Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Second-quarter earnings hold up

While results were mostly strong, executives worry about higher European costs

by Alexander H. Tullo

August 4, 2022

| A version of this story appeared in

Volume 100, Issue 27

The largest chemical companies posted upbeat results for the second quarter despite external economic factors, namely the war in Ukraine, which is driving up European energy costs. Chemical executives worry that the coming months could see a full blown crisis that could scuttle European chemical production.

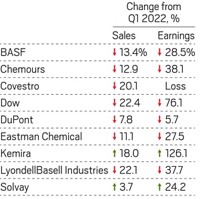

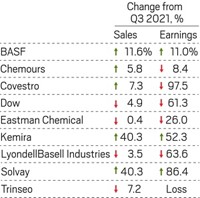

Second-quarter results

For the second quarter, the world’s largest chemical maker, BASF, posted a 16% increase in sales and a 17% increase in profits versus the same period in 2021. Elemental to the company’s gains were its chemicals and materials businesses, which saw sales increases of 27% and 30%, respectively, mostly due to higher product selling prices.

A weakness for the company was its surface technologies unit, which houses its automotive catalysts business, hit hard by sluggish car production. BASF’s second quarter sales in China declined by 17% due to COVID-19 lockdowns in the country.

In a speech to analysts, BASF chairman Martin Brudermüller said that compared to the first quarter, uncertainty around the economic outlook has increased. “The main reasons for this are the ongoing war in Ukraine, the risks associated with natural gas supplies in Europe, and the resulting high prices for raw materials and energy as well as China’s zero-COVID strategy and related lockdowns,” he said.

“For the second half of the year, BASF anticipates a gradual cooling of economic development globally,” Brudermüller says. “But much more pronounced in Europe.”

Europe depends on Russia for 40% of its natural gas supply. Chemical makers use this gas for both energy and as a chemical feedstock. In recent weeks, one of the main gas pipelines from Russia to Germany, Nord Stream, has been down for repairs, heightening anxiety about the security of supply in a few months when the weather gets colder.

Brudermüller says that BASF should be able to keep operating its plant in Ludwigshafen at reduced rates provided supplies of natural gas do not fall below 50% of normal supply. Measures the company is considering at the site to reduce gas consumption include curtaining ammonia production and substituting fuel oil for natural gas.

Polyurethanes maker Covestro saw its profits decline by 56% during the quarter, which it blamed on high raw material and energy prices. The company has reduced its pre-tax profit outlook for the rest of the fiscal year by about 15%.

With this revision, the company gave a stern warning. “If gas supplies are rationed in the further course of the year, this could result in partial load operation or a complete shutdown of individual Covestro production facilities,” the company said in a statement. “Due to the close links between the chemical industry and downstream sectors, a further deterioration of the situation is likely to result in the collapse of entire supply and production chains.”

Profits slipped at the largest US chemical maker, Dow, for the second quarter while sales increased by 13%. The sales increase came from high prices, which rose 16% versus a year ago. Sales volumes were flat for the quarter versus a year ago and actually declined from the first quarter due to softness in Chinese and European markets.

Dow is also bracing for tighter European gas supplies. “I think our preparation for the fourth quarter, as we get closer to winter time, you have to be thinking that the government could move into some curtailments,” CEO Jim Fitterling said on a conference call with analysts.

“Germany is the place that we have to keep an eye on,” Fitterling continued. “We’ve already reduced our natural gas use in Böhlen, which is really the biggest exposure.”

Chemical executives are also seeing signs that the European costs are cooling demand for chemical products. “We started to see moderating European demand due to high inflation at the end of the second quarter and continue to pass through elevated energy and feedstock costs in the prices of our products where possible,” said new LyondellBasell CEO Peter Vanacker in his first conference call with analysts.

Celanese CEO Lori Ryerkerk told analysts that she has seen some signs of only modest softening in the market. “Let me be clear that we see little firsthand indication, in our order books or otherwise, that warrants the prevailing anticipation of a dramatic pullback in demand,” she noted.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter