Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

An Uphill Battle

With short lives and uncertain profits, antibiotics are a unique development challenge for drug companies

by Lisa M. Jarvis

April 14, 2008

| A version of this story appeared in

Volume 86, Issue 15

In the early 1990s, Eli Lilly & Co. put out to pasture a compound that had once held great promise as the first of a new class of antibiotics. Daptomycin, a lipopeptide discovered in a soil sample taken from Turkey's Mount Ararat, was just too challenging to bother pursuing any further.

The problem was that, despite signs of activity, the drug wasn't very potent. But when clinicians turned the dosage up or administered the drug more often, trial volunteers developed muscle damage. The therapeutic window—the range in which a drug can be given safely and effectively—was simply too narrow.

Lilly had decades of experience developing antibiotics; from the 1940s through the 1960s, it had introduced the seminal drugs erythromycin, vancomycin, and cephalosporin to the market. But for daptomycin, scientists just couldn't find a path forward that made sense, says Barry I. Eisenstein, who was vice president of Lilly Research Laboratories and head of infectious disease research at the company from 1992 to 1996.

The fact that Lilly already marketed vancomycin, a broad-spectrum antibiotic that was considered the gold standard of care at the time, made the decision to scrap the drug easier. Good options to treat infections were already out there. Why waste more time on a drug that would compete with a company breadwinner?

Daptomycin was shelved, and a few years later Lilly got out of antibiotics research altogether. In fact, the mid- to late-1990s was marked by a mass exodus of big pharma firms from antibiotics R&D. The market seemed sated, and research was too slow and financially unrewarding.

And yet a decade later, a clear need for new compounds has arisen. Only two novel classes of antibiotics have been introduced in the past 40 years: oxazolidinones and lipopeptides. And the overall number of new, approved antibiotics–almost all members of known classes–has steadily declined, according to the Infectious Diseases Society of America.

Meanwhile, several strains of bacteria have outwitted vancomycin and other key antibiotics, leaving doctors with few options to combat what are often referred to as "superbugs." Methicillin-resistant Staphylococcus aureus (MRSA), in particular, has made headlines because of its alarming ability to strike otherwise healthy people.

Thus the conundrum in antibiotics research: Companies aren't motivated to look for novel drugs in a category that for years was fairly well supplied and not very lucrative. At the same time, bacteria have a crafty way of rendering existing drugs obsolete, usually around the time companies lose interest in finding replacements. The result is a disheartening cycle in which scientists barely catch up, only to again fall behind the disease curve.

Small companies are starting to step in where big pharma left off. Cubist Pharmaceuticals, where Eisenstein now serves as senior vice president of scientific affairs, saw promise in daptomycin and licensed it from Lilly in 1997. As Eisenstein enthusiastically tells it, in six short years, Cubist scientists managed to solve the dosing problem—giving a higher dose less frequently widened the therapeutic window—and ushered the drug through late-stage trials, past regulatory authorities, and to the market. Last year, Cubist raked in $290 million in sales of Cubicin, its brand name for daptomycin.

Cubist has been the pacesetter for the cadre of biotechs devoted to developing new antibiotics; today, companies such as Targanta Therapeutics, Replidyne, Optimer Pharmaceuticals, and Paratek Pharmaceuticals have drugs on the edge of commercialization. Like Cubist, many of the tiny biotechs pursuing antibiotics are built around chemists or physicians who formerly led anti-infectives R&D and commercialization efforts at bigger firms like Lilly, Wyeth, and Abbott Laboratories that abandoned the field.

Cubist has proven that a small company can bring a drug to market without a partner and lay the financial groundwork for a robust new product pipeline. The company's Lexington, Mass., headquarters bustles with signs of expansion, a clear reminder of its recent success.

But the industry needs to make more progress if antibacterial drug discovery is to evolve. Much of the late-stage new product pipeline at biotech firms consists of molecules licensed from U.S. or Japanese drug companies. These molecules are largely derivatives of already-marketed compounds rather than innovative new classes.

Rather than delve into basic research, though, biotechs must focus their limited resources on their lead compounds—those well-understood derivatives of older drugs. That leaves few research dollars for the newer discovery techniques, such as high-throughput screening, combinatorial chemistry, and structure-based drug design, needed to make molecules from scratch.

Cubist's expanding headquarters houses its nascent effort to build the infrastructure for new technologies to discover antibiotics. "We just had our first profitable year," notes Chet Metcalf, senior medicinal chemist at Cubist. "Much of our previous R&D work had gone into Cubicin. We're just now able to put profits back into new molecules."

Indeed, Lilly's decision to scrap daptomycin—a drug that just required a bit more creative thinking—underscores the particular challenges of discovering and developing novel antibacterial compounds. Developing a new antibiotic is a sisyphean task, thanks to the dauntingly steep evolutionary hill researchers must climb. "The organisms we're trying to inhibit have been around for millions, if not billions, of years and have a 20-minute generation cycle," points out Cubist's chief scientific officer, Steven C. Gilman. That's a lot of time to devise means of surviving environmental threats.

And bacteria tolerate the most extreme conditions on Earth. They live on the floor of the ocean or at the core of a snowflake. They thrive in toxin-laden soil deep below Earth's surface as easily as in the acidic turmoil of the digestive tract. Of course, not all bacteria are pathogenic, but those that are make formidable adversaries for medicinal chemists and microbiologists looking for molecules that can overcome their natural defense mechanisms.

Then, once researchers beat evolution and make it to the top of the hill—once they have found that one molecule that can stop a pathogen—the ball starts rolling down again. Resistance is not an "if" but a "when," Gilman says. As bacteria figure out how to evade antibiotics, not only does the entire discovery process start over but a company's key revenue generator loses steam.

To top it off, antibiotics are among those quaint, old-fashioned drugs that patients eventually stop needing. Lilly, for example, abandoned daptomycin at a time when it was enjoying its first taste of billion-dollar success with Prozac, a depression treatment that patients take indefinitely. Such consistency in generating blockbuster sales—the kind investors have come to expect from large companies—just isn't the norm for antibiotics.

Yet scientists can also use evolution to their advantage. Bacteria are battling it out with each other for survival, which means nature has come up with some good defenses against pathogens. Novel classes of antibiotics have traditionally been discovered by digging through soil samples that tend to be laden with actinomycetes, a group of bacteria that make secondary metabolites useful in fighting infections.

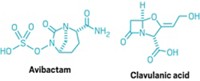

Those natural products then serve as a springboard for chemists to generate derivatives. Medicinal chemists have typically exploited the potential of β-lactam antibiotics—any molecule with a β-lactam ring at its center, such as penicillin derivatives and cephalosporins. By tweaking the five- or six-member ring fused to β-lactam, chemists found that they could crank up antibacterial activity.

In fact, natural products and their derivatives continue to dominate both recent antibiotic product launches and companies' late-stage drug development pipelines. In addition to Cubicin, the pipeline includes Merck & Co.'s platensimycin, discovered in soil from South Africa, and Targanta's oritavancin, found in a sample from Haiti.

That reliance on nature to make the best medicine hasn't been completely voluntary. In an effort to develop new antibiotics from scratch, scientists have tried many ways to tap into the knowledge that came with the unraveling of the genome and the advent of combinatorial chemistry and high-throughput screening. Yet so far those efforts have failed.

"Despite all the work we haven't come up with a single new antibiotic based on the genome; it was a total waste," says Stuart Levy, cofounder of Paratek and director of the Center for Adaption Genetics & Drug Resistance at Tufts University.

Thomas R. Parr, Targanta's chief scientific officer and a former Lilly researcher, agrees. "The ability to take a putative target molecule and try to guess what's going to fit into the receptor slot, binding pocket, or active site has not been a very successful approach," he says. "Nature is a more clever and competent chemist than a human being is at finding starting points."

The difficulty can be summed up in a lack of chemical entry points, Cubist's Metcalf says. Bacterial targets are different from those found in the human body, so screening libraries of known compounds that are designed to work against human targets isn't effective. "You can't often find a chemical entry point, or when you find one it doesn't work against the target in the cell," Metcalf notes.

Furthermore, medicinal chemists are typically trying to design a compound that can take out multiple strains of bacteria in one fell swoop, a particularly difficult feat when starting from square one.

Some companies have tried to use the total genome sequences in bacteria and humans to find unique and essential genes, notes Robert C. Moellering Jr., professor of medical research at Harvard Medical School. The idea is to then knock out those genes and kill the bacteria. The problem has been sorting through gene codes to figure out the right one and then finding a small molecule that can get in and block it. "So far, that's been too difficult a task to overcome," Moellering says. "Some big pharma companies have spent more than $100 million on these projects with nothing to show for it."

Thus, researchers turn back to nature. Natural products, however, are limiting. Scientists have already picked most of the low-hanging fruit—the classes of compounds that tend to dominate soil samples. "The easy targets are all known and have been exploited," Moellering says.

With such business and scientific challenges in mind, companies are taking a wide range of approaches to finding new antibiotics. Some executives believe natural products will continue to be the primary source of novel molecules, while others are convinced scientists must find a way to use advanced technologies to build compounds from the bottom up. The answer could also be a happy medium, where companies apply newer techniques to speed up their search for useful natural products.

Targanta is in the camp that believes natural products will continue to be the way forward, although it does keep an eye on newer tools. The company is devoting the bulk of its resources to bringing oritavancin, a semisynthetic glycopeptide licensed from Lilly, to market. The Cambridge, Mass.-based biotech filed a New Drug Application with the Food & Drug Administration in January and is expecting a response by December so that the drug could launch in 2009.

Even Targanta's earlier-stage efforts are focused on derivatives of natural products. "The bugs are smarter than the chemists," Parr says. "I think there is still great promise to find things by looking to nature." The challenge, he adds, will be to accelerate the process of sifting through natural products to find useful molecules while figuring out how to streamline the chemistry needed to turn those molecules into drugs.

Meanwhile, Boston-based Paratek is mining an older natural product class that it believes has not been fully exploited. The company's lead molecule is a derivative of tetracycline, an antibiotic that hit the market in the 1950s. However, little new chemistry has been introduced since then to overcome resistance or other issues with the drug. Paratek chemists made thousands of tetracycline derivatives to try to cut resistance while preserving antibacterial activity. Eventually, they hit on some promising compounds.

"This four-ring structure has a lot going for it," Levy says of tetracycline. His team is now analyzing the data from Phase II trials of PTK-0796, a broad-spectrum derivative for intravenous and oral use.

Optimer, meanwhile, is focused on developing narrow, or at least narrower, spectrum antibiotics that take out just one or two pathogens; broad-spectrum drugs, in contrast, use brute force to wipe out a range of bugs that may be causing an infection. The narrower approach is not useful in all settings, concedes Michael Chang, Optimer's president and CEO, particularly in the absence of rapid diagnostics to detect the specific bacteria infecting a patient. But certain indications in patients call for narrow-spectrum drugs, and with fewer targets to hit, researchers could have an easier time designing them.

Advertisement

The San Diego-based firm's lead compound, OPT-80, is an 18-membered macrocycle that treats Clostridium difficile infection (CDI), an infection in the lining of the colon that is a prime candidate for a narrow-spectrum drug. A broad-spectrum antibiotic like vancomycin, currently the only approved treatment for CDI, kills most of the flora in the gut, but C. difficile protects itself by forming spores. When antibiotic use is stopped, the C. difficile grows again, and this time its growth isn't tempered by other bugs. "It grows with a vengeance," Chang says.

OPT-80 would be the first very-narrow-spectrum antibiotic on the market, Chang says. The drug is currently in two Phase III trials; results from the first trial are expected in 2008 and from the second in the first half of 2009. If all goes well with the trials and regulatory authorities, the drug could hit the market by 2010.

Replidyne is also exploring a narrow-spectrum approach as part of its overall R&D strategy. The Louisville, Colo.-based company identified a compound against C. difficile from assets it licensed from GlaxoSmithKline. The compound blocks methionyl transfer RNA synthetase, an enzyme involved in synthesizing proteins. By halting the production of toxic proteins, the drug renders the bacteria harmless, says Nebojsa Janjic, Replidyne's chief scientific officer. The company plans to file an Investigational New Drug (IND) application with FDA, the first step in initiating human tests of the drug, by the end of the year.

A second program seeks to overcome some of the more virulent bugs by inhibiting bacterial DNA replication, the organism's means of reproducing and sustaining an infection. Replidyne has identified a series of compounds that inhibit replication and hopes to select one IND candidate by the end of the year.

Cubist, with one successful drug under its belt, is probably in the best position among the small biotechs to move beyond the natural products approach and into novel drug discovery techniques. The company is incorporating computational chemistry, chemoinformatics, and structure-based drug design into R&D.

At the same time, Cubist continues to exploit compounds found in nature by improving known drugs and isolating new compounds that could be engineered into drugs. That effort is aided by better assays that can weed out the known antibiotics that tend to dominate natural product samples.

Cubist's Metcalf believes the way forward is to figure out how to create new libraries that take into account the differences between bacterial cells and human cells. Fragment-based drug design isn't biased to any particular type of target, he notes, and can be a starting point to using structural knowledge to advance a molecule into a drug.

However, substantial resources will be required to incorporate new techniques into antibiotics drug discovery. Usually, that kind of money comes only from big pharma. Pfizer, which bolstered its antibiotics capabilities in 2005 through the acquisition of Vicuron Pharmaceuticals, is one of the few major companies with substantial activities in the area.

Although Pfizer's lead compound, dalbavancin, belongs to the same class as vancomycin, the company is also trying to bring new technology to bear on antibiotic development. "I think there's now opportunity to marry some technologies," says Paul S. Miller, head of antibacterials research at Pfizer. In recent years, researchers have been able to get at new organisms, such as those dwelling at the depths of the ocean or at extreme temperatures. Simultaneously, scientists are beginning to understand how to use genomic tools to manipulate the genes of an interesting organism to tweak and improve the molecules it produces.

Furthermore, scientists can revisit the sample libraries accumulated in decades past—the stuff found in the backyard, as Miller puts it—and apply new techniques to find interesting molecules. Many times, only a tiny fraction of what was contained within those soil samples could be cultured, he notes. Today, the potential exists for using genome DNA amplification technology to fish out genes responsible for assembling a compound. Those genes can then be cloned in a laboratory organism to determine whether it could make an interesting drug.

"The microbial diversity on the planet is enormous, and we've only been able to characterize the tip of that iceberg," Miller says.

Interest from big pharma does appear to be percolating: Merck has several programs in the early stages of development; GSK is reportedly active in the area; and Johnson & Johnson has partnered with the Swiss firm Basilea for the development of a broad-spectrum cephalosporin.

Even a modest revival in antibiotics R&D from big pharma could help fertilize drug discovery efforts in the industry. "A lot of the work and the new creative stuff we're beginning to explore in the natural product area involves partnering with others who bring something to the table," Miller says. Smaller companies may have access to new sample sources or cutting-edge technology, while Pfizer brings the chemistry and microbiology infrastructure to the collaboration.

Miller is concerned that the lack of interest in the field might impede collaboration that can lead to advances. "Competition is really good," he says. "We get ideas from each other, and when there are fewer companies, there are fewer sources of ideas and less cross-fertilization of scientists moving around."

To spur collaboration and competition, some researchers say, government needs to do more to recognize the pitfalls of the antibiotics business. They say one way of encouraging investment in R&D would be to create new incentives, such as extending the patent lives of molecules that may have sat on laboratory shelves for years.

"Antibiotics are different than other drugs," Cubist's Eisenstein says. "They uniquely depreciate because of Darwinian selection principles." In diseases such as cancer, he points out, any resistance that develops is contained within the patient; the drug is still effective for the rest of the population with the disease. But with antibiotics, that resistant strain can spread to the general population.

"There are cases that a drug has not even been approved but already developed resistance," Optimer's Chang notes. When a drug has a limited life span, its commercial potential is compromised. "Where is the incentive?" he asks.

Furthermore, in an attempt to delay the cycle of resistance, physicians tend to hold off on prescribing the newest drugs, using them only in the sickest patients stricken by the most severe organisms, Eisenstein says. But keeping the newest antibiotics as a last line of defense "paradoxically kills the supply," he argues. Companies aren't eager to refill the pipeline if they don't stand to make money on new products.

Some incentives are necessary, scientists say, because bugs continue to learn new ways of evading the current arsenal of drugs. "Sixty years ago, the leading causes of serious infections were Pneumococcus and S. aureus. Today, it's still the same problems," Harvard's Moellering says. "Meanwhile, they've become more resistant to antimicrobials, and we haven't done much at all to decrease the prevalence of those infections."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter