Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

European chemical firms face slowdown in industry

Results for 2019 show resilience, but coronavirus impact shadows forecasts for this year

by Melody M. Bomgardner

March 3, 2020

| A version of this story appeared in

Volume 98, Issue 9

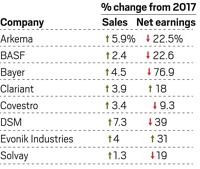

Source: Companies

For European chemical companies, 2019 was a year marred by political instability, trade tariffs, and slowing growth. In earnings reports, company CEOs stress their firms’ ability to stand up to economic uncertainty and a weak manufacturing environment. But it is not yet clear how resilient businesses will be this year in the face of the coronavirus.

Sales and earnings were lower at Arkema, BASF, Covestro, and Solvay compared with 2018—a strong year for chemical demand. All four companies blame a weak car-manufacturing sector, which impacted a wide range of segments including coatings, adhesives, polyurethanes, additives, and soda ash used to make car windows.

Sales of chemicals for consumer electronics and the oil and gas sector were also sluggish, defying hopes for a rebound late in 2019.

At Solvay, higher pricing for performance chemicals and double-digit volume growth for composite materials cushioned the blows. Still, Solvay says it will lay off 500 workers, including a number of senior managers “as we de-layer and simplify.” Clariant similarly announced a workforce reduction of 500–600 positions. Wacker Chemie said it is looking to cut 1,000 jobs.

BASF’s layoff announcement came back in June when it said it would slash 6,000 jobs worldwide by 2021. In July the company—the world’s largest chemical maker—warned investors about declining prices for commodity chemicals and materials.

The situation didn’t improve in the second half of the year. “We were thus unable to reach the financial targets we had communicated at the beginning of the year,” CEO Martin Brudermüller said in his full-year report. “We are not satisfied with our results.”

The financial picture last year was brighter for DSM and Bayer. DSM saw strong demand for human and animal nutrition products. Its materials segment was steadied by sales in high-margin businesses like Dyneema fiber. Bayer posted higher sales and earnings thanks to strong prescription and over-the-counter drug businesses.

For at least the first quarter of 2020, company leaders are steering through impacts of the coronavirus on their own manufacturing operations and on demand from their customers.

Solvay CEO Ilham Kadri told journalists on Feb. 26 that the firm had resumed operations at all of its facilities in China. The firm does not have any operations in Hubei Province, the center of the coronavirus outbreak.

Despite that good news, Kadri remains cautious. “It doesn’t mean the impact is stopping,” she said. Solvay expects the coronavirus to have a $27 million impact on its earnings for the quarter. Arkema estimates an earnings impact of roughly $22 million.

BASF’s Brudermüller expects the virus to have a significant effect through the second quarter of 2020, and says it could continue to weigh on the global economy later in the year. Overall, BASF expects global chemical production to grow only 1.2% this year, compared to 1.8% in 2019. That would be the lowest rate of growth since the financial crisis of 2008.

UPDATE

The table in this article was updated on March 5, 2020, to include sales and earnings figures from Evonik Industries.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter