Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

More Than A Supplier

Case Study #3: BioVectra seeks greater returns by partnering with Taxolog and Sandoz on a generic cancer drug

by Ann M. Thayer

March 15, 2010

| A version of this story appeared in

Volume 88, Issue 11

Being a custom manufacturer of active pharmaceutical ingredients (APIs) for drug company customers can be rewarding on its own, but there is more to be gained financially by making and selling the final drug. As a rule of thumb, suppliers know that the API accounts for only 10% or less of the value of the final pharmaceutical product.

COVER STORY

More Than A Supplier

After spending about 40 years making a living on APIs, BioVectra decided to try to tap into the bigger piece of a pharmaceutical’s value as a hedge against pressures on API prices. The Canadian firm came up with a strategy in which, as Chief Operating Officer Dale Zajicek explains, “the ability to make the API was just something that enabled a greater value for the company.”

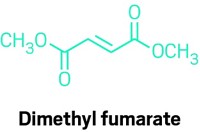

Experienced in producing taxane APIs, notably the generic anticancer drug paclitaxel, BioVectra is determined to bring to market a generic version of docetaxel, a paclitaxel analog that differs in its side-chain structure and the substituent on C-10. In 1996, Sanofi-Aventis launched docetaxel as Taxotere. Last year, the French company enjoyed $3 billion in worldwide Taxotere sales, but in late 2013, the last U.S. patents protecting it from generic competition will expire.

Although it has the skills to extract starting materials and manufacture taxanes, BioVectra knew that to advance its version of docetaxel it would need plenty of other expertise. It looked for help with intellectual property, technology development, formulation, regulatory filing, and commercialization. “We used partnering as a means of accomplishing the end product,” Zajicek explains.

For access to a premier synthetic method, BioVectra turned to Taxolog, a Fairfield, N.J.-based company founded in 1997 by Florida State University chemistry professor Robert A. Holton. It was Holton’s semisynthetic route that first allowed the large-scale production of paclitaxel and for Bristol-Myers Squibb’s launch of its blockbuster drug Taxol.

BioVectra and Taxolog began to talk in earnest about five years ago. “I recall one of our guys going to a meeting and coming back saying, ‘BioVectra was looking pretty serious about this stuff,’ ” Holton says. Indeed, it was around that time, Zajicek says, that “we decided that we might be able to find bigger and better ways to do things, and that triggered a discussion beyond ‘Do you want to buy intermediates?’ to ‘Let’s collaborate.’ ” Within about six months, he says, BioVectra and Taxolog worked out a deal that divvied up activities on the basis of the two companies’ strengths.

Taxolog has exclusive rights to Holton’s taxane-related intellectual property portfolio, including semisynthetic processes and many taxane analogs. Sanofi-Aventis uses its own synthesis to make docetaxel, which was discovered at the French National Center for Scientific Research (CNRS) when Pierre Potier’s lab was trying to synthesize paclitaxel.

The starting material for docetaxel is 10-deacetylbaccatin III, which is readily available from certain species of yew tree. Holton’s docetaxel process, like the one he developed for Taxol, relies on a metal alkoxide to couple 10-DAB with an appropriate side chain (C&EN, June 20, 2005, page 120). Taxolog’s docetaxel route also uses a side-chain precursor that, according to Holton, is easier to make and much less expensive than other options for creating the chain.

Taxolog chemists put in considerable effort to streamline the process and make the synthesis even more efficient than the one used for many years to make Taxol, Holton says. “We have the side chain down to ‘cheap and easy,’ and the whole process is very short—a couple of pots,” he says. “I’m pretty confident that our process is much more robust and efficient than others.” The streamlining also generated new intellectual property.

BioVectra, meanwhile, has scaled up Taxolog’s route to docetaxel, making “only tweaks, because Holton’s team had done a great job in terms of refining it,” Zajicek says. If help is needed during further scale-up, Taxolog has scientists available, Holton adds. Together the companies found another firm to finish and package the injectable drug.

Because of the commercial quantities that will be needed, docetaxel is a good fit for BioVectra. “It’s a 30-kg-per-year drug, and that is our niche,” Zajicek says. He says the company prefers “high value, high complexity” projects requiring from tens of kilograms to a few thousand tons per year of an API.

In April 2008, the partners submitted a drug master file covering the docetaxel manufacturing process to the Food & Drug Administration. BioVectra then took the lead in finding a commercialization and marketing partner.

Earlier this year, BioVectra announced that it had signed an agreement with Sandoz, the generic drug arm of Novartis, for rights in the U.S. The companies worked together for much of 2009 on a commercialization plan, including filing an Abbreviated New Drug Application (ANDA) with FDA in June 2009.

Although nearly market-ready, BioVectra’s generic docetaxel has not yet completed the generic drug approval process. FDA has accepted the ANDA for review, and BioVectra and Sandoz will jointly handle queries by the agency.

Because BioVectra uses a different synthetic route, process patents are not likely to be an issue, and the composition-of-matter patent on the drug substance itself will expire in May. But as part of the filing process, the partners have challenged the remaining Sanofi-Aventis patents listed with FDA: four patents around formulation, or injectable compositions, of taxanes.

Under the agreement, Sandoz is handling all the legal issues. As expected, Sanofi-Aventis responded by suing Sandoz, as it has other competitors trying to commercialize generic docetaxel. As a result, FDA has placed a stay on any marketing authorization, allowing 30 months for the litigation to be settled or the stay to expire. BioVectra believes that its ANDA was the first to be filed, an accomplishment that will reward its product with 180 days of market exclusivity if FDA approves it.

Holton points out that neither Taxolog nor BioVectra could have afforded tackling the legal aspects alone. Zajicek calls having a big partner “a necessity.”

“It is too risky for a company like us to just jump in and invest millions of dollars in developing a drug,” Zajicek adds. “But we can partner strategically and still accomplish the things that the biggest companies in the business can.” Although BioVectra is not the first custom chemical manufacturer to do so, Zajicek is still proud that the company could “pull all this together and create a whole different value for the API beyond just manufacturing it,” he says.

Likewise, Holton is pleased to see Taxolog’s technology moving toward the marketplace. He says both Taxolog and BioVectra will benefit financially from the sales and manufacturing agreement with Sandoz, as they did in licensing the ANDA. BioVectra is seeking additional partners for marketing in Europe, Canada, and Japan.

FDA approval of BioVectra’s generic docetaxel is neither imminent nor even a sure thing, Zajicek points out. Nevertheless, he takes note of what has been accomplished so far: “We became the first to file, and for us it’s the culmination of how a small company can use partnering to succeed,” he says.

BioVectra executives feel so good about docetaxel that they plan to apply the same approach to a couple of other generic drugs of interest. “We’ll take the same model, collaborate with the right people who have pieces we need, and then go find a partner that can then take it to the marketplace effectively,” Zajicek says.

“Manufacturing still is 90% of our activity,” Zajicek adds, “but we try to take that other 10% and do some things that will be significant opportunities—if they are successful.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter