Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Chemical earnings blossom in brisk economy

Consumer spending spurs a good second quarter, overshadowing trade tensions

by Melody M. Bomgardner

August 2, 2018

| A version of this story appeared in

Volume 96, Issue 32

In the second quarter, strong and broad-based demand, driven in large part by consumer spending, buoyed sales at global chemical firms. For most of last year, results were just OK. In contrast, several chemical executives have raised their 2018 full-year forecasts.

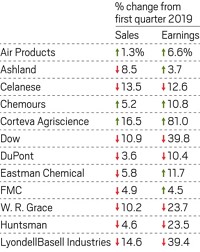

Note: DowDuPont results for 2017 are pro forma.

Sources: Companies

While they pursue growth, companies also continue cutting costs, a holdover from the Great Recession and the long recovery. Among them, DowDuPont reported it has reached $900 million in postmerger cost savings and raised its savings target again, to $1.4 billion. That type of spending discipline helped DowDuPont and others beat analyst expectations for quarterly earnings.

In a conference call with analysts, DowDuPont CEO Edward Breen pointed to double-digit growth in sales, volumes, and operating earnings compared with last year’s second quarter. “We are delivering growth in each division due to a combination of strong global demand and innovation,” he said.

That included a jump in sales of seeds and agricultural chemicals, which rebounded after a cool spring. The company also saw unusually high demand for chemical intermediates and plastic packaging materials. All told, its adjusted earnings reached $3.2 billion, a 40% increase over what a combined Dow and DuPont would have earned in the second quarter of 2017.

Arkema, Ashland, and DSM reported strong demand for specialties. At Arkema, that included sales of lightweight and three-dimensional printing materials, while Ashland hailed huge growth in sales for composites and drug ingredients. DSM’s nutrition product sales rose 8%.

Close to a year of positive momentum from an expanding global economy also lifted the fortunes of firms selling chemical intermediates. Celanese reported a 27% increase in sales of acetyl intermediates, and Huntsman saw boosted demand for polyurethane inputs.

Similarly, Covestro’s sales were up more than 10% thanks to demand for polyurethane, polycarbonate, and coating materials. The company says it plans to expand production in all three segments; it will spend over $100 million on film production and twice that to make more of the polyurethane foam precursor methylene diphenyl diisocyanate.

BASF reported broad-based demand in functional materials, chemicals, and oil and gas, enabling it to raise prices. But 6% of its gains were eaten up by currency effects, mainly due to the weak dollar, which hurt European firms but boosted results at companies based in the U.S.

Firms on both sides of the Atlantic said they have not yet experienced a noticeable impact from recently enacted tariffs, though they cast a wary eye on what executives euphemistically call “geopolitical tensions.”

Companies with international operations can source raw materials and sell products in the same countries where they have manufacturing plants. So far that has kept tariff headaches at bay at DowDuPont, according to Breen. “We support fair trade,” he told analysts, “and continue to work with all stakeholders to find effective and measured solutions to unfair trade policies.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter