Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Brazilian Meeting

Petrochemical makers in Latin America expect to largely escape the global economic downturn

by Alexander H. Tullo

December 1, 2008

| A version of this story appeared in

Volume 86, Issue 48

ANYONE WHO has turned on a television or picked up a newspaper in North America, Europe, or Asia in recent months has been infected by economic worries and takes it for granted that the world is suffering from the worst financial crisis since the Great Depression.

Brazilians are hardly as preoccupied. It is as if the euphoria over their country's greatest economic expansion since the early 1970s has inoculated them from the world's economic flu. Indeed, at the annual petrochemical meeting held by Asociación Petroquímica y Química Latinoamericana (APLA), Latin America's chemical association, the people wearing suits inside the Hotel Sofitel seemed as carefree as those donning swimwear outside on Rio de Janeiro's Copacabana beach.

That is not to say local businesspeople don't think they will be influenced by the crisis. Rather, they figure it will make their economy dip from "very good" to "not as good." At 740 people, attendance at the meeting was off about 10% from last year. But APLA President Arturo GarcÍa noted that representation was "very high considering the turbulent circumstances."

In contrast to previous APLA meetings, where speakers from petrochemical companies profiled their projects in the region, the emphasis in Rio was on the economy, and thus, the audience heard from economists. One was Paulo Rabello de Castro, chairman of the Brazilian credit-rating agency SR Rating. He praised policies in Brazil that have brought inflation and currency under control.

Nevertheless, de Castro expects the region to feel some pain from the world's economic hardships. For instance, he said a slowdown in consumption in the U.S. means fewer imports from China and thus fewer exports of Latin American commodities to China.

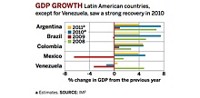

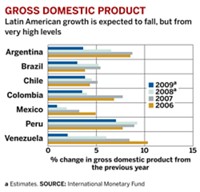

Carlos Mussi, of the Economic Commission for Latin America & the Caribbean, was more optimistic, predicting growth of 3.2% in Latin America and the Caribbean for 2009, down from 4.6% this year and 5.6% in 2007. "The effects of the crisis haven't reached our financial system at the moment," Mussi said. He did acknowledge that regional companies will likely have difficulty finding foreign financing, which could hurt business.

Petrochemical executives concurred with what the economists were saying. Rui Chammas, polypropylene director for Brazil's Braskem, said he expects polymer demand in Latin America to increase by 5.1% in 2009, down slightly from the 6.3% and 5.5% growth seen in 2007 and 2008, respectively.

Ricardo Gutiérrez Muñoz, chief executive officer of Mexico's Mexichem, said his company's Mexican operations are feeling the pinch from the crisis in the U.S. "But we are surprised to see our operations in Brazil growing," he said. In Venezuela, he noted, government infrastructure and housing projects are providing many opportunities.

Vitor Mallmann is CEO of Quattor, a Brazilian petrochemical company formed this year to rival the country's largest chemical producer, Braskem. He told C&EN that he agrees with the consensus that growth in the country will slip next year but stay positive. He expects polyolefin demand growth of about 3% in 2009, down from 6% this year.

For example, Mallmann noted a drop in sales of Brazilian cars, a major market for polyolefins. On the other hand, he said a weakening in Brazil's currency, the real, will stem plastics imports from Argentina and the U.S. Today, about 20% of the polyethylene and 15% of the polypropylene in Brazil is imported. He also said a relatively low annual consumption of plastics in Brazil, some 35 kg per capita, leaves room for growth.

ACCORDING TO Mark Eramo, executive vice president of olefins for the Houston-based market research firm Chemical Market Associates Inc., the economic slowdown is hastening a severe downturn of the global petrochemical business cycle. "We will look back at October and November of 2008 as two very significant months," Eramo said. "The consumer is slowing down, and the supply chain is backing up."

Eramo said demand growth for chemicals is either slow or nil. Prices are in "free fall" and profits are at a bare minimum. Average prices for ethylene have declined from about $1,600 per ton in October 2007 to only $800 a year later.

As a result, chemical producers are cutting plant operating rates. Compounding these problems, Eramo said, is a downturn in the market cycle that was due to happen anyway as several big new plants, planned years in advance, came onstream. Some 3.6 million tons per year of ethylene capacity is opening this year in the Middle East, where another 6.0 million tons will be added next year. "The problem over the next couple of years is that Asia can't consume all the Middle East can export," he said.

In all, the world will be burdened with 12 million tons of excess capacity, 10% of the global total and worse than in the business trough of 2001 and 2002. Signs of recovery won't begin until 2012.

Eramo expects plant closures in the U.S. and Europe. In Latin America, he noted, some chemical projects won't happen as planned. He expects Braskem and Venezuela's Pequiven will delay their ethylene cracker joint venture in Venezuela, originally expected to be completed in 2012. He also noted that Westlake Chemical and the National Gas Co. of Trinidad & Tobago have made little progress on the ethylene complex under study for the island nation.

Other observers attending the meeting said the massive Comperj project, an $8.5 billion refining and petrochemical complex planned for completion in Rio de Janeiro by 2012, will be delayed. If this and other big projects are shelved, economists and executives at future meetings might admit that the financial crisis had a greater impact on the region than they originally expected.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter