Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Petrochemicals

Aramco takes more steps into the chemicals business

Deals with Reliance and Motiva deepen the state oil company’s commitment to diversifying

by Alexander H. Tullo

August 24, 2019

| A version of this story appeared in

Volume 97, Issue 33

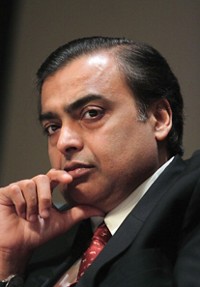

Furthering its goal of pushing deeper into chemicals as the fuel market matures, the Saudi state oil company Saudi Aramco has signed a letter of intent to buy a 20% stake in Reliance Industries’ petrochemical and refining business for about $15 billion. In addition, Aramco’s US arm, Motiva Enterprises, has agreed to acquire Flint Hills Resources’ petrochemical plant in Port Arthur, Texas, for an undisclosed sum.

Reliance’s petrochemical business had over $25 billion in sales during its most recent fiscal year, making it the 11th-largest chemical company in the world, behind South Korea’s LG Chem, according to C&EN’s survey of the Global Top 50 chemical companies.

The refining and marketing business had sales of nearly $58 billion. It operates the world’s largest refinery, in Jamnagar, India.

Reliance and Aramco have a longstanding relationship: Aramco has already provided 2 billion barrels of oil to the Jamnagar complex. With this new deal, Aramco will supply 500,000 barrels of crude to the refinery per day.

“Saudi Aramco continues to show keen interest in accessing the Indian market, which has the strongest long-term growth prospects,” says Alan Gelder, vice president for refining and chemicals at the consulting firm Wood Mackenzie. “Aramco is also demonstrating discipline in targeting strongly competitive assets that are well placed, through petrochemical integration, to be sustainable through the energy transition.”

In Texas, Motiva is getting a Flint Hills complex that produces ethylene, cyclohexane, and polymer-grade propylene. The facility is adjacent to a large Motiva refinery, according to Wood Mackenzie. Last year, Motiva signaled an interest in building its own ethylene and aromatic chemical facilities at the Port Arthur site.

The two deals continue a massive spending spree on both foreign and domestic chemical assets for Aramco, which has acknowledged a future of ebbing global demand for fuels. Earlier this year, the firm agreed to buy a 70% stake in the Saudi petrochemical maker Sabic, the world’s fourth-largest chemical maker. Aramco has also pledged to spend $100 billion on petrochemical projects.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter