Case Study 1

From a shark to a possible Parkinson’s drug

Enterin brings a unique steroid close to market with help from Pfizer

by Michael McCoy

Pfizer is the world’s largest drug company, and its visibility has only grown in the past 2 years after its launch of both a vaccine and a therapy for COVID-19. Together, those products will generate about $54 billion in sales for Pfizer this year.

ENT-01 AT A GLANCE

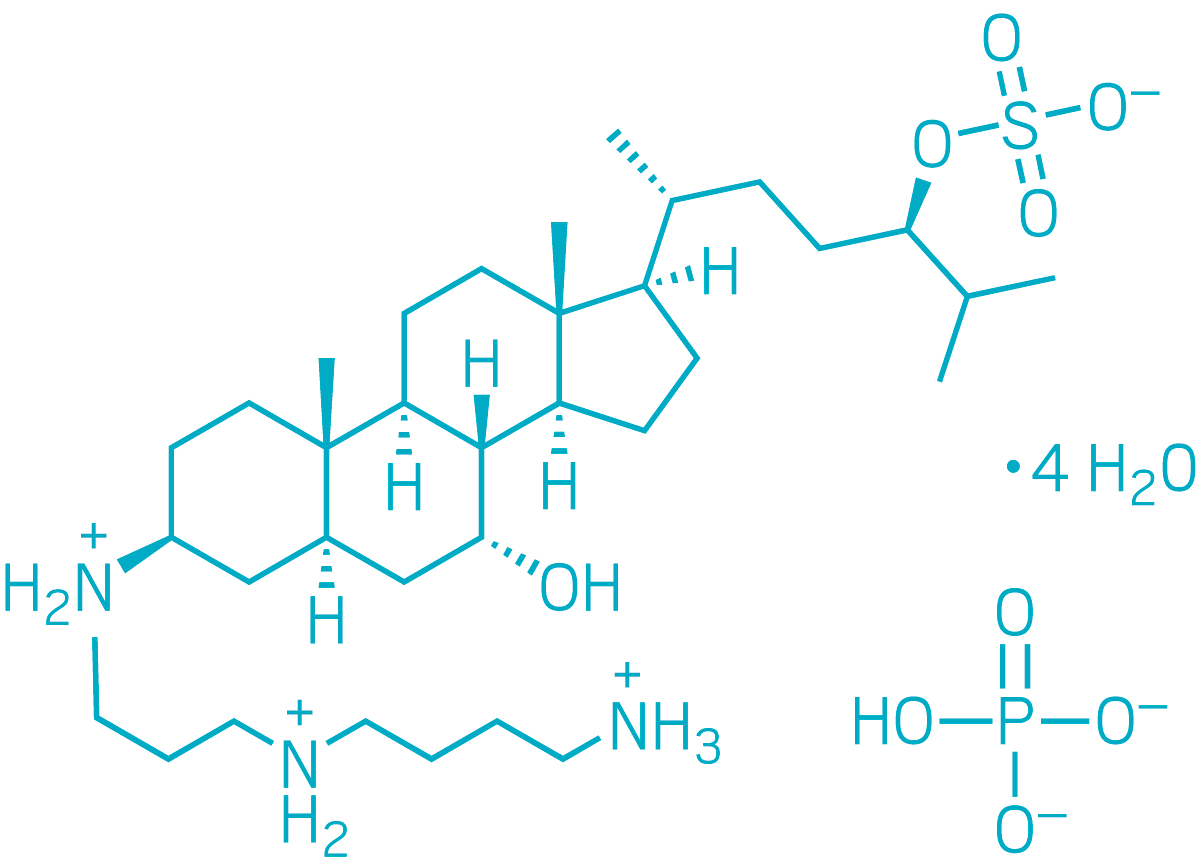

▸ Active ingredient: Squalamine phosphate hydrate

▸ Discovered: Early 1990s by Michael Zasloff in the livers of dogfish sharks

▸ Indication: Parkinson’s disease

▸ Mechanism: Displacement of α-synuclein deposits in intestinal nerve cells

▸ Status: Completed a Phase 2b clinical trial

Less well known is the company’s role as a contract manufacturer of other firms’ drug active ingredients and finished products. And known only to a select few is Pfizer’s special ability to synthesize complex steroidal molecules at its site in Kalamazoo, Michigan.

But it was just that ability that brought the tiny biotech firm Enterin to Pfizer’s door. Enterin has hired Pfizer CentreOne, the drug company’s contract manufacturing arm, to make squalamine, the active ingredient in a therapy called ENT-01 that the biotech is developing to treat Parkinson’s disease. Enterin announced the results of a successful Phase 2b study in January and is now planning a Phase 3 study. If that trial and others go as planned, Enterin could need hundreds of metric tons of squalamine from Pfizer in Kalamazoo.

Enterin’s roots are in research that Michael Zasloff, the firm’s chief science officer, conducted in the early 1990s when he was at the drug company Magainin Pharmaceuticals. He had discovered a family of antimicrobial peptides called magainins in the skin of the African clawed frog, and the search for the peptides in other animals brought him and his colleagues to the dogfish shark.

“We decided to look at a vertebrate that had a very primitive immune system but was also very hardy,” Zasloff recalls. While studying the shark, his team found another antimicrobial, but what the researchers thought would be a peptide turned out to be squalamine, a steroid with an unprecedented structure.

So began Zasloff’s 2-decade obsession with squalamine. The molecule’s polyamine tail gives it a positive charge. Over the years, he and his colleagues determined that when squalamine enters cells, it binds to negatively charged phospholipid membranes, displacing almost any positively charged protein that is electrostatically bound there.

Magainin tried to capitalize on this property of squalamine to treat cancer and wet macular degeneration, even after Zasloff left the company for an academic job, but it didn’t find commercial success, and it closed its doors in 2009.

A few years later, a relative of Zasloff’s was diagnosed with Parkinson’s disease. In researching its causes, Zasloff learned that the neurodegeneration associated with the disease is linked to α-synuclein, a positively charged protein that can aggregate in neurons. Dense clusters of α-synuclein, called Lewy bodies, are a hallmark of the brains of people affected by Parkinson’s.

Around the same time, Heiko Braak, a researcher in Germany, proposed an intriguing theory: that in people with Parkinson’s disease, α-synuclein first accumulates in neurons of the gastrointestinal tract before migrating to the central nervous system. That would explain why one of the earliest symptoms of Parkinson’s is constipation.

“The suggestion was that α-synuclein accumulates first in the gut, leads to the symptom of constipation, and is then followed by progressive accumulation in the spinal cord, the brain stem, and then ultimately the portion of the brain that interferes with movement,” Zasloff says.

Zasloff suddenly saw a new role for squalamine—as an oral drug that would treat Parkinson’s disease by displacing α-synuclein clumps in nerve cells in the gut.

So, in 2016, he formed Enterin with Denise Barbut, a neurologist and founder of several biotech start-ups, and William Kinney, a former colleague from Magainin, to develop squalamine for Parkinson’s. The following year, the company raised $12.7 million in series A financing from New Ventures III and other investors.

Kinney knows squalamine well. In the early days of Magainin, he helped Zasloff extract it from dogfish shark liver, eking out 100 mg for each 500 kg of liver. He also developed the original synthetic route to squalamine, a 16-step process that starts with bisnoralcohol, a raw material obtained by fermenting soybean sterols.

Back then, Kinney bought bisnoralcohol from Pfizer and hired two smaller contract development and manufacturing organizations (CDMOs) to conduct the synthesis. Ash Stevens (now part of Piramal Pharma Solutions) completed the first 9 steps, and Sipsy (now part of Central Glass) completed the last 7 steps.

The synthesis worked, but by the time Kinney was at Enterin, he knew it was not adequate to produce squalamine at scale. “The yield was not optimal. The process was complicated and needed column chromatography,” he recalls. “We knew we needed to improve.”

Pfizer, the bisnoralcohol source, was a logical scale-up partner. The company has a long history with steroidal compounds dating back to Upjohn, which pioneered the commercial manufacture of corticosteroids in Kalamazoo, and has long been a supplier of progesterone, testosterone, and other steroids to drug companies worldwide.

One of Pfizer’s contributions was a new method of creating squalamine’s polyamine tail and connecting it to the steroidal part of the molecule. The synthesis that Kinney developed used an azide to ensure the correct amine reacted with the steroid. But the azide was explosive and created a toxic by-product.

“We didn’t want to use an azide at scale at the plant,” says Carl Deering, a manager with 35 years of chemistry experience at Pfizer and predecessor firms. So the Pfizer team developed an alternative method involving protecting and deprotecting groups to ensure the proper coupling.

Kinney says he was also impressed by the work of Pfizer scientists to improve the recovery of squalamine, which was taking up to 2 weeks to crystallize and another week to filter. Because of the polyamine tail, squalamine “doesn’t know whether it’s a polar molecule or a greasy molecule,” he says, and a typical organic solvent-based crystallization results in an oily mess. Some water was needed.

The Pfizer team devised an improved solvent mixture and a humidified drying technique that “got to just the right hydration state to crystallize a beautiful crystalline solid,” Kinney says. “It was a simple solution but almost artistic in its beauty.”

In one more contribution, Pfizer is now preparing to bring the entire squalamine synthesis to the Kalamazoo site. “We want to bring the whole thing in-house,” Deering says.

At present, Pfizer turns bisnoralcohol into a key starting material. The company sends this material to another Michigan firm, Bridge Organics, for conversion into what is called Compound 34, which then goes back to Pfizer for the rest of the synthesis. Taking initiative outside of their contract with Enterin, scientists in Pfizer’s bioprocess development group engineered a fermentation to yield a new starting material that will allow the firm to eliminate 2 synthesis steps.

In all, Deering says, Pfizer has eliminated 3 of the 16 steps and shortened others to streamline the synthesis. And the firm continues to cut waste and improve efficiency. Its goal is to create a synthesis that will produce squalamine at a competitive cost if it is approved. “We are 100% confident we can scale it up,” Deering says.

Kinney and Zasloff say they have been pleasantly surprised by their Pfizer partners’ flexibility and responsiveness, not traits they had expected at the world’s largest drug company. They also like the direct contact they have with scientists working on their project. “Sometimes with CDMOs there’s no chemist-to-chemist communication,” Kinney says. “Not so with Pfizer.”

And they are happy they will have a heavyweight in their corner when the time comes to submit a new drug application (NDA) to the US Food and Drug Administration. “We want to feel confident that when an NDA is submitted, all the regulatory matters are done correctly,” Zasloff says. “We feel comfortable with the Pfizer team.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter