Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Chemical industry jumps out of gate in first quarter

Earnings are strong, but executives have an eye on inflation and China

by Alexander H. Tullo

May 13, 2022

| A version of this story appeared in

Volume 100, Issue 17

First-quarter financial results for the major US and European chemical firms are in, and they show that the industry got off to a strong start in 2022.

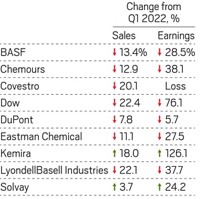

First-quarter chemical results

A couple of problems have executives worried about the quarters ahead, however. They see strict COVID-19 lockdowns in China slowing operations, and they think that inflation—exacerbated by Russia’s invasion of Ukraine—hasn’t quite finished rippling through the economy.

Sales at the world’s largest chemical maker, BASF, climbed 19% in the first quarter from the same quarter a year earlier, while earnings jumped 35%. Higher selling prices, mainly in the firm’s chemical and materials unit, drove the results.

A 60% rise in earnings helped Celanese break a profit record set during the second quarter of last year. Acetyl chemicals remain enormously profitable for the company.

At Dow, results showed solid improvement, but profit margins in its core packaging plastic business thinned because of escalating raw material costs. Eastman Chemical and DuPont posted modest declines in earnings while sales rose.

The challenge for chemical makers, particularly those in Europe, has been keeping up with climbing costs. “The war has led to drastic price increases for energy and various raw materials in Europe and a high level of uncertainty regarding future supplies,” BASF chairman Martin Brudermüller told analysts. Over the past year, costs at the firm’s European operations have risen by over $900 million.

Eastman CEO Mark Costa said in his conference call that consumers still haven’t felt the full impact. “I think inflation is certainly going higher as you go into the second quarter,” he said. As of April, Eastman was still boosting prices to keep up with its own higher costs for energy and raw materials, Costa said. The firm’s customers will now pass along the higher costs to consumers downstream.

Chemical executives are also fretting about the strict COVID-19 lockdowns in China, which mainly impact the large port city of Shanghai. LyondellBasell Industries CEO Ken Lane said petrochemical makers in China have throttled back production—and that includes his company’s own joint venture there.

Solvay CEO Ilham Kadri reported similar experiences. “We have one site which is running at 50% capacity due to the lack of operators,” she told analysts. “The Shanghai port is operating, but the port is very congested.”

Celanese CEO Lori Ryerkerk told analysts that her company, which produces in China mostly around Nanjing, has been able to maintain operations, but moving material has been tough and might remain so. “Maritime logistics have been increasingly challenging due to container and ship availability, as well as port congestion that is expected to worsen in China and the US,” she said.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter