Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Informatics

A quest for data on products’ carbon footprint begins

The chemical industry tries to lead on sustainability with new guidelines on accounting for emissions across the supply chain

by Rick Mullin

November 13, 2022

| A version of this story appeared in

Volume 100, Issue 40

Apple declared 2 years ago that it had achieved carbon neutrality—a balance between carbon emitted and carbon absorbed—across its corporate operations. The claim appeared to position the tech giant as a leader among the many companies hoping to make the same announcement by 2050 as signatories to the Paris climate accords.

Most companies realize, however, that corporate operations are only one source of their carbon emissions. Every Apple iPhone, iPad, Apple Watch, and Apple TV—indeed, every product the company sells—has a carbon footprint that is not figured into its claims regarding in-house activities. This leaves a lot out. By some estimates, as much as 80% of emissions associated with a company’s products, a measurement known as product carbon footprint (PCF), occur elsewhere along its supply chain.

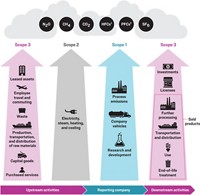

Industry efforts to measure greenhouse gas emissions date back to 1998, when a standard known as the Greenhouse Gas Protocol was introduced by the World Resources Institute and the World Business Council for Sustainable Development (WBCSD). The protocol created accounting standards and tools for measuring on-site emissions—called scope 1 emissions—and those associated with energy and other off-site utilities, called scope 2 emissions.

The protocol includes another category, scope 3, that accounts for both upstream emissions—the total carbon footprint of a company’s suppliers—and downstream emissions, the environmental impact of products over their life spans.

This year has seen a distinct shift of chemical business’s focus to the complex task of accounting for the upstream part of scope 3 emissions. Steps taken include the issuance of guidelines by an industry consortium on corralling and reporting data on off-site emissions. The process of measuring industrial scope 3 emissions is just beginning, but executives involved in the effort see the chemical sector taking a leading role.

“In the climate journey, the scope 3 comes now,” says Pascal Chalvon Demersay, chief sustainability and government affairs officer at the Belgian chemical maker Solvay. “It makes a lot of sense to focus first on 1 and 2. But now there is a change of paradigm to managing data we don’t generate ourselves. We do not have ownership of the data from our customers and suppliers.”

The challenge of getting real numbers on scope 3 emissions is steep, Chalvon Demersay says, and PCF accounting requires the same level of accuracy as financial accounting.

Access to actual, or primary, data is essential, he says, noting that most companies currently use secondary data such as historical averages for the production and transportation of purchased goods. The difference is obvious. “In financial accounting,” Chalvon Demersay says, “if you don’t have the specific margin of a company and you report the average . . . well, it’s not possible.”

Information technology infrastructure for reporting and sharing data securely is also necessary, Chalvon Demersay says. And the chemical industry needs to step up its efforts quickly. “We need to create momentum,” he says. The challenge amounts to creating a global-scale collaboration to share carbon emission data.

The chemical sector is well placed to take a lead role in meeting the challenge, Chalvon Demersay says. “The chemical industry is kind of the mother of industries. We serve all value chains, and we have thousands of suppliers.” A method for calculating PCF in this industry would contribute greatly toward establishing a “common language” across all industries, he says.

Solvay was one of six chemical companies, all European, that convened Together for Sustainability (TfS) 11 years ago to foster communication between companies and their suppliers about sustainability-related data. Bringing raw material suppliers into the PCF equation has been a key focus for the group, which now has 37 chemical industry members.

The scope scheme

Europe’s chemical makers recognized early that the industry’s credibility would hinge on accounting for emissions across the supply chain, says Gabriele Unger, general manager of TfS. “You are not only buying suppliers’ products,” Unger says. “You are connected with them, and you want to expand the standards you uphold in your company. You want to translate them into your supply chain.”

But tying the supply chain into a company’s PCF accounting is complicated by the lack of standards and a hesitancy to share data. “There is a limit to how much detail you can publish and talk about,” Unger says. “It is not an industry’s usual thing to publish supplier lists.”

TfS took a step toward establishing standards for PCF reporting in September when it issued guidelines that take into account energy use, manufacturing processes, and transportation specific to the chemical industry and to specific chemicals. It soon hopes to introduce software for sharing data.

Alessandro Pistillo, director of digital strategic projects at the German chemical maker BASF and cochair of the scope 3 greenhouse gas emission group at TfS, says the group drafted the guidelines by building on established generic protocols such as the International Organization for Standardization’s ISO 14000 series of environmental standards, which have been in place for 25 years. The task was to make these protocols more meaningful to chemical producers.

“It was necessary to have a clearer guideline that enables companies to determine product carbon footprint on a more consistent, comparable platform than offered by the generic standards,” Pistillo says. TfS would like to see the chemical industry guidelines adopted by other manufacturing sectors that depend on PCF data from their chemical suppliers.

TfS recently selected a software company to support a data-sharing platform that it hopes to introduce next year, says Jens Plambeck, a procurement manager responsible for scope 3 emission accounting and reduction at Bayer and cochair of TfS’s work group on software platform development. TfS wants to enable a digital network that will replace a system that relies on random communication between supply partners—much of it via email.

“There is a certain limit to the number of emails you can send and receive and all the ping-pong that happens,” Plambeck says. “It is not scalable, and quite labor intensive.” TfS wants to create a community for data sharing, “in a way to ensure confidentiality, privacy, and data ownership,” Plambeck says.

Earlier this month, TfS hosted an online symposium with representatives from the WBCSD to introduce the guidelines and discuss the shared goals of the chemical industry program and the WBCSD’s Pathfinder Framework, a cross-industry effort launched last year to establish standards for scope 3 emission accounting.

The WBCSD is coordinating with other PCF standards efforts, notably Catena-X, an auto industry group, according to Anna Stanley-Radière, director for climate action at the WBCSD. The council is concerned with addressing the quality and comparability of emission data and establishing consistent rules for calculating and reporting PCF across industries, she says.

“Lots of industries have very different, complex value chains,” says Stanley-Radière, who moderated the TfS event this month. “That is why it is so great to see the leadership TfS has taken and the collaboration that comes with it.”

The WBCSD has a related initiative called the Partnership for Carbon Transparency (PACT). It recently published the results of a pilot program in which the computing firms IBM, SAP, and Siemens coordinated with CircularTree, a software developer, and Aptar, a packaging company, to facilitate data exchange between three chemical companies and a consumer product company on a detergent’s PCF.

The project used a data exchange protocol developed by PACT members, according to Stanley-Radière. The model employs peer-to-peer communication, a security measure that allows one supplier to connect exclusively with another along the supply chain such that the data transferred between them can be shared across the chain without the latter company revealing the name of its supplier.

Software providers are also collaborating to support carbon accounting along the supply chain. Siemens initiated the Estainium network, a cross-industry collaboration aimed at supporting secure PCF data exchange. The model under development by the Estainium network, like PACT’s data exchange protocol, has no central database. It instead relies on peer-to-peer interaction among firms in a user’s supply chain.

CircularTree is involved in both PACT and Estainium. CEO Gunther Walden, who formerly worked at Siemens on software used in the auto and food and beverage industries, started the company in 2018 with his brother, Joerg Walden, the founder of iPoint, a regulatory compliance software firm.

“Our target was to develop a system to drive sustainability in industry with a specific focus on supply chain,” Gunther Walden says. The product is designed to provide customers with one software tool with which they can connect to an entire supplier base.

For the product to work, other software providers will need to adopt the same approach to providing and protecting data on the network. “It’s a matter of how you browse to get the data, and that is a new skill from PACT,” Walden says, referring to the WBCSD’s recent pilot. “The gist is coming up with standards for the data.”

Walden says he is leery of separate industries striking out to develop their own standards. But the chemical industry’s TfS initiative makes sense, he says. “Tell me an industry that is not using chemicals.”

Accounting for carbon emissions is a concern for individual companies as well. BASF, for example, developed a software system it calls Strategic CO2 Transparency Tool 3 years ago. With it, the company has been able to understand its own operations’ carbon footprint, says Peter Saling, cochair of sustainability methods for BASF and leader of the group that developed the new guidelines at TfS.

Recently, BASF formed a partnership with Carbon Minds, a life-cycle analysis database company specializing in PCF. The object of the partnership, Saling says, is to collaborate on a methodology for determining PCF.

Carbon Minds, a spinout from RWTH Aachen University, launched its first database for products’ life-cycle analysis in 2020, cofounder Chief Technology Officer Raoul Meys says. “I like to say that we are a young company but a relatively old team in our field.” Its founders have worked in life-cycle analysis for nearly a decade, he says. They have gained the expertise in chemical processes, transportation, and trade needed to generate the kinds of reference data that companies rely on to determine their carbon footprints.

Meys notes that basing PCF calculations on actual, primary data is only beginning and that companies will be using average, secondary information for years to come. Even when primary data are used to determine a raw material’s carbon footprint, average data will provide a vital point of comparison, he says.

“When we look at iPhone prices, we might not necessarily believe the first price we see,” he says. Nor will a company want to accept carbon footprint assessments without knowing an average accepted by its peers.

Stanley-Radière at the WBCSD acknowledges that ready access to primary data will not emerge overnight. Neither will broad access to harmonized standards. But things are coming together. Just this month, she says, PACT announced the results of two more pilot projects showcasing the peer-to-peer data-sharing model.

Meys agrees that momentum has started toward developing a system for accurate carbon footprint accounting—a system that will be required to put the data into action. “The logical next step is looking for a pathway to reduce emissions,” he says. “We are going to see a lot of movement in industry to make proper decisions based on good data.”

Apple is going to need good PCF data as well. The company, which outsources nearly all its manufacturing, may be carbon neutral in-house, but it has set itself a 2030 deadline to get its vast and complicated supply chain there as well.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter