Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Earnings Decline Slightly

Lower demand and rising costs continue to hamper results at 25 firms

by William J. Storck

May 22, 2006

| A version of this story appeared in

Volume 84, Issue 21

While the fourth quarter of 2005 proved difficult for U.S. chemical companies, with earnings rising just slightly above year-earlier results, the first quarter of 2006 was even worse: C&EN's group of 25 firms posted an aggregate earnings decline—the first the industry has seen since the third quarter of 2003.

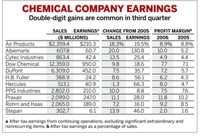

When all of the results were in, the companies had a total earnings decline of 2.7% to $4.0 billion. Sales were bolstered largely by price increases to a total of $49.6 billion, a 5.1% increase from the comparable period in 2005. Earnings are from continuing operations, excluding extraordinary and nonrecurring items.

As a result, profitability suffered. The aggregate profit margin for the combined companies fell to 8.1% from 8.7% in the same period a year earlier. This outcome, however, was a big improvement from last year's fourth quarter, when the total profit margin, battered by the aftermath of the Gulf Coast hurricanes, was just 6.1%.

Disasters aside, there was a weakness in many industry fundamentals in the first quarter. According to the Federal Reserve Board, total U.S. chemical production declined 1.5% from the same period a year earlier. Within that, the important basic chemicals sector saw output drop a whopping 7.8%.

Prices, though, continued to increase, rising 8.9% for all chemicals, according to Labor Department data. Meanwhile, the average producer price index for basic chemicals in the quarter jumped 14.4%.

Despite the decline in production in the quarter, the increase in prices raised the dollar value of chemical shipments, or what companies actually sell to customers. The Department of Commerce reports that shipments of all chemicals in the first quarter rose 6.2% to $142.6 billion. Shipments of chemicals excluding pharmaceuticals, a product basket that is more in line with the mix of products at the 25 companies, rose 7.7% to $107.7 billion.

Although chemical earnings were down overall, the majority of firms had earnings increases in the quarter. Seventeen of the companies saw earnings rise, with two, Celanese and H.B. Fuller, showing triple-digit growth. The remaining eight had lower earnings than in the first quarter of 2005. This includes Terra Industries, where earnings went from $4.4 million in first-quarter 2005 to a loss of $25.3 million in the first three months of this year.

The two largest companies on the list, Dow Chemical and DuPont, were among the firms with lower earnings. Dow's earnings fell 10.6% to $1.21 billion on a 2.9% rise in sales to $12.0 billion. Earnings at DuPont declined 10.3% to $867 million, while sales were down by 0.5% to $7.39 billion.

Nevertheless, profitability remained high at both companies. Dow posted a profit margin of 10.1% compared with 11.6% in the comparable 2005 quarter, while DuPont's profit margin of 11.7% was down from 13.0% in the year-earlier period.

Both companies put a brave face on the declines. At Dow, Chief Financial Officer Geoffrey E. Merszei, says: "This was a quarter in which we again benefited from our strategy, with an increase in [earnings before income taxes] of our combined performance businesses mitigating a decline in our basics portfolio. And while turnarounds during the quarter impacted volume, and U.S. sales slowed at the start of the year on the expectation of lower prices, we saw demand pick up again in March, and that momentum has continued into the second quarter."

DuPont Chief Executive Officer Charles O. Holliday Jr. says: "We knew it would be a difficult operating environment in the first quarter, and I am very encouraged by the better-than-expected performance of our company. We are fully committed to growing revenue, controlling costs, and improving returns on assets across all of our businesses." Additionally, Holliday says, "We are raising our full-year earnings outlook in light of our first-quarter performance and the progress we have made in successfully implementing initiatives to accelerate shareholder value."

The largest measurable percentage decline in earnings for the quarter—59.1%, compared with the year—earlier period-came from Huntsman Corp. CEO Peter R. Huntsman chose to make a comparison with the previous quarter. "Our results in first-quarter 2006 show marked improvement as compared to the hurricane-impacted results achieved in the fourth quarter of 2005," he says, noting that sales volumes improved across most product lines as end- market demand continues to grow in North America, Europe, and Asia.

But all is not perfect. "As we have indicated in the past, we are frustrated with the valuations that the market appears to place on our differentiated businesses," Huntsman notes. "We continue to evaluate available options for improving shareholder value, and as previously announced, we are aggressively pursuing the sale of certain of our base chemicals and polymers assets and/or a spin-off of these segments."

Eastman Chemical, which had 35% earnings growth in final quarter of 2005, saw its fortunes turn in the first quarter of this year as earnings fell 27.7% from year-earlier levels to $112 million. The decline came on a 2.3% increase in sales to $1.80 billion. The decline was due primarily to lower polymers segment earnings, which fell to $17.0 million from $84.0 million in the comparable 2005 quarter. The company's raw material and energy costs increased by about $100 million compared with those in first-quarter 2005, and results also were affected by about $19 million in costs associated with operational disruptions at Eastman's Longview, Texas, facility.

Among companies with gains for the quarter, Celanese, a company new to the C&EN list, took the prize. Earnings at the firm more than tripled, rising 234.2% to $127 million as sales increased 11.8% to $1.65 billion. Profitability at the company jumped to 7.7% from 2.6%. "Our results demonstrate the strength of our integrated hybrid structure as our downstream businesses delivered improved performance year-over-year," CEO David N. Weidman says. "We are focusing our portfolio, expanding globally, and relentlessly pursuing cost improvements to deliver on our commitments and create value for our shareholders."

Also new to the list of 25 firms is Lyondell Chemical, which enters the group as the third-largest company. Up until now, year-to-year comparability had been problematic when analyzing the firm's data.

Lyondell had 14.2% earnings growth to $290 million, double its 7.1% sales increase to $4.76 billion. The company's profit margin increased to 6.1% from 5.7%. Of the future, CEO Dan F. Smith says, "Volatility and current high prices in the energy markets continue to present challenges, but strong business conditions ultimately should prevail, positioning Lyondell's chemical products for another strong year."

Celanese and Lyondell have replaced Ferro and PolyOne in C&EN's survey of chemical company earnings.

Other companies are predicting a good year on the basis of their first-quarter results. One of them is FMC Corp., which had a 38.0% increase in earnings to $69 million as sales rose 7.5% to $594 million. "With our strong first-quarter performance, we have raised our full-year 2006 outlook for earnings, before restructuring and other income and charges, to $5.35 to $5.55 per diluted share," CEO William G. Walter says. Diluted earnings per share is the value reached if all convertible securities were converted or all warrants or stock options were exercised. "Through the balance of the year, we expect to realize the ongoing benefits of higher selling prices in industrial chemicals, lower interest expense, and continued profitable growth in agricultural products and specialty chemicals, though unfavorable currency translation and higher energy and raw material costs are expected to persist," he adds.

For all of 2006, Praxair expects to see continued year-over-year growth of about 10% and diluted earnings per share in the range of $2.74 to $2.82, representing 13-17% growth over 2005. CEO Dennis H. Reilley says, "We expect strong growth in 2006 and 2007 as projects in our backlog come onstream and new applications technologies take hold." In the first quarter, Praxair's earnings rose 19.1% to $225 million. Sales improved 10.9% to $2.03 billion.

At Rohm and Haas, CEO Raj L. Gupta expects 3-4% demand growth due to higher sales in key markets such as electronic materials and coatings, even though the outlook for global demand and input costs remains uncertain. At the same time, the company is focused on improving sales mix, managing selling prices, maintaining growth in emerging markets, and improving manufacturing efficiency. "As a result," Gupta says, "we expect full-year sales growth in the 3-5% range, yielding annual sales of approximately $8.3 billion and full-year earnings in the $3.15- to $3.30-per-share range."

Oil Companies

High Costs Cut Chemical Earnings

Criteria For C&EN Earnings Analysis

C&EN's quarterly report on financial performance of the U.S. chemical industry contains data from 25 major U.S. basic chemical companies and from five petroleum companies, each of which has more than $1 billion in annual chemical sales.

To be included in the table of basic chemical companies, a company must have at least 50% of its sales in chemicals.

In referring to chemical sales, C&EN means sales of chemicals for which the molecular composition has been changed during manufacture. Hence, these include traditional categories of basic petrochemicals and inorganics, organic intermediates and inorganic compounds, polymers such as plastics and fibers, and agricultural chemicals and specialty derivatives.

In listing earnings, the report gives after-tax income for continuing operations, excluding significant nonrecurring and extraordinary items.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter