noting in a statement that the US needs “a strong, diversified and resilient U.S.-based electric vehicle battery supply chain.” In other news related to batteries, LG announced in April that it had more than tripled its capacity in Yeosu, South Korea, to make carbon nanotubes, used as a conductive additive.

8

Mitsubishi Chemical

2020 chemical sales: $25.3 billion

Jean-Marc Gilson took over as the Japanese company’s CEO in April, replacing the retiring Hitoshi Ochi. As a non-Japanese CEO, Gilson is a rarity in Japan and a first for Mitsubishi Chemical. One of the company’s major projects is the construction of a US methyl methacrylate (MMA) plant using its Alpha technology, which makes the acrylic resin precursor from ethylene, methanol, and carbon monoxide rather than the hydrogen cyanide and acetone typically used. Mitsubishi had been considering such a project for nearly a decade. Now, the firm is buying land in Geismar, Louisiana, and hopes to have a plant completed by 2025. Additionally, the company has closed an older MMA plant in Beaumont, Texas, paving the way for the new one. Mitsubishi is also trying to make acrylics more recyclable. The firm is building a demonstration plant in Japan with Microwave Chemical to test technology for breaking down acrylics using microwave radiation. It is also working with Agilyx on disassembling the polymers with pyrolysis.

9

Linde

2020 chemical sales: $24.4 billion

Linde is gearing up to bring its industrial gas and engineering expertise to bear on sustainable chemistry. At a coal-fired power plant in Springfield, Illinois, it is installing a carbon-capture pilot plant. In Burghausen, Germany, Linde aims to make methanol from green hydrogen and carbon dioxide in partnership with Wacker Chemie. And a joint venture between Linde and ITM Power is planning a hydrogen-producing electrolyzer, dubbed the world’s largest to be based on proton-exchange membranes, by 2022. Linde is also working with BASF and Sabic to develop cracking furnaces that run on electricity furnished by alternative energy rather than fossil fuels. With Shell, the company is working on a catalytic oxidative dehydrogenation process to make ethylene.

10

LyondellBasell Industries

2020 chemical sales: $23.4 billion

Most large chemical companies nowadays are plunging into plastics recycling to counter public backlash, and LyondellBasell Industries is at the front of the pack. CEO Bob Patel is one of the founders of the Alliance to End Plastic Waste, formed by industry to address the recycling problem. And Lyondell has its own initiatives. It and the waste management firm Suez bought the plastics recycler Tivaco and are combining it with Quality Circular Polymers, a recycling venture Lyondell and Suez started in 2018. Quality Circular has some high-profile clients. For example, Samsonite is using its resin for a line of sustainable suitcases. Meanwhile, Lyondell continues to grow its core petrochemical business, often on the cheap. In December, the firm bought, for the bargain price of $2 billion, a 50% interest in a new ethylene cracker and two polyethylene plants that the struggling Sasol had built. Similarly, it bought into an ethylene cracker joint venture already under construction in China.

11

ExxonMobil Chemical

2020 chemical sales: $23.1 billion

While oil companies such as Shell and BP were redefining themselves as alternative energy players in recent years, ExxonMobil stuck with petroleum. The firm was taking what it considered a realistic position. Oil and gas are cheap and convenient, it argued, and would be hard to dislodge from the energy market for the next few decades. But COVID-19 hit the oil and gas business hard. ExxonMobil racked up a gaping corporate loss of $28 billion in 2020, even as its chemical unit earned an operating profit of $2.7 billion. The company is facing shareholder pressure to change, and it is starting to respond. For example, in April, it outlined a $100 billion plan to store 100 million metric tons per year of carbon dioxide in the Gulf of Mexico. The new environmental consciousness trickles down into chemicals. At a complex in France, ExxonMobil Chemical plans to host a pyrolysis plant that breaks down waste plastics into chemical raw materials. And at its Baytown, Texas, chemical facility, it is testing a plastics recycling process. Separately, in a rare move, ExxonMobil is divesting a business, selling its Santoprene thermoplastic vulcanizate operation to Celanese for $1.15 billion.

12

Air Liquide

2020 chemical sales: $23.1 billion

Air Liquide has ambitious sustainability goals, including becoming carbon neutral by 2050. As a symbolic gesture in that direction in May, the company provided green, or carbon-neutral, hydrogen to Paris de l’hydrogène, an event where artists colorfully illuminate the Eiffel Tower. More tangibly, that same month, Air Liquide, Rothschild & Co., and the Solar Impulse Foundation announced a $236 million fund to foster environmentally friendly companies. The consortium will invest in areas such as clean energy, sustainable food, the circular economy, smart cities, and sustainable mobility. Air Liquide’s venture capital arm has invested $120 million in 35 companies since it was founded in 2013. In April, for instance, it announced an investment in Inopsys, a specialist in the on-site treatment of wastewater generated while making pharmaceuticals and fine chemicals.

13

PetroChina

2020 chemical sales: $21.8 billion

Advertisement

PetroChina will bring a pair of unique petrochemical projects—which cost a total of $2.5 billion—on line later this year. The company is building ethylene crackers in Tarim and Changqing, China, that will use ethane sourced from domestic natural gas fields as their feedstock. These projects wouldn’t be unusual in the US or the Middle East, where oil and natural gas are cheap and plentiful, but ethylene crackers in resource-constrained China are mostly fed with naphtha derived from imported oil. The country also sources petrochemical feedstocks from coal. Both routes to ethylene are relatively expensive and put China at a competitive disadvantage.

14

DuPont

2020 chemical sales: $20.4 billion

As DuPont separated from DowDuPont in 2019, observers wondered how long the company would last. DuPont executive chairman Ed Breen once presided over the breakup of the industrial conglomerate Tyco, causing some to reckon he had similar plans for DuPont. It now appears that DuPont is here to stay, with Breen satisfied that the company has done enough portfolio restructuring to stand on its own. The largest of those moves came in February, when the company completed the sale of its Nutrition & Biosciences division to International Flavors & Fragrances. The sale yielded $7.3 billion in proceeds. DuPont also agreed to sell its biomaterials business, a producer of 1,3-propanediol, and it divested its stake in the polysilicon maker Hemlock Semiconductor. Breen elected to keep DuPont’s electronic materials business, which he had been considering selling. In fact, DuPont is adding to this business, agreeing in March to purchase Laird Performance Materials, which makes materials for heat management in electronics, for $2.3 billion.

15

Hengli Petrochemical

2020 chemical sales: $17.3 billion

Hengli Petrochemical’s growth has been amazing. Last year, the company came out of nowhere to debut at 26 in the Global Top 50. In 2020, and despite the COVID-19 pandemic, the Chinese petrochemical maker’s chemical sales grew by a whopping 46%. Construction at an almost unbelievable pace is responsible for this growth. In 2020 alone, Hengli started two large production lines for purified terephthalic acid (PTA), a polyester raw material, in Dalian, China. The lines, which use technology from Invista, bring Hengli’s PTA capacity to 12 million metric tons (t) per year. In November, Hengli signed a licensing agreement, also with Invista, for two more PTA lines at its site in Huizhou, China. In addition, the company plans to build a plant in Dalian to make a biodegradable plastic from PTA, adipic acid, and 1,4-butanediol. Hengli says the plant will have 450,000 t of annual capacity, a large figure for a biodegradable plastic.

16

Sumitomo Chemical

2020 chemical sales: $15.8 billion

The Japanese chemical maker has emphasized green projects of late. In June, it signed an agreement to use Ginkgo Bioworks’ synthetic biology capabilities to improve the production of an undisclosed biobased chemical and to make other Sumitomo Chemical products. Sumitomo’s similar relationship with Zymergen resulted in a biobased film for displays and touch screens. Sumitomo is also building a pilot plant in Chiba, Japan, that will make ethylene from ethanol supplied by Sekisui Chemical. In addition, Sumitomo is planning a facility in Singapore that will make methanol from carbon dioxide and hydrogen. To investigate even more technologies with low environmental impact, Sumitomo is building a research facility in Chiba.

17

Toray Industries

2020 chemical sales: $15.2 billion

The Japanese chemical maker had a rough 2020 because of the COVID-19 pandemic. Chemical sales were down 14%, and chemical operating profit dropped 32%. Toray Industries’ carbon fiber composites business saw a 23% sales drop. Airlines were decimated by COVID-19-related travel restrictions and halted aircraft orders, forcing the company to shut a composite materials plant in Spartanburg, South Carolina. Toray’s textile fiber business also struggled because of slack demand for apparel and industrial fibers during the pandemic. The performance wasn’t offset by brisk business in nonwoven fabrics for medical masks and gowns.

18

Shin-Etsu Chemical

2020 chemical sales: $14.0 billion

Shin-Etsu Chemical’s Shintech subsidiary calls itself the world’s largest polyvinyl chloride (PVC) maker. A new investment, announced in January, should help it expand that lead. Shintech intends to spend $1.3 billion to build new capacity in Plaquemine, Louisiana, for PVC and its precursors chlorine and vinyl chloride. The company will complete a previously announced project—of similar cost and scope—at the site this year. Strengthening another business in which it has a strong position, Shin-Etsu will spend $285 million to expand photoresist output in Taiwan and Japan.

19

Evonik Industries

2020 chemical sales: $13.9 billion

Recently, Evonik Industries has been favoring small acquisitions that provide access to new technology. In June, it inked an agreement to buy Infinitec Activos for an undisclosed sum. Infinitec specializes in delivery methods—such as peptide-studded gold and sapphire nanoparticles, lipid vesicles, and nanoscale alginate hydrocolloid capsules—for cosmetic ingredients. In November, Evonik bought Houston-based Porocel Group, a provider of refinery catalysts and catalyst regeneration services, for $210 million. Evonik has built a burgeoning business in lipids for the delivery of messenger RNA (mRNA) used as a COVID-19 vaccine. And it recently launched a collaboration with Stanford University to develop a degradable polymer–based system for delivering mRNA therapeutics. In more traditional industrial chemistry, the company is building a $470 million plant in Marl, Germany, for making nylon 12, a high-end polymer critical for automotive applications such as brake lines. Evonik is considering the sale of its superabsorbent polymer unit, which employs 800 people.

20

Reliance Industries

2020 chemical sales: $13.6 billion

Advertisement

Reliance Industries has been trying to sell a 20% stake in its refining and chemical business to Saudi Aramco, but talks are going slowly. To ease the deal and allow for other transactions, such as an initial public offering of the business, Reliance is now carving the business into a stand-alone firm. It expects to complete the process by year’s end. But Reliance, India’s largest private sector company, isn’t losing interest in chemicals. Just last month, the firm announced a massive investment in Abu Dhabi, United Arab Emirates, with Abu Dhabi National Oil to build chlorine, ethylene dichloride, and polyvinyl chloride plants.

21

Covestro

2020 chemical sales: $12.2 billion

Covestro spun off of Bayer in 2015 with just two main chemistries: polyurethanes and polycarbonates. The company finally made a major diversification move in April with its $1.8 billion purchase of DSM’s resin and functional materials business, which generated sales in 2019 of about $1.2 billion. In the transaction, Covestro is getting 3D-printing materials, antireflective coatings for photovoltaic panels, adhesives for recyclable carpets, acrylic resins for paints, and optical fiber coatings. In its core business, Covestro is spending $50 million to build a plant in Map Ta Phut, Thailand, by the end of next year that makes its Vulkollan polyurethane elastomers.

22

Shell Chemicals

2020 chemical sales: $11.7 billion

Shell Chemicals returns to the Global Top 50 after a 5-year hiatus because it is disclosing its chemical sales figures again. The return comes as the larger Shell organization plans massive changes that will profoundly impact both its chemical and oil businesses. Shell plans to achieve net-zero carbon emissions by 2050, meaning it will have to reduce, or offset, all its greenhouse gas emissions. It will redefine itself as something other than an oil company. Its 13 refineries will become 6 energy and chemical “parks” that will increasingly supply renewable energy and chemicals produced from alternative feedstocks. Shell is part of a consortium that will build a water electrolysis plant in Germany to make green hydrogen. The firm is replacing 16 ethylene steam cracker furnaces in Moerdijk, the Netherlands, with 8 new ones to reduce carbon emissions by 10%. Shell is collaborating with Dow to replace conventional gas-fired ethylene furnaces with electrically heated ones that run on renewable power. And it is starting to use synthetic crude oil derived from waste plastics at its ethylene cracker in Norco, Louisiana.

23

Yara

2020 chemical sales: $11.6 billion

The Norwegian fertilizer maker aims to get into the business of ammonia fuel for shipping and other industries. Yara plans to install water electrolysis units at its Porsgrunn, Norway, facility to generate the hydrogen it needs to make about 500,000 metric tons per year of ammonia. The plant currently generates hydrogen from natural gas. The electricity for the process would come from Norway’s grid, already almost completely renewable thanks to the country’s expansive hydroelectric power resources. Yara wants to produce such green ammonia outside Norway, too. In Pilbara, Australia, it plans to make ammonia with solar power. And in Sluiskil, the Netherlands, it is studying ammonia based on offshore wind.

24

Braskem

2020 chemical sales: $11.3 billion

Many people would think of Dow and BASF as the technology giants in industrial chemistry. But Braskem, a Brazilian petrochemical maker, is a technological heavy hitter too. It is partnering with the University of Illinois Chicago on a route to ethylene based on the electrochemical reduction of carbon dioxide from flue gas. At its chlor-alkali complex in Maceió, Brazil, Braskem will host a pilot plant to make ethylene dichloride using a novel process developed by the start-up Chemetry. In this energy-saving process, called eShuttle, chloride ions react with cuprous chloride (CuCl) to form cupric chloride (CuCl2), which reacts with ethylene to form the polyvinyl chloride raw material. In Pittsburgh, Braskem recently completed a $10 million expansion of its technology and innovation center to allow work on recycling, 3D printing, and catalysis.

25

Mitsui Chemicals

2020 chemical sales: $11.3 billion

Mitsui Chemicals is increasingly emphasizing sustainability. In June, the Japanese company announced that it will investigate, with BASF, the efficacy of the chemical recycling of plastics—such as using pyrolysis to break them down into an ethylene cracker feedstock. Mitsui is also spending $370 million to triple capacity for the polyurethane raw material methylene diphenyl diisocyanate in Yeosu, South Korea. The company is seeing increased demand for the product in energy-saving insulation. In a small acquisition in October to build on its eyeglass lens business, Mitsui acquired Cotec, which makes hydrophobic and antireflective ophthalmic lens coatings.

Spending

Most companies pulled back on capital spending during the COVID-19 pandemic, but less so on R&D.

| Chemical capital spending | Chemical R&D spending | |||||

|---|---|---|---|---|---|---|

| 2020 ($ MILLIONS) | CHANGE FROM 2019 | % OF CHEMICAL SALES | 2020 ($ MILLIONS) | CHANGE FROM 2019 | % OF CHEMICAL SALES | |

| Air Liquide | $3,011 | 1.4% | 13.0% | $346 | -4.4% | 1.5% |

| Air Products | 2,509 | 26.1 | 28.3 | 84 | 15.1 | 0.9 |

| Arkema | 690 | -4.7 | 7.7 | 275 | -3.2 | 3.1 |

| Asahi Kasei | 941 | -3.8 | 10.1 | 308 | -10.4 | 3.3 |

| BASF | 3,570 | -18.2 | 5.3 | 2,380 | -3.3 | 3.5 |

| Borealis | 701 | 63.4 | 9.0 | 172 | 4.0 | 2.2 |

| Braskem | 535 | 2.9 | 4.7 | 49 | 1.2 | 0.4 |

| Corteva Agriscience | 250 | -14.7 | 3.9 | n/a | n/a | n/a |

| Covestro | 803 | -22.6 | 6.6 | 299 | -1.5 | 2.4 |

| DIC | 306 | -3.9 | 4.7 | 113 | -3.8 | 1.7 |

| Dow | 1,252 | -36.2 | 3.2 | 768 | 0.4 | 2.0 |

| DSM | 523 | -11.9 | 5.7 | 454 | 14.0 | 4.9 |

| DuPont | 1,194 | -51.7 | 5.9 | 860 | -9.9 | 4.2 |

| Eastman Chemical | 383 | -9.9 | 4.5 | 226 | -3.4 | 2.7 |

| Evonik | 1,091 | 8.6 | 7.8 | 494 | 1.2 | 3.5 |

| ExxonMobil Chemical | 1,813 | -6.2 | 7.9 | n/a | n/a | n/a |

| Hanwha Chemical | 455 | -42.5 | 5.3 | 62 | 39.9 | 0.7 |

| Indorama | 536 | 0.7 | 5.1 | 19 | 45.9 | 0.2 |

| Johnson Matthey | 298 | -18.6 | 3.0 | 249 | -2.5 | 2.5 |

| Lanxess | 520 | -10.2 | 7.5 | 123 | -5.3 | 1.8 |

| LG Chem | 4,689 | -11.3 | 18.4 | 945 | 1.9 | 3.7 |

| Linde | 3,455 | -9.7 | 14.2 | n/a | n/a | n/a |

| Lotte Chemical | 680 | -10.1 | 6.6 | 68 | -5.4 | 0.7 |

| LyondellBasell Industries | 1,763 | -30.3 | 7.5 | 113 | 1.8 | 0.5 |

| Mitsubishi Chemical | 2,179 | 11.5 | 8.6 | n/a | n/a | n/a |

| Mitsui Chemicals | 702 | 4.2 | 6.2 | 317 | -7.1 | 2.8 |

| Mosaic | 1,171 | -8.0 | 13.5 | n/a | n/a | n/a |

| Sabic | 3,505 | -34.2 | 12.2 | n/a | n/a | n/a |

| Sasol | 1,495 | -43.3 | 20.5 | n/a | n/a | n/a |

| Shell Chemicals | 2,640 | -35.5 | 22.5 | 109 | -2.7 | 0.9 |

| Shin-Etsu Chemical | 2,212 | -12.0 | 15.8 | 480 | 5.6 | 3.4 |

| Sinopec | 3,795 | 16.8 | 8.1 | n/a | n/a | n/a |

| Solvay | 518 | -39.5 | 4.7 | 342 | -7.1 | 3.1 |

| Sumitomo Chemical | 669 | -17.4 | 4.2 | n/a | n/a | n/a |

| Syngenta | n/a | n/a | n/a | 577 | 5.7 | 5.1 |

| Tosoh | 474 | -17.2 | 6.9 | 183 | 7.1 | 2.7 |

| Umicore | 360 | -30.2 | 3.7 | 225 | 2.5 | 2.3 |

| Wanhua Chemical | n/a | n/a | n/a | 296 | 19.8 | 2.8 |

| Westlake Chemical | 525 | -33.3 | 7.0 | n/a | n/a | n/a |

| Yara | 739 | -30.7 | 6.4 | 91 | 1.1 | 0.8 |

Sources: Company documents, C&EN analysis.

Note: Figures are for companies on the top 50 list reporting capital and/or R&D expenditures. n/a means not available.

26

Syngenta

2020 chemical sales: $11.2 billion

One again, Syngenta is involved in merger and acquisition activity. ChemChina, which already owned the Israeli generic crop protection chemical maker Adama, bought Syngenta in 2017 for $43 billion. Now ChemChina is merging with another Chinese firm, Sinochem, to form a conglomerate with about $160 billion in annual revenue. Chinese authorities approved the deal earlier this year. But the impact on Syngenta will likely be minimal. ChemChina and Sinochem had already combined their agricultural operations into an organization called Syngenta Group.

27

Bayer

2020 chemical sales: $11.2 billion

Advertisement

In June 2020, Bayer attempted to ensure its financial stability by settling 125,000 lawsuits claiming its Roundup glyphosate herbicide, which it acquired with its 2018 purchase of Monsanto, contributed to defendants’ non-Hodgkin lymphoma. Bayer is now trying to limit future liability related to the product. It is considering withdrawing glyphosate from the residential lawn and garden market, which has spurred the “overwhelming majority of claimants,” the company says. Bayer may form a scientific panel to review Roundup-related safety information, and it is launching a new website where it will host studies related to the product.

28

Solvay

2020 chemical sales: $11.1 billion

Solvay has been trimming its portfolio to focus on specialty chemicals. In a major recent move along these lines, the company is carving out its soda ash unit into a separate business, a possible precursor to divesting the operation, which generates about $1.75 billion in annual sales. The business is Solvay’s oldest, dating back to 1863, when Ernest Solvay developed a process to make soda ash out of brine and limestone. Now the mineral is also extracted from trona, which Solvay mines in Green River, Wyoming. In addition, the company completed the sale of a basket of businesses to the private equity firm Latour Capital in March. Those businesses include a barium and strontium carbonate unit, a sodium percarbonate business, and a barium chemical joint venture with Chemical Products. In 2020, Solvay sold its nylon 6,6 business to BASF.

29

Wanhua Chemical

2020 chemical sales: $10.6 billion

The Chinese polyurethane raw materials supplier bucked the general trend of sales decline in 2020 with a nearly 8% increase in chemical sales and a 10% rise in profits. After a weak first half of the year, demand bounced back in the second half, the company says. The COVID-19 “pandemic in China was rapidly and effectively controlled,” Wanhua Chemical says in its annual report. “Domestic market demands and the downstream export overseas were resumed rapidly, and growth of prices of chemical products was recovered.” Wanhua sought to build a beachhead in the US with a $1.25 billion project to build a methylene diphenyl diisocyanate plant in Louisiana. But US-China trade friction and a jump in construction costs appear to have prompted the firm to shelve the initiative.

30

Indorama

2020 chemical sales: $10.6 billion

Indorama built itself up into one of the world’s largest chemical companies via aggressive growth in the polyester chain, both by buying businesses and by constructing massive new plants. Now the Thai company is looking to diversify. In 2020, it bought Huntsman’s intermediates and surfactant business, which makes surfactants and ethanolamines. And it is negotiating the purchase of Oxiteno, the specialty chemical arm of the Brazilian conglomerate Grupo Ultra and the second-largest producer of ethoxylates in the world. Indorama is also developing its capabilities in recycling. It is buying CarbonLITE’s polyethylene terephthalate (PET) recycling plant in Dallas and building a US PET depolymerization plant with the Canadian start-up Loop Industries.

31

Lotte Chemical

2020 chemical sales: $10.4 billion

The South Korean chemical producer has been stepping up its plastics sustainability efforts. In April, Lotte announced plans for a plant in Ulsan, South Korea, that will break down postconsumer polyethylene terephthalate (PET) waste into bis(2-hydroxyethyl) terephthalate, which it will use to make new PET. The plant, a first for the country, will cost about $90 million. The company also has an agreement with SPC Pack to develop packaging made from PET derived from sugarcane. With Korea Container Pool, Lotte created an expandable polypropylene container for the home delivery of food. The company says the plastic insulates better than polystyrene or paper and is readily recyclable.

32

Johnson Matthey

2020 chemical sales: $10.0 billion

Johnson Matthey’s chemical sales edged up by over 12% during its fiscal year, in part owing to strong prices for precious metals such as platinum, which the company uses to make catalytic converters. JM, however, has been trying to evolve. Similar to how big oil companies like Shell are redefining themselves as alternative energy firms, JM is trying to pivot toward batteries and hydrogen. Earlier this year, for instance, the company announced it will build a second plant, in Vaasa, Finland, for a cathode material that contains lithium, cobalt, and nickel and that will be used in lithium-ion batteries. Additionally, JM is undertaking a “strategic review” of its pharmaceutical chemical business, which makes drug ingredients.

33

Umicore

2020 chemical sales: $9.7 billion

The Belgian firm, which focuses on metal-based chemicals, is undergoing changes. Its board appointed Mathias Miedreich to succeed Marc Grynberg as CEO later this year. Miedreich is an executive with the auto parts supplier Faurecia, where he led the Clean Mobility division. Consolidation in Umicore’s nickel and cobalt chemical business will see the company shed about 200 jobs. Much like its rival Johnson Matthey, Umicore has been trying to diversify away from catalytic converters for gasoline vehicles and focus on electric cars. In May, it signed a cross-licensing agreement with BASF covering more than 100 families of patents relating to battery cathode active materials and their precursors. Umicore is also working with the firm Anglo American to develop platinum-group-metal-based catalysts that aid the storage of hydrogen in fuel-cell vehicles. The technology stores hydrogen with a chemical carrier rather than compression.

34

Asahi Kasei

2020 chemical sales: $9.3 billion

The Japanese chemical maker is rolling out key expansion projects. In March, aiming to meet demand for electric vehicles, Asahi Kasei unveiled plans to spend $270 million to increase capacity for its Hipore lithium-ion battery separator membranes in Hyūga, Japan. The project will bring the firm’s overall separator capacity to 1.9 billion m2 per year by 2023. Asahi is building a second microcrystalline cellulose plant in Kurashiki, Japan, at a cost of $125 million. The product is used as a binder for pharmaceutical tablets. The company is also closing a plant in Wakayama, Japan, where it makes acrylic latex and photocatalyst coatings and employs 38 people. Asahi says domestic demand has been weak.

35

DSM

2020 chemical sales: $9.2 billion

The Dutch company has been steering away from traditional chemical sectors and toward nutrition and health. In April, DSM sold its resin and functional materials business to Covestro for $1.8 billion. The unit makes 3D-printing materials, antireflective coatings for photovoltaic panels, acrylic resins for paints, and optical fiber coatings. DSM is holding on to its engineering resin business, which makes nylon and other high-end polymers, as well as its Dyneema ultra-high-molecular-weight polyethylene fiber business. These operations make up less than 20% of DSM’s overall sales. After the Covestro transaction, DSM invested $100 million in the personal nutrition start-up Hologram Sciences. In March, it agreed to acquire Amyris’s fermentation-derived flavor and fragrance ingredient line for $150 million.

36

Arkema

2020 chemical sales: $9.0 billion

The French firm has been trying to migrate toward the high end of the specialty chemical spectrum. In May, Arkema completed the sale of its polymethyl methacrylate business to the styrenic polymer maker Trinseo for $1.4 billion. The business generated sales of about $620 million in 2020. In June, Arkema turned around and announced two initiatives to increase production of the insulation foam-blowing agent hydrofluoroolefin-1233zd, which has lower global warming potential than current blowing agents. Arkema is spending $60 million to expand capacity in Calvert City, Kentucky, and is contracting with chemical maker Zibo Aofan to make it in China. In January, Bostik, Arkema’s adhesives arm, invested $11 million to form Crackless Monomer Company with the Taiwanese cyanoacrylate maker Cartell Chemical.

37

Air Products & Chemicals

2020 chemical sales: $8.9 billion

The industrial gas maker sees its future in energy. Last month, it announced a $1.1 billion investment to make “blue” hydrogen from natural gas in Edmonton, Alberta. The project calls for Air Products to capture the by-product carbon dioxide and send it into a pipeline system where it will be used for enhanced oil recovery and ultimately sequestered. The hydrogen will fuel local trucks and buses as well as a power plant. The company is participating in the world’s most ambitious green ammonia project: a $5 billion undertaking in Saudi Arabia to make ammonia from hydrogen produced by water electrolysis. The hydrogen-carrying molecule will be shipped to hydrogen-fueling stations around the world. The company is also planning a coal-to-methanol project in Indonesia.

38

Mosaic

2020 chemical sales: $8.7 billion

Mosaic is perhaps best known for its enormous—and environmentally burdensome—phosphate mining operations in Florida. But the company is putting money toward research into making sure phosphates—and other plant nutrients—are used as effectively as possible. In December, Mosaic unveiled a collaboration with BioConsortia to colonize nitrogen-fixing bacteria on nonlegume crops like corn. It is partnering with Sound Agriculture on activators for soil microbiomes. And with AgBiome, Mosaic is investigating minimizing fertilizer loss to the environment.

39

Hanwha Solutions

2020 chemical sales: $8.6 billion

Hanwha Solutions has been growing prodigiously recently, mostly owing to its burgeoning solar materials business. The South Korean company is also branching out into other sustainable activities. For instance, it will begin supplying process water—heated to about 95 °C—to Lotte Chemical’s Ulsan, South Korea, plant, where the water will provide the energy for an absorptive refrigeration system. The companies say the setup will cut carbon dioxide emissions. In its core materials business, the company says it will double the production of for hydrogenated resins—used in adhesives—by the end of this year. The company entered that business only in 2019 to compete with the big players ExxonMobil and Eastman Chemical.

40

Eastman Chemical

2020 chemical sales: $8.5 billion

The US chemical company is making a large divestiture with the $800 million sale of its tire additives business to the private equity firm One Rock Capital Partners. The deal includes many products that Eastman got in 2012 when it bought Solutia for $4.8 billion, including Crystex insoluble sulfur and Santoflex antidegradants. Eastman is jumping into the chemical recycling of polyethylene terephthalate in a big way, spending $250 million on a plant at its flagship facility in Kingsport, Tennessee, that will use methanolysis to break down as much as 100,000 metric tons per year of the polymer. The company intends to use the resultant dimethyl terephthalate and ethylene glycol to make specialty polyesters.

41

Chevron Phillips Chemical

2020 chemical sales: $8.4 billion

Longtime Chevron Phillips Chemical CEO Mark Lashier retired as president and CEO in April. Bruce Chinn, formerly the head of Chevron Chemicals, replaced him as CEO. B. J. Hebert, who joined Chevron Phillips in 2020 after 3 years as president of Occidental Chemical, is taking on the roles of president and chief operating officer. In October, Chevron Phillips launched Marlex Anew Circular polyethylene, which incorporates recycled content. That content includes a synthetic crude oil from Atlanta-based Nexus Fuels, which uses pyrolysis to break down postconsumer plastic. Chevron Phillips aims to produce 450,000 metric tons of the polymer annually by the end of the decade. Separately, the company has broken ground on a 1-hexene plant in Old Ocean, Texas, that is scheduled to open in 2023. The product is a comonomer for linear low-density polyethylene.

42

Rongsheng Petrochemical

2020 chemical sales: $8.4 billion

Recent years have seen Chinese petrochemical producers, often involved in the polyester supply chain, join the Global Top 50. Hengli Petrochemical is one of those firms. And now Rongsheng Petrochemical is another. The company is one of the largest producers of purified terephthalic acid in the world, with 13 million metric tons of capacity at plants in Dalian, Ningbo, and Hainan, China. It also makes polyester resin and fiber. It is an investor in Zhejiang Petrochemical, a large oil refinery and petrochemical complex that is currently starting up.

43

Borealis

2020 chemical sales: $7.8 billion

Sustainability continues to be a focus for the Austrian petrochemical maker. In June, the company signed an agreement to buy oil from Renasci Oostende Recycling, which uses a thermal process to break down postconsumer plastic. Borealis will turn this feedstock into plastics again at its complex in Porvoo, Finland. Borealis also started up a demonstration unit at its polyethylene plant in Antwerp, Belgium, to test a heat-recovery technology developed by the start-up Qpinch. The technology is modeled on the adenosine triphosphate–adenosine diphosphate cycle in biology. Separately, Borealis put its fertilizer business up for sale in February.

44

Westlake Chemical

2020 chemical sales: 7.5 billion

The Houston-based chemical maker has the second-largest polyvinyl chloride (PVC) business in the world, behind Japan’s Shin-Etsu Chemical. Westlake is now integrating this business further downstream—a common move for PVC makers—with the purchase of the North American building product business of Australia’s Boral for $2.15 billion. The business makes about $1 billion per year worth of roofing, siding, trim, shutters, windows, and decorative stone per year. Westlake already has about $1.4 billion in annual sales of building products such as PVC pipe. Much of that business came with the company’s 2016 purchase of PVC rival Axiall.

45

Sasol

2020 chemical sales: $7.3 billion

Sasol ended a saga in November when it started up a low-density polyethylene plant in Lake Charles, Louisiana. The unit was the last of the plants the South African company built as part of a $12.8 billion petrochemical complex. The project went $4 billion over budget, leading to the ouster of its co-CEOs. To strengthen its balance sheet, Sasol aims to divest $6 billion in assets. To that end, the company formed a joint venture with LyondellBasell Industries to run the ethylene cracker and two polyethylene plants it built in Lake Charles, essentially selling half these operations for $2 billion. Sasol is keeping alcohols, ethylene oxide and ethylene glycol, and ethoxylation plants at the site. Separately, Sasol sold its 50% interest in the Gemini HDPE high-density polyethylene joint venture with Ineos for $400 million.

46

Nutrien

2020 chemical sales: $7.2 billion

Nutrien got a new CEO in May when Mayo Schmidt replaced Chuck Magro. Schmidt had been chair of the Canadian fertilizer maker’s board since 2019 and before that was CEO of the Canadian agribusiness Viterra. Magro had led Nutrien and its predecessor Agrium since 2014. Because of tight supplies of potash, Nutrien pledged in June to raise production at its six potash mines. Like a few other big fertilizer makers, Nutrien is developing low-carbon ammonia as a fuel. It is one of 15 partners, led by the nonprofit RTI International, working with the US Department of Energy to develop a demonstration facility for low- and zero-carbon ammonia. Nutrien already produces about 1 million metric tons of low-carbon ammonia annually in the US and Canada.

47

Lanxess

2020 chemical sales: $7.0 billion

It has been a year of portfolio moves for Lanxess. In February, the German company announced its first big acquisition since it bought the US specialty chemical maker Chemtura in 2017. Lanxess agreed to purchase Emerald Kalama Chemical, the world’s largest producer of benzoic acid, for $1.1 billion from the private equity firm American Securities. The Vancouver, Washington–based company had 2020 sales of $425 million. In January, Lanxess agreed to buy the fungicide specialist Intace and the disinfectant firm Theseo, both based in France. And in June it sold its organic leather chemical business for $93 million—plus potential milestones—to TFL Ledertechnik, a leather chemical specialist.

48

Tosoh

2020 chemical sales: $6.9 billion

In a rather bucolic sustainability initiative, Tosoh is using wood from trees pruned at public facilities in Shunan City, Japan, to generate power in its nearby chemical plant. The Japanese company is making the environment a priority in its broader business as well. It plans to spend $90 million to renovate and expand its Tokyo Research Center by 2026. The upgrade will include a building dedicated to advanced organic materials research. And citing heightened environmental regulations, the company says it will end production next year of chlorinated paraffins, which are used as flame retardants and plasticizers.

49

DIC

2020 chemical sales: $6.6 billion

DIC completed the acquisition of BASF’s pigment business in June for $1.4 billion. The deal was announced in 2019 but took considerable time to make it past antitrust authorities. Indeed, the US Federal Trade Commission forced DIC to sell its pigment plant in Bushy Park, South Carolina, at an $83 million loss. Separately, DIC’s Sun Chemical subsidiary launched a manganese-based curing agent for alkyd coatings and inks. It’s meant to replace toxic cobalt compounds.

50

Corteva Agriscience

2020 chemical sales: $6.5 billion

The agrochemical and seed maker, formed through the merger of Dow and DuPont’s agrochemical units, joins the Global Top 50 for the first time. James C. Collins Jr. became Corteva Agriscience’s first CEO in 2019. Now Collins is retiring under fire after a 37-year career with DuPont and Corteva. An activist investor, Starboard Value, sought his removal along with eight Corteva directors for what it said was underperformance. Corteva agreed to put three of Starboard’s nominees on its board to make peace. Collins’s departure was announced a few months later.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter