Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Japanese chemical companies finish a strong year

Earnings mark a pandemic recover, but worries over high energy prices remain

by Alexander H. Tullo

May 19, 2022

| A version of this story appeared in

Volume 100, Issue 18

Japanese chemical makers have reported their results for the fiscal year that ended in March. All the major companies posted healthy increases in sales and earnings as their businesses recovered from the impact of the COVID-19 pandemic.M

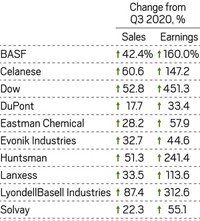

Japan's 2021 results

anagers at these firms see obstacles to their progress, however: high prices for energy and raw materials, and a weak Japanese yen.

Every company surveyed had increases in both sales and earnings. Three firms—JSR, Mitsubishi Chemical Holdings, and Teijin—flipped to profitability after losses in the previous fiscal year.

Earnings at Asahi Kasei more than doubled, while sales rose by 16.9%. The lift was driven mostly by the company’s core materials business, which benefited from surging sales of engineering plastics to a rebounding auto industry.

Sumitomo Chemical’s earnings jumped 252.1% on a sales rise of 20.9%. The improvement was broadly based: strong demand and higher prices drove positive results in the firm’s fiber, resin, and industrial chemical businesses.

Teijin welcomed a recovery in its automotive and aircraft materials business that helped it turn a profit and post a 10.7% sales increase. But in its earnings report, Teijin complained that “supply chain operations remained sluggish in various industries, while factors such as the semiconductor shortage and the rise in raw material and fuel prices and logistics costs had massive adverse impacts on corporate performance.”

Mitsubishi, Japan’s largest chemical maker, saw a 22.1% jump in sales during the fiscal year. It attributed the gains to “recouping from the impact of COVID-19.”

But the firm’s earning announcement warned that the outlook remains “murky” because of Russia’s invasion of Ukraine. “Careful attention should be paid to a possible downturn in the domestic and overseas economies in tandem with geopolitical risks, soaring raw material and fuel prices and a disruption in the supply chain,” Mitsubishi said.

According to the US Energy Information Administration, oil prices nearly doubled during the 12-month period ending in March, to over $117 per barrel for Brent crude, an international benchmark. Much of the rise had occurred since the Russian invasion in February.

Kaneka’s earnings announcement echoed worries that energy and consumer price inflation could overturn a fragile economic recovery. “The impact of sanctions against Russia is unclear, and there are concerns that persistently high prices could disturb the recovering economy,” the company said.

Kaneka is also watching the sinking value of the Japanese yen, which is hitting 20-year lows against the US dollar because of different monetary policies in the two countries. A weaker yen will help Japan’s chemical exports by making them cheaper, but it will also make energy imports more expensive for local chemical producers.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter