Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Investment

Research spending continues on an upward trajectory

For the second year in a row, chemical companies ratcheted up investments devoted to novel products and process experimentation

by Marc S. Reisch

June 9, 2019

| A version of this story appeared in

Volume 97, Issue 23

Last year was another good one for chemical firms’ corporate research budgets. Spending levels rose, and at a faster rate than they did in 2017.

A strong global economy in 2017 encouraged managers to spend more liberally on research in 2018. At least for the first half of the year, economic activity—along with demand for chemicals—hummed along.

Only toward the middle of 2018 did threats to global tradeappear. The US and China imposed a series of tit-for-tat tariffs on each other. The pending British exit from the European Union, known as Brexit, sent a shudder up the European business community’s spine as it contemplated duties and customs slowdowns.

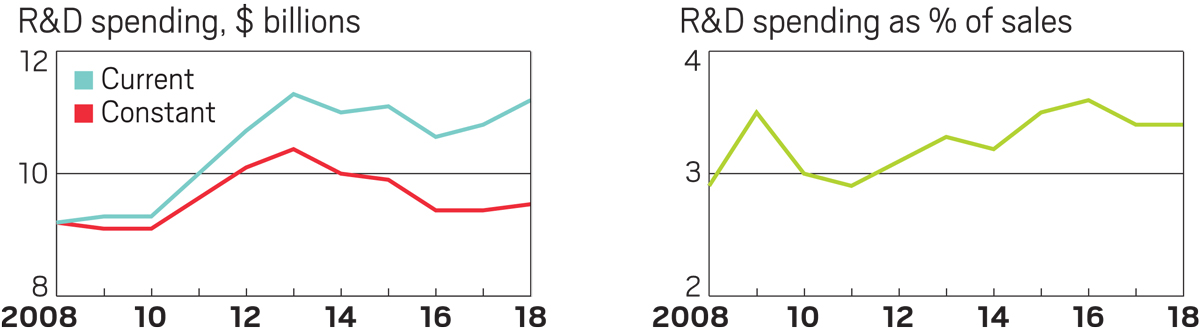

While these trade winds are likely to influence future-oriented spending in 2019, spending on R&D last year continued to be relatively strong. According to C&EN’s annual R&D spending survey, 20 large US, European, and Asian chemical firms collectively boosted research outlays by 3.3% in 2018 to a little more than $11.2 billion. The healthy jump follows a more modest 2.1% increase in 2017, when the group spent $10.9 billion.

Over the past 10 years, R&D spending, like the economy, has ebbed and flowed. Collective spending by 19 of the 20 companies surveyed (excluding Lotte Chemical because 10 years of data are not available) was up 22% last year compared with 2008. The budget for that group reached a decade high of $11.3 billion in 2013. The decade low was $9.2 billion in 2008 as the Great Recession began to take hold. For the next 2 years, spending languished at $9.3 billion.

After adjusting for inflation, money spent on R&D today doesn’t buy what it did 10 years ago. The funds the group spent in 2018 would be worth only $9.5 billion in 2008 dollars, just 3% higher than what the group devoted to R&D that year.

Financing research

Inflation aside, the share of chemical company sales devoted to R&D has hovered around 3% for the past decade. Its peak was 3.6% in 2016.

These relatively low spending levels for large industrial chemical enterprises have not always been the rule. Thirty years ago, spending levels were closer to 6%. For instance, in 1986, a group of 17 US companies that C&EN tracked, including DuPont and Dow Chemical, devoted about 5.7% of sales to R&D.

Back then, C&EN surveyed only US-headquartered companies. In 2013, we added European firms to the annual accounting. This year’s survey includes four significant Asian chemical companies.

Research ups and downs

By adding the new companies—Lotte Chemical, Mitsui Chemicals, Shin-Etsu Chemical, and Tosoh—C&EN remedies a shortcoming in its survey and more fully recognizes the global nature of the chemical enterprise. The list of 20 firms also includes 10 US stalwarts and 6 European standard-bearers.

Another change to the survey is that two firms—Air Products and Chemicals and Praxair—are no longer included. Both focus heavily on the industrial gas sector.

Air Products in particular has narrowed its focus to industrial gases with the sale of its performance materials division and the spin-off of its electronic materials division. Praxair recently combined with Linde to form an even larger industrial gas-centric player.

The R&D table, like last year’s, presents Dow and DuPont as one company to recognize the 2017 marriage of the two firms. Next year’s table will recognize their 2019 divorce and the emergence of a third firm, Corteva Agriscience, which comprises their combined agricultural assets.

Notable too is that this year’s future-oriented spending story focuses only on R&D. We discontinued a capital-spending survey after deciding that most C&EN readers are more interested in money targeted at research that advances the chemical enterprise.

Sometimes the money for those advances comes from surprising places. Historically, FMC was a diverse chemical conglomerate with R&D spending in the mid–$100 million range. Its R&D budget jumped 116% in 2018 to $292 million, marking its transformation into a pure agricultural player after the 2017 acquisition of DuPont’s agrochemical operations.

As companies change and industries evolve in the future, C&EN will be there to capture the impact on R&D spending.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter