Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

World Chemical Outlook 2019: Around the globe

by C&EN Staff

January 14, 2019

| A version of this story appeared in

Volume 97, Issue 2

Credit: Will Ludwig/C&EN/Shutterstock

World Chemical Outlook 2019

Around the globe

Takeaways

A slowdown in China and Europe will dampen demand for chemicals.

US chemical output will reach a new peak as new capacity comes on line.

Chemical M&A will continue as firms restructure to ensure earnings growth.

Economists writing about 2018 already sound a bit wistful. Last year, the global economy grew 3.7%, according to the International Monetary Fund, and the US enjoyed an extraordinary time of growth and job creation.

But this year, growth in the US is expected to slow to 2.5%, down from 3.5% in 2018. The story is the same for other advanced economies, according to IMF projections. And China’s growth rate will continue falling back to earth, moving to 6.2% from 6.6%.

For the chemical industry in particular, demand for chemicals in Europe is expected to increase by only 0.5% this year, according to the European Chemical Industry Council, a trade association.

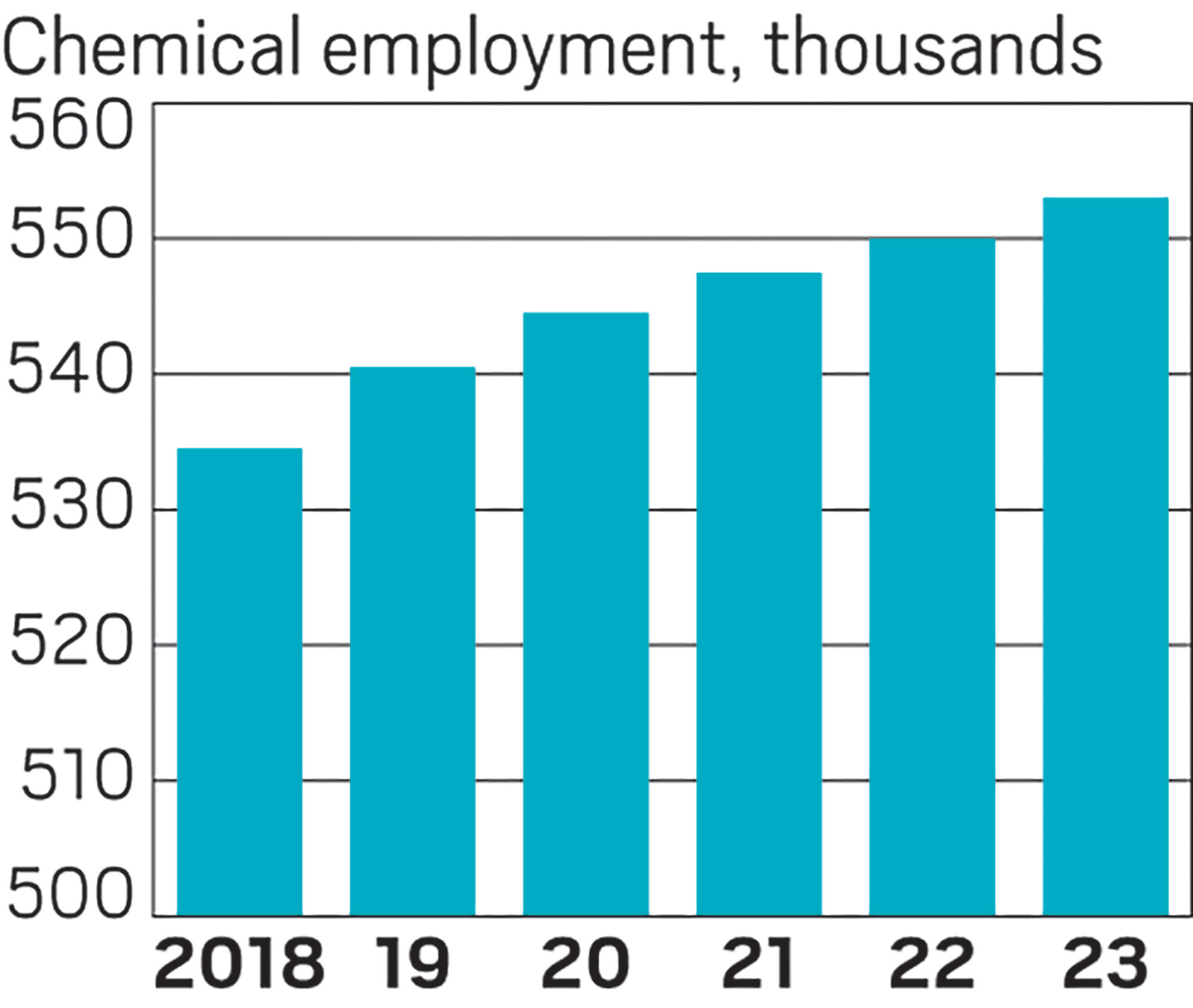

US chemical employment will grow thanks to shale gas–driven investments.

Note: Numbers are projections.

The US, in contrast, will be a bright spot. There, the cumulative power of spending and investment since the 2008 recession will keep factories humming, and that’s good news for chemical businesses. “The industry is poised for significant growth in output. It’s a very promising outlook,” says Kevin Swift, chief economist at the American Chemistry Council (ACC), a trade group for US chemical makers.

High demand for chemicals used in manufacturing will dovetail with a rise in production capacity as new chemical facilities open to take advantage of the shale gas boom, Swift points out. The ACC projects that US chemical output, excluding pharmaceuticals, will rise 3.6% this year, up from an already vigorous 3.1% in 2018.

The biggest factor driving US demand for chemicals is consumer spending. Thanks mainly to job growth, consumer confidence remains at historically high levels. Even jobs in the chemical sector are multiplying after decades of erosion. And continued low unemployment is expected to finally push up wages this year.

But that wage pressure will also mean rising interest rates as the Federal Reserve looks to avoid inflation. That will make financing more expensive for consumers and is expected to dampen sales of cars, while sales of single-family homes will at best remain flat this year.

Businesses can still access relatively low-cost financing, and rising rates are not expected to hurt business investment. According to the Institute for Supply Management, manufacturers say they will increase capital expenditures by 6% this year. Chemical firms that supply materials for heavy equipment benefited from such spending last year, and that’s expected to continue.

Advertisement

While it’s hard to imagine there are any chemical company acquisitions still to be made, deals will flourish this year, according to EY. The consulting firm says the need to expand earnings and fend off competition will cause more consolidation in petrochemicals, paints and coatings, polymers, and specialty chemicals. The breakup of DowDuPont into three new companies will likely create trickle-down merger and acquisition activity as they cast off noncore businesses.

One concern looming over the US industry is trade. Many of the new Gulf Coast chemical facilities were developed in part or full for the export market. This year exports are likely to be hampered by slowing growth overseas, Swift says.

Companies will also be watching the ongoing trade disputes, though Swift says the ACC has included their impact in its outlook.

Europe’s chemical industry is getting ready to navigate what could be a difficult year. Sales for some leading European companies, including BASF, faded toward the end of 2018, with expectations that they will not pick up anytime soon. But the most unpredictable factor—and the one that could cause the most pain for chemical firms—is the trade turmoil that may result from the political chaos currently gripping the European Union.

Takeaways

Low-level growth in European chemical production is anticipated.

Germany expects chemical sales to rise by 2.5%.

Brexit could significantly disrupt cross-border trade.

Chemical output in Europe is on course to grow a meager 0.5% to $620 billion in 2019, according to the European Chemical Industry Council, Europe’s leading chemical industry group. “We remain cautiously optimistic about the 2019 prospects,” Director General Marco Mensink says.

If there are no major setbacks, production in the German chemical and pharmaceutical industry—Europe’s largest—is anticipated to increase 1.5% in 2019, says Hans Van Bylen, president of VCI, Germany’s main chemical industry association. “Chemical prices should rise by 1%. In this setting, the industry’s sales are likely to improve by 2.5%,” he says. “We think that modest growth in chemical business can be achieved in 2019.”

But then there is Britain’s exit—or Brexit—from the EU. The UK Parliament will vote Jan. 14 on how the country will separate from the EU on March 29. Either the UK Parliament will acquiesce by voting to accept the EU’s restrictive divorce terms, or, as is widely anticipated, it will reject the EU’s deal. A “no deal” Brexit would stop UK companies from trading freely with the EU. Setting up a new UK-EU trade agreement could take months, with major implications for European chemical trade.

“If there is no deal, this would be very damaging for our businesses,” said Tom Crotty, a board member at the petrochemical maker Ineos, at a recent meeting of the UK’s Chemical Industries Association in London. EU countries could also be hit hard by a no-deal Brexit. The Association of German Chambers of Commerce and Industry estimates that a no-deal Brexit would place 750,000 German jobs at risk.

Regardless of how the UK leaves the EU, the region’s chemical industry will miss the presence of UK members of the European Parliament. Without the UK, Europe’s Green Party may have a greater influence. “It will get a degree more complicated,” Mensink told Chemical Industries Association members in London.

But Brexit may not be the only crisis European companies have to dodge in 2019. The economies of Germany and Italy are wobbling, and Italian politicians have been railing against the EU. Brexit could even be followed by “Quitaly,” some political analysts say.

Heading for the Brexit

The UK’s departure from the European Union will roil chemical trade.

The UK chemical and drug sector exports $60 billion per year, 60% of which goes to the EU.

About 75% of the UK’s chemical imports come from the EU.

UK chemical makers have lobbied the UK to accept the EU’s Brexit terms, enabling a two-year transition period.

A no-deal Brexit could result in months of cross-border trade disruption.

An estimated 80% of small businesses would be unprepared in the event of a no-deal Brexit.

The European Parliament may adopt stricter environmental policies after Brexit.

Sources: Chemical Industries Association, Ready for Brexit.

Middle Eastern national oil companies are plunging deeper into chemicals at a scale that they, no strangers to large projects, have not attempted before.

Takeaways

Large Middle Eastern oil companies are deepening involvement in chemicals.

Growth in chemicals will make up for a maturing transportation fuel sector.

Middle Eastern governments see chemicals as a job-creation engine.

Saudi Aramco recently pledged $100 billion over 10 years toward petrochemical projects. That alone is half of what all chemical companies spent in the US during the shale gas boom in the 2010s.

At home, Aramco is planning an ethylene cracker with France’s Total. It is building an oil-to-chemicals complex, meant to produce chemicals—instead of fuels—from oil, with fellow state-owned Saudi firm Sabic. And Aramco and Sabic are in merger discussions.

Abroad, Aramco plans to build one of the world’s largest oil-refining and chemical complexes in India at a cost of $44 billion. It may also construct an ethylene and aromatics project in Port Arthur, Texas, with refining affiliate Motiva Enterprises.

Abu Dhabi National Oil Co. is investing $45 billion in chemicals with partners. It aims to triple capacity downstream from its Ruwais, United Arab Emirates, refinery by 2025. Part of this will be a new cracker and derivatives complex at its Borouge joint venture with Borealis.

At the Gulf Petrochemicals and Chemicals Association Forum in Novemberin Dubai, United Arab Emirates, Aramco CEO Amin H. Nasser explained that his firm sees chemicals as one of its best markets. They will account for a third of oil demand growth by 2030.

Andrew Spiers, a senior vice president at the consulting firm Nexant, points out that today’s Middle Eastern projects are more elaborate than those built during the region’s boom of the past decade. Then, projects were meant to turn ethane into exportable products such as polyethylene and ethylene glycol.

Now, ethane supplies are running low, and the new projects are based on heavier feedstocks such as naphtha and crude oil. This means more coproducts such as propylene and aromatics—and more opportunities to add value by making specialty chemicals. For example, Sadara Chemical, a recently completed joint venture between Aramco and Dow Chemical, is a major producer of polyurethane chemicals.

The trend dovetails with the aim of Middle Eastern governments to boost employment. “The further down the chain you go, the more added value you have and the more labor intensive production tends to be,” Spiers says.

For the last several years, Brazil has been in disarray as a massive corruption scandal sent shock waves throughout the government. It led to the ouster of president Dilma Rousseff in 2016 and the imprisonment of former president Luiz Inácio Lula da Silva.

Takeaways

Far-right politician Jair Bolsonaro became Brazil’s president on Jan. 1.

The business community is hoping for fiscal tightening, such as pension reform.

The new government promises a sharp increase in science funding.

Additionally, Brazil is struggling to climb out of a recession that peaked in 2015 and 2016. This year’s International Monetary Fund growth projection of 2.4% would be Brazil’s best performance in six years.

Seething against corruption, crime, and boom-and-bust economics, Brazilians in October elected far-right candidate Jair Bolsonaro as president with 55% of the vote. Bolsonaro is frequently compared to US president Donald J. Trump. He is known for his bombastic homophobia, global warming skepticism, and nostalgia for the authoritarian military regime that ruled the country from 1964 to 1985.

Yet while some Brazilians fear for their democracy, big business appears optimistic about Bolsonaro. The Brazilian stock market, the Bovespa, climbed nearly 14% in October and November.

João Luiz Zuñeda, founding partner of the Brazilian chemical consulting group MaxiQuim, attributes the stock market performance to an influx of investment from foreigners expecting free-market policies such as pension reform and the sale of state-owned companies. Already, the state oil and gas firm Petrobras has said it intends to divest noncore assets in areas such as chemicals, fertilizers, and refining.

“In both cases—welfare and sale of state assets—representatives of workers and the public sector have already shown that they are against the changes,” Zuñeda says. “It will be an important challenge to the Bolsonaro government.”

Success by Bolsonaro might resuscitate Brazil’s recovery, BlackRock Investment Institute analyst Isabelle Mateos y Lago told clients in a recent report. However, she warned about backsliding on democracy. “If Bolsonaro were to act in ways that damaged institutions, as some fear, this could pose longer-term risks to Brazil’s growth.”

Bolsonaro has pledged not to extend the belt-tightening to science. Meager funding from the private sector is a chronic ailment for science in Brazil. Compounding the problem, federal funding has declined by about 50% since Brazil’s economic troubles began in 2014. “Many groups kept running as they used to,” says Fernando Galembeck, a physical chemist at the University of Campinas. “But many others were badly hurt.”

Bolsonaro promises to raise R&D funding to 3% of Brazil’s gross domestic product, up from a little over 1% today. Galembeck is skeptical that the money will flow within the next few years. Moreover, he worries that the new government will emphasize “big science,” such as the Sirius synchrotron under construction in Campinas, and leave academic research behind.

“What I’m really concerned about is the science done at universities. I think it will continue to suffer because preference will be given to big, visible projects,” he says. “This is the biggest danger that I can see now.”

Early last month, the US and China declared a three-month truce in their trade conflict after a meeting between their respective leaders. But as the meeting was going on, Canadian authorities quietly arrested a senior executive from Chinese electronics firm Huawei at the request of the US, a move that triggered fierce protests from China. This messy end to 2018 ensured that the US-China trade spat will continue to make headlines in 2019. As C&EN went to press, trade negotiators from both sides were meeting in Beijing.

Takeaways

The US is due on March 1 to increase a tax on $200 billion worth of Chinese imports to 25%.

A long conflict could hamper investment in the US petrochemical sector.

China’s electronics industry will encourage development of local raw material suppliers.

The conflict began in March when the US, in an effort to convince China to change certain investment and intellectual property policies, threatened to impose a 25% import tax on $50 billion worth of Chinese goods. The US not only made good on the threat but also started collecting a 10% tax on an additional $200 billion worth of Chinese imports. China retaliated by introducing taxes on $110 billion worth of US products.

Chemicals are an important component of US-China trade. The American Chemistry Council (ACC), which represents the US chemical industry, calculates that over 1,000 US chemicals and plastics, worth nearly $11 billion per year, are affected by China’s retaliatory tariffs. On the US side, buyers have to pay more for over 1,500 Chinese chemicals and plastics worth more than $15 billion.

“The tariffs will cut off U.S. manufacturers from international supply chains and from importing inputs that help keep them competitive in the global marketplace,” the ACC commented in September.

Depending on the chemical or plastic, the tariffs could have a variety of effects. In the case of polyolefins, for example, the tariffs imposed by China could reduce investment in new facilities in the US.

$15.4 billion

Value of Chinese chemicals and plastics targeted by US tariffs

$10.8 billion

Value of US chemicals and plastics facing Chinese tariffs

China’s retaliatory tariffs on petrochemicals and plastics are lowering the financial returns on US-based plants, making the construction of new facilities less likely, according to Ashish Chitalia, a principal analyst at Wood Mackenzie Chemicals, an industry consultant. China is the world’s largest market for basic plastics, and tariff rates of 5 to 25% hurt US competitiveness, he explains.

On the other hand, Chitalia notes, higher prices for Chinese-made plastic goods could lead to new investments in the US by plastic processors.

For chemicals used by the electronics industry, the impact of a long trade war would be profound. Lita Shon-Roy, president of the electronic materials consulting firm Techcet, says US materials suppliers could gradually lose what share they have of the Chinese market.

“Eventually, China will minimize their dependency on American-made goods through vertical integration and rerouting their supply chain to the exclusion of the US,” Shon-Roy says. In the US, the electronics industry has had to absorb price increases in excess of 25% for certain Chinese-made materials, she adds.

If the US and China don’t come to an agreement before March 1, $200 billion worth of Chinese goods that the US currently taxes at 10% will have their rate increased to 25%. China will certainly retaliate, but as it is running out of US imports to tax, it may impose new restrictions on US companies.

Immigration is a hot-button issue in the US, from the borders to Washington, DC.

Takeaways

Immigration is a high-profile talking point in politics, but major policy changes are unlikely.

H-1B visas for highly skilled immigrants could be the exception.

Despite all the attention, though, experts say few big policy changes are on the horizon for science-related immigration policy in 2019 given ongoing political gridlock. That stalemate will likely worsen as Democrats take over leadership of the US House of Representatives this month. But some smaller changes could come from the Donald J. Trump administration itself, especially to the H-1B visa system.

The biggest immigration change for scientists under Trump so far might be in the atmosphere surrounding the issue. The Trump administration’s ban on travel from seven countries marked the start of international skepticism about the US as a welcoming place for scientists, advocacy groups say. Adding to that skepticism are recent rumors of policies that would make it harder for Chinese students studying some science fields to get or keep visas.

34%

Percentage of chemistry doctorates granted to temporary visa holders by US universities in 2017, according to the US National Science Foundation Survey of Earned Doctorates.

The concern is reflected in data on international student enrollment in US schools. For example, according to the Institute of International Education, new international enrollments in graduate school were down 5.5% in 2017–18, the second straight year of decreases. The largest number of international students, more than 363,000, come from China.

“We are concerned with this chilling effect,” says Lizbet Boroughs, associate vice president for federal relations at the Association of American Universities, which represents the top US research universities. Anecdotally, AAU has heard from universities that travel to the US for meetings or other work trips is also getting harder. “Science is supposed to be collaborative,” she says.

The most likely changes in 2019 would be tweaks to the H-1B visa process. Companies use the H-1B visa to hire high-skilled workers, and the Trump administration may change the process without an act of Congress. One option would give people with a master’s degree or higher a better chance of winning a slot in the H-1B visa lottery, which in 2018 received more than twice the number of applications than the 85,000 slots available. Another would move the application system from paper based to electronic.

However, around 70% of H-1B visas go to high-tech workers. Consequently, any change to that visa system would likely have a small impact on chemistry and other science fields.

In 2016, European Union member states agreed that by 2020 all scientific articles should be open access immediately upon publication. As that deadline approaches, several initiatives are pushing to meet that goal.

Takeaways

Europe wants full open access by 2020.

Plan S faces criticism; the number of read-and-publish agreements is increasing.

EU copyright reform may allow freer access for text and data mining.

The newest of these, Plan S, is an agreement among 13 national funders and three charitable foundations, including the Bill and Melinda Gates Foundation, to require grant recipients to publish only in journals that make all content freely accessible.

The plan faces criticism. Over 1,500 researchers have signed an open letter voicing concerns, and some funders have chosen to express support for the plan but not sign it. For example, the Swedish Research Council has stated that it needs time to evaluate the Plan S timeline and guidelines.

The coalition behind Plan S is looking for more funders to join it in 2019. It is also gathering feedback from the public until Feb. 1.

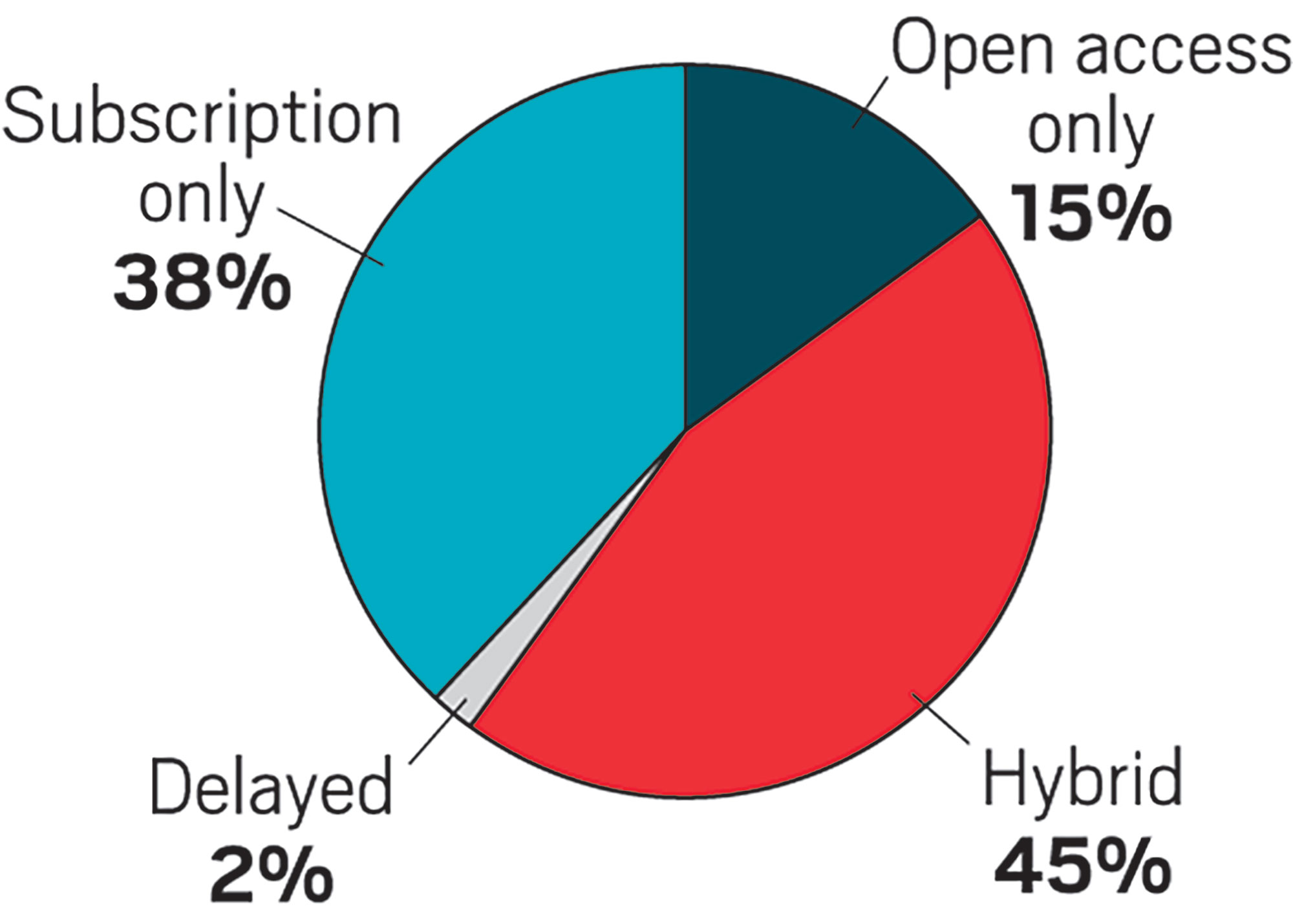

Restricting researchers to fully open-access publications would significantly limit their choices

Note: Hybrid journals offer both subscription and freely accessible content. Delayed content is made freely accessible after a certain period of time. Analysis is based on journals indexed in Scopus in 2016, including those in physical, life, and social sciences; engineering; arts; and humanities. As of Dec. 26, 2018, Scopus claims to index more than 23,700 peer-reviewed journals.'

Meanwhile, consortia continue to negotiate with publishers to set up so-called transformative, or read-and-publish, deals in 2019. In these deals, which will be Plan S compliant during a transition period, an institute or country pays publishers a set amount in proportion to the number of articles that the organization or country publishes. The deals often combine charges for journal access and publishing open-access articles.

“Transformative agreements are one of the primary strategies for driving large-scale transition of scholarly publishing to open access,” says Ralf Schimmer, deputy general manager of the Max Planck Digital Library. These approaches are increasingly being adopted across Europe, he adds.

But the approach is not without risk. Researchers can lose access to journals if negotiations break down, as has happened in Germany, Sweden, and the Netherlands.

Open-access alliances are also calling for data that are open and adhere to criteria termed FAIR Guiding Principles—for findability, accessibility, interoperability, and reusability. More accessibility may come with proposed reforms to EU copyright regulations; however, critics of draft legislation note that it provides freer access for text and data mining only for nonprofit purposes or the public interest. Negotiators have yet to agree on the final text during closed discussions.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter