Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Profits continue to rise in Japan

All major chemical producers experienced increased sales in first half of fiscal year

by Jean-François Tremblay

November 7, 2018

| A version of this story appeared in

Volume 96, Issue 45

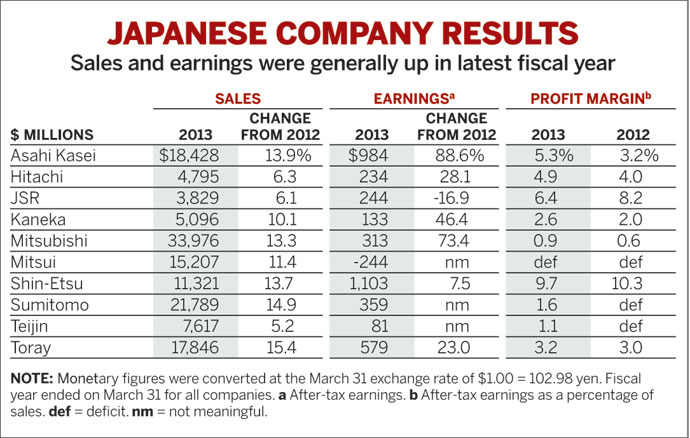

Sales rose at all major firms, but earnings declined at some.

Note: Percent change from previous year's first half.

Source: Companies

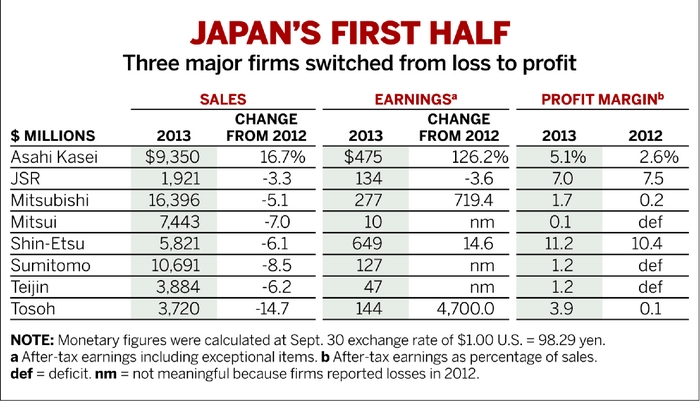

Major Japanese chemical producers credited favorable economic conditions for rising sales in the first half of the fiscal year that ends March 31, 2019. At most firms, increased sales led to higher earnings as well.

Shin-Etsu Chemical, the world’s largest producer of silicon wafers and polyvinyl chloride, seemed to be printing money with an astounding 43% surge in net earnings on a 14% increase in sales. The company’s profit margin, already a healthy 16% a year ago, now exceeds 20%. While most of its businesses performed well, profit margins in its semiconductor silicon business surged nearly 60% from a year ago, Shin-Etsu observed.

Another strong performer was Asahi Kasei, whose earnings jumped 11% on the back of an 8% rise in sales. All its major segments—residential homes, chemicals, fibers, and health care—performed strongly, the company said. Chemicals contributed most, with an 11% increase in margins.

Some firms, however, were unable to increase earnings despite buoyant market conditions in Japan and the rest of the world. At Ube Industries, a producer of chemicals, construction materials, pharmaceuticals, and machinery, earnings declined by nearly 22%. The firm cited the rising price of coal, manufacturing problems at one of its plants, and price declines in the synthetic rubber market as some of the challenges it faced in the fiscal first half. Ube’s net profit margin was an anemic 3.5% during the period.

At Sumitomo Chemical, earnings fell by more than 10%. A maintenance shutdown at its complex in Chiba, Japan, affected performance, the firm said. Sumitomo also experienced a sharp deterioration in its pharmaceutical business because of a decision by the Japanese government to pay less for some drugs it buys from the firm. Profit margins also declined in the company’s crop protection business because of currency depreciation in some markets and the higher cost of key raw materials.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter