Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Outsourcing

Chemical firms battle soft demand

A slowing economy and trade worries mar second-quarter results

by Melody M. Bomgardner

August 1, 2019

| A version of this story appeared in

Volume 97, Issue 31

In 2018, chemical companies, like Tolstoy’s families, were all happy for the same reason: a roaring economy. Now, with the economy slowing, companies have turned unhappy in their own ways, as each finds out how cooling demand is affecting its business.

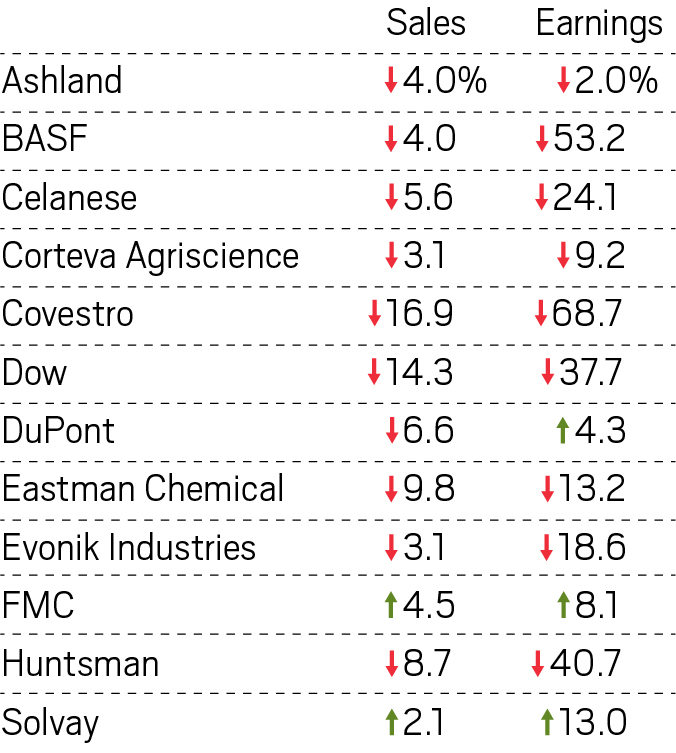

Second-quarter results

Note: Corteva, Dow, and DuPont results for 2018 are pro forma.

BASF, Covestro, Dow, and Huntsman all reported falling prices in their high-volume chemical and material segments in the second quarter of 2019. BASF’s production volumes also shrank 6%, which the firm blamed on scheduled turnaround work on two major steam crackers.

At Covestro, sales of polyurethanes and polycarbonates sank by 24% and 15%, respectively, on lower pricing, even as volumes ticked up. Huntsman, in contrast, saw both lower prices and lower volumes in sales of advanced materials to automotive and power markets. The strong dollar also hurt it.

In addition to lower pricing power, Dow reported declines in sales volumes to consumer product markets, particularly electronics, outside the US and Canada. In the US and Europe, demand for coatings was slowed by wet weather. But Dow’s continued focus on packaging gave it access to markets with dependable growth.

Eastman Chemical joined Dow and Huntsman to complain about the impact of trade disputes on demand, particularly for chemicals used in durable goods like vehicles and appliances.

The diverse impacts of slowing demand were evident in Solvay’s results. “Growth in aerospace, mining, agro, and aroma performance was offset by the headwinds in automotive, electronics, and oil and gas,” CEO Ilham Kadri told investors. Still, the firm’s portfolio mix helped it increase earnings 13% compared with the prior-year quarter.

DuPont grew profits in its first quarter after spinning off from DowDuPont. CEO Marc Doyle told investors that well-timed cost-trimming and pricing actions helped, as did having a diverse portfolio that delivered strong results in probiotics, water treatment, safety, aerospace, and health-care markets.

Meanwhile, in its first quarter as a pure-play agriculture firm, the DowDuPont spin-off Corteva Agriscience benefited from geographic diversity but still saw earnings erode by 9%. Sales in North America were 3% lower than last year because of weather-related planting delays and less planting of corn, soybeans, and canola. But Latin American farmers upped orders of seeds and chemicals by 14%.

Ashland, like BASF, had warned investors in advance that the quarter’s earnings would fall short of earlier estimates. In the end, solid gains in pharmaceuticals and nutrition limited the decline to 2%. Firms tracked by C&EN are now sticking with their guidance for the rest of the year.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter