Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

Latching On To A Growth Market

Custom chemical manufacturers that can make antibody-drug conjugates see promising business

by Ann M. Thayer

December 14, 2009

| A version of this story appeared in

Volume 87, Issue 50

At the American Society of Clinical Oncology meeting in June, researchers reported Phase II clinical study results for Genentech's antibody-drug conjugate trastuzumab-DM1. Although the company has already proven that the trastuzumab antibody alone fights breast cancer, the results suggest that linking the potent cell-killer DM1 to the targeting antibody molecule increases its punch.

The positive results for T-DM1, now in Phase III trials, sparked interest not only among oncologists but in pharmaceutical chemical circles as well. In a small pocket of the custom chemical industry, business development managers have been waiting for a sign that antibody-drug conjugates (ADCs) will succeed. The few companies that can handle these potent and pricey materials see manufacturing them as a promising business opportunity.

"There are several different products in the clinic, and it is clear that the next drug will be the proof of concept," says Iwan Bertholjotti, head of ADC operations at Lonza's plant in Visp, Switzerland. "A positive result will help a lot to push these new drugs through the clinic."

Wyeth, now part of Pfizer, sells the only approved ADC, called Mylotarg. Like most ADCs in development, it is used against cancer, specifically acute myeloid leukemia. But Mylotarg hasn't done well since its launch in 2000, says Don C. Stark, president of the Boston-based consulting firm Whistler Associates. "It targets a small niche market and hasn't really demonstrated great benefit" and thus basically has been rendered a last-hope therapy, he explains.

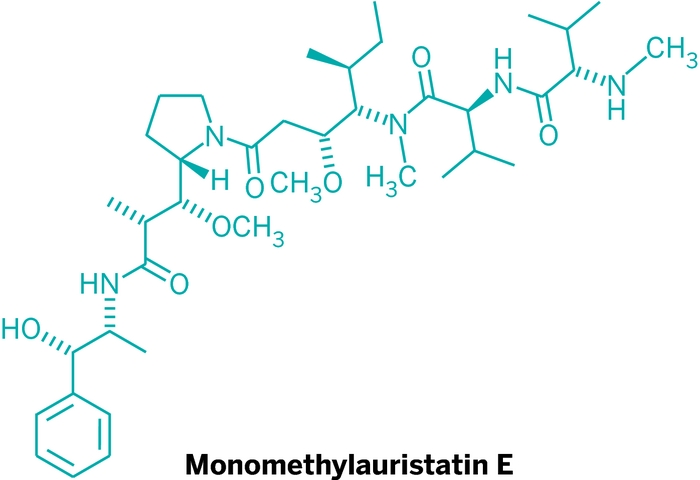

Since 2000, drug companies developing ADCs have struggled to find the right tumor targets and to create better linkers that combine the drug and the antibody, Stark says. For an ADC to work best, the antibody must avoid healthy cells by selectively binding to receptors specific to tumor cells and, only after doing so, releasing the cytotoxic payload. Eagerly anticipated are next-generation ADCs using linkers developed by companies such as Seattle Genetics and ImmunoGen, which have licensed the technology to other drug firms.

In addition to providing the linker, ImmunoGen also supplies maytansinoid-based cell-killing agents, such as DM1 and DM4, which are 1,000 to 10,000 times more potent than traditional chemotherapy drugs. Because of their toxicity, such agents can be delivered safely only through targeted therapies. They must be handled with extreme care both on their own and as part of ADCs.

Lonza's experience with ADCs dates back to early 2004. Between 2006 and 2008, the company made a substantial investment in its Visp facility and this year validated production to generate registration data for a customer's ADC. "We expect to enter the commercial phase by 2010," Bertholjotti says.

According to others in the industry, it's a widely known secret that Lonza has worked closely with Genentech as it advances T-DM1 toward the market. Meanwhile, India's Piramal Healthcare says it will be supporting the planned launch of a leading U.S. biotech company's ADC. In October, the firm said it would invest about $1.6 million in its Grangemouth, Scotland, facility to prepare one of the firm's six high-potency manufacturing suites for commercial-scale ADC production.

Commercial production of these highly potent compounds is typically in batches of only a few kilograms. Overall production of any given compound is on the order of tens to a few hundreds of kilograms per year, suppliers say.

Lonza is one of a few custom chemical firms with the capabilities to make both potent compounds and monoclonal antibodies (mAbs). In April, Mountain View, Calif.-based SafeBridge Consultants certified Lonza's Visp ADC facility and its supporting operations, recognizing the company's ability to safely handle potent drug and ADC materials.

The focus at Visp is on the conjugation process. Whether Lonza supplies both, one, or neither of the two starting materials depends on customer needs, Bertholjotti explains. In July, it signed a deal with Medarex, recently acquired by Bristol-Myers Squibb, to manufacture antibodies and ADCs as needed.

To compete in this space, suppliers assert, companies must have integrated capabilities for safely containing highly potent compounds and handling biological materials. "You need backward integration into both biopharmaceuticals and chemistry, which makes it very difficult for many that are trying to enter into this manufacturing area," Bertholjotti says.

France's Novasep has positioned itself through the recent purchase of Henogen, in Belgium. Although Novasep's primary goal was to add bioprocessing capabilities to existing assets such as chromatography, being able to produce antibodies is a "very attractive addition and nice collateral benefit," says Jean Bléhaut, marketing and business development manager for Novasep. "We can offer a one-stop shop for ADC manufacturing."

The company has been making highly potent compounds since 2003, when it acquired a former Aventis business in Le Mans, France. It expanded the site most recently in 2008. In September, SafeBridge certified a large part of the facility, including its pilot plant, a manufacturing suite, and R&D and quality-control labs.

Novasep's participation in ADC projects previously involved making cytotoxics at large scale and performing the coupling steps. Now it can produce antibodies in up to 200-L batches, or enough to make ADCs for late clinical or early commercial stages, Bléhaut says. "We are ramping up our capabilities for coupling and downstream processing of ADCs," he says. "We are already engaging in clinical-phase projects and will soon have commercial capabilities."

Like others with the expertise, Novasep has identified ADCs as a growing area in which it wants to participate. "We believe that about 130 projects are between preclinical and late-stage development," Bléhaut says. "There is a lot of money being invested in developing new ADCs."

Indeed, anticancer drugs are the most dynamic segment of the pharmaceutical industry, projected to grow at 12% annually over the next five years, according to a recent study by Enrico T. Polastro, a senior industry specialist at the consulting firm Arthur D. Little. Biopharmaceutical anticancer agents, chiefly mAbs, have seen "spectacular growth" and account for 65% of about $50 billion in total worldwide cancer drug sales, he reports.

Although a clinical trend toward more selective therapies is positive for mAbs, small-molecule drugs have long been the backbone of cancer treatment, Polastro says. ADCs marrying small and large molecules could generate "exciting developments," he contends.

And the low volumes, high capital costs, and strict safety standards for manufacturing potent drugs could favor outsourcing production to specialized vendors, Polastro concludes, especially for the many small and emerging drug firms behind such products.

Between improved linker technology and ADCs that are nearing proof of concept, "anybody who has antibodies sitting on a shelf wants to look into perhaps breathing some life back into them and seeing if they can extract some value," says Charlie Johnson, high-potency business manager at Switzerland's Carbogen Amcis. More and more companies are looking to make conjugates with antibodies that might have proven to be selective, but not therapeutically effective, alone.

"If you can get the conjugation process to work and the antibody is selective enough for the particular tumor type, then you can be pretty much guaranteed that an ADC will work to some extent," Johnson says. "It may not work as well as T-DM1, but it is considered a surer bet in early-phase R&D" than many other therapies. He says customers are also interested in constructs other than mAbs—such as antibody fragments, other therapeutic proteins, peptides, vitamins, and oligosaccharides—for targeted delivery.

Companies with expensive-to-make mAbs want to work with a trusted partner, Johnson says. Carbogen produces highly potent compounds on a large scale and has lab-scale containment and clean-room facilities for making ADCs for Phase I and II clinical trials. The company is also expanding into protein-based analytics, which are necessary for characterizing ADCs, he explains.

Characterization of complex ADCs is key to successful conjugation, points out Cynthia Wooge, process development manager at SAFC, the fine chemicals business of Sigma-Aldrich. Manufacturers must ensure, for example, that the antibody isn't damaged and the proper drug loading has occurred.

This summer, SAFC got SafeBridge certification for its kilogram-scale drug conjugation suite in St. Louis. The company is expanding its Madison, Wis., high-potency drug manufacturing plant and says it can expand the St. Louis ADC suite to the commercial scale when needed. Although SAFC also has biologics capabilities, Wooge says, it is not now producing any mAbs for ADCs but instead is working with customers that provide their own.

"What we bring to the table is experience in conjugation and the ability to handle the highly potent drugs, so we will do the conjugation, characterization, and release testing," Wooge says. Because all the raw materials are precious, she says, this process often starts with small bench-scale runs to verify the desired product. "Then we'll do miniature conjugations to understand the process and determine our critical control parameters to make it reproducible for scale-up," she adds.

Eventually, scaling up is where all ADC makers want to be. "We stay in close communication with our customers so that as they get further advanced in their clinical studies, we will be able to advance with them," Wooge says. "We have already begun looking at the design work and potential demand so that we'll be available to support commercial manufacturing."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter