Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Earnings Jump In First Quarter

Recovery: Return of consumer demand brings chemical results closer to prerecession level

by Melody Voith

May 3, 2010

| A version of this story appeared in

Volume 88, Issue 18

First-quarter chemical earnings are far surpassing analysts’ expectations, and for the first time since late 2008, company executives are talking about growth, rather than mere survival.

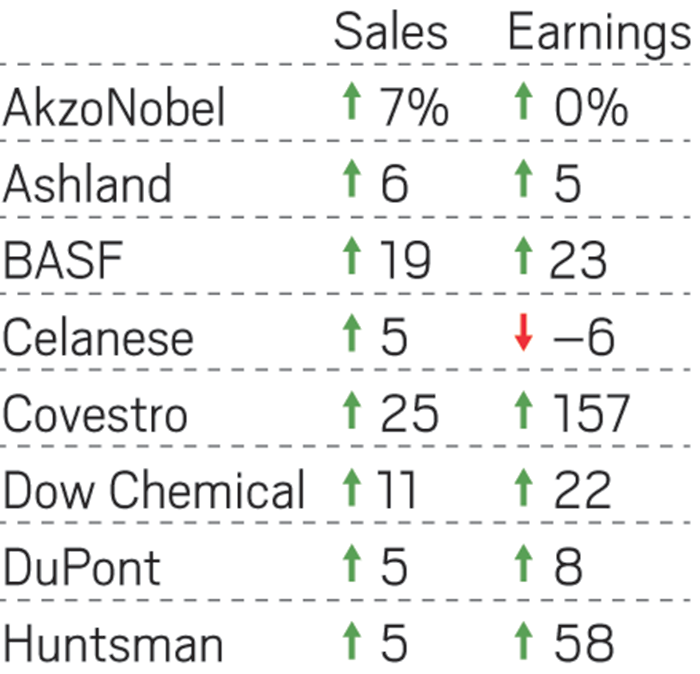

“The consumer is finally returning,” observed Andrew N. Liveris, CEO of Dow Chemical, in a conference call with analysts. Sales at the company, the largest U.S. chemical producer, rose 48% compared with last year’s first quarter, to $13.4 billion. When results from sold-off businesses are removed, the rise was 33%.

The sales boost at Dow and other chemical firms can be attributed roughly equally to higher prices and increased volumes. Although Asia’s brisk economy was the leading source of growth for Dow, Liveris reported that business in North America and Europe showed “notable improvements.”

The rebound in consumer spending buoyed most of Dow’s businesses. Its performance, specialties, and coatings segments benefited from sharply higher demand for cars, electronics, appliances, packaging, and water treatment. Referring to the company as “the new Dow” after its integration of Rohm and Haas, Liveris told analysts he still plans to find joint-venture partners for its remaining basic chemicals and plastics businesses, even though sales were up significantly in those segments as well.

A year of dramatic cost-cutting helped Dow and at least seven other firms leverage the rebound and more than double earnings compared with the first quarter of 2009. Dow’s earnings per share of 43 cents blew past the 25 cents expected by John Roberts, a stock analyst at Buckingham Research, who wrote that customers may be buying more than normal in anticipation of possible price increases.

Similarly, DuPont’s earnings per share of $1.24 beat consensus expectations by 18 cents. Earnings of $1.1 billion were more than double last year’s first quarter, on a sales increase of 24%. “DuPont’s aggressive restructuring has yielded benefits, as margins in the performance businesses have returned to prerecession levels,” wrote P. J. Juvekar, a chemicals analyst for Citigroup, in a note to investors.

Like Dow, DuPont saw its largest sales growth in Asia, up 71% from last year to $1.6 billion. Globally, in addition to sales increases to automotive and electronics customers, demand for photovoltaic (PV) materials “surged beyond our expectations,” DuPont CEO Ellen J. Kullman told analysts, thanks to government incentives and pent-up demand from last year. “DuPont sales in PV are so strong that we now expect to surpass $1 billion in 2011, one full year ahead of plan,” she said.

At Celanese, earnings skyrocketed to $106 million from a paltry $12 million in the year-ago quarter, driven by strong demand for specialty engineered polymers. The company’s earnings per share of 67 cents beat expectations by 8 cents. But two years ago, in the first quarter of 2008, Celanese earned $145 million, and it is still climbing out of the slump.

Sales of polymer additives, including brominated flame retardants, and catalysts for end uses such as alternative fuels helped Albemarle almost triple earnings from last year’s first quarter. Specialty polymers and coatings propelled earnings at Eastman Chemical to $101 million from $18 million a year ago. At PPG Industries, sales grew 12% compared with last year’s quarter, driven by strong sales of industrial coatings.

Overall, industry executives and analysts say cost-cutting, increases in capacity utilization, and rising consumer demand will support earnings growth in 2010. Indeed, DuPont, Celanese, Praxair, and Nalco raised their earnings expectations for the year. But analysts warn that the recovery will bring higher raw material costs that could take a bite out of margins.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter