Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Environment

Seeking To Cement A Green Future

New chemistries promise to revolutionize stodgy building materials industry

by Melody Voith

January 25, 2010

| A version of this story appeared in

Volume 88, Issue 4

At first glance, cement, drywall, and bricks do not appear to be compelling targets for reinvention by green technology start-up firms. These old-fashioned building products, made from all-natural sources, have been used successfully for centuries and continue to dominate the building materials market.

Yet builders have recently become aware of the significant carbon footprint of their most basic building supplies. Experts estimate that the manufacture of traditional building materials is responsible for 10–12% of carbon dioxide emissions in the U.S., mainly because of the large amount of energy used to create them.

Venture capital investors have started showing an interest in companies that claim they can significantly reduce the amount of energy required to turn basic ingredients into sturdy building blocks. These firms are drawing on new proprietary chemistry that they say reduces the need for external heat sources.

Environmentally friendly concrete start-up Calera has had the backing of famous technology investor Vinod Khosla for the past few years. In September 2009, green drywall company Serious Materials attracted $60 million in venture funds. And earlier this month, low-carbon-producing brick maker CalStar Products opened its first production facility with the help of $15 million in venture money.

Calera, Serious, and CalStar boast cementlike processes that create tough, hardened building products without high energy inputs. Executives say they will be introducing their products at competitive prices for consideration by early adopters. But they look forward to a time when their products will be the cheaper alternative, which will help convince the conservative construction industry to take a chance on new materials, even though the old ones work just fine.

In some future global economy that puts a price on carbon, production processes that save on energy will come out ahead, notes Larry Fisher, research director of NextGen Research, the emerging-technology arm of ABI Research. “As we move forward and energy becomes a top-line issue, this will get more play,” Fisher says.

With the failure of the recent global climate talks in Copenhagen to put a firm limit on carbon emissions, however, the incentive for reducing carbon doesn’t yet exist. Fisher points out that today’s green building products, such as engineered wood, claim less than 10% of an overall $460 billion market. In the short term, he predicts, green start-ups will focus on customers who specialize in green buildings, such as those hoping to build federal facilities or achieve Leadership in Energy & Environmental Design (LEED) certification from the U.S. Green Building Council.

Portland cement, the most common type of cement used worldwide, is the biggest target for reducing the CO2 footprint of building materials. According to the World Business Council for Sustainable Development, cement manufacturing is responsible for 5% of global CO2 emissions. China is the world’s largest cement maker, followed by India and the U.S. In the U.S., cement production represents 2.9% of overall energy usage.

To make cement, manufacturers heat limestone in a kiln to 2,650 °F. The process eliminates chemically bound water molecules, releases CO2, and produces a marble-sized material called clinker, which is then ground to a fine powder. Gypsum is added, and the resulting cement is mixed with water, sand, and aggregates to produce concrete. The rehydration causes an exothermic chemical reaction that hardens the mix.

Brent Constantz, Calera’s chief executive officer and an associate professor of geological and environmental sciences at Stanford University, plans to produce cement and aggregate that will enable the production of concrete with a negative CO2 footprint. In Calera’s process, CO2 from hot industrial flue gas is bubbled through mineral-rich seawater or hard water. Calcium and magnesium carbonates precipitate out of the solution and are transformed into two concrete ingredients: a synthetic limestone aggregate and an amorphous calcium carbonate with cementlike properties.

“Our process is akin to the skeletogenic process of corals and other marine organisms that precipitate carbonates from seawater,” Constantz says. Calera estimates that each cubic yard of its concrete would soak up more than 1,000 lb of CO2. In contrast, producing a cubic yard of traditional concrete generates more than 500 lb of CO2.

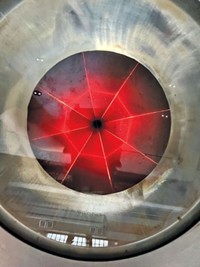

For the precipitation to occur, the solution must have a high pH. Depending on the water source, Constantz tells C&EN, the company can opt to use a proprietary, low-energy electrochemical process to add alkalinity. The full process is being tested at the company’s Moss Landing pilot plant near Monterey, Calif.

Given the mass-balance challenges of creating sufficient carbonates from flue gas and water, Constantz says Calera will have to carefully select its locations. The ideal site would include a power plant to supply CO2, a concrete ready-mix plant, and a water desalination plant. He says Calera’s wastewater, when stripped of its calcium and magnesium, could be inexpensively desalinated. And salt from the desalination could resupply Calera with raw material for the electrochemical plant.

At Serious Materials, cement chemistry is being put to a different use—replacing the ubiquitous gypsum used in drywall. Although concrete can be made from different recipes to obtain precise handling and performance characteristics, gypsum-based drywall is pretty much all the same, says Brandon Tinianov, chief technology officer at Serious. And it can be vastly improved, he adds. In addition to being energy intensive to make, gypsum panels are brittle, dusty, soft, and subject to mold, Tinianov says.

To make standard drywall, mineral gypsum—calcium sulfate dihydrate—is mined from sedimentary rock. The gypsum is crushed, ground into a fine powder, and then heated to 350 °F to drive off most of the water. This energy-intensive process is called calcining. To make boards of the material, calcined gypsum is mixed with water and spread between layers of paper to reharden as it dries.

Instead of gypsum, Serious Materials’ EcoRock panels are made with slag—a mixture of the nonmetallic components removed from iron ore during steelmaking. It generally contains calcium and aluminum silicates and mineral oxides. Serious adds proprietary agents and catalysts to produce an exothermic chemical reaction that hardens the material. EcoRock can be made according to different hardness specifications, Tinianov claims, and is more mold-resistant than traditional gypsum panels.

Without the need to mine and heat gypsum, the manufacture of EcoRock emits 80% less CO2 than standard drywall production, Tinianov asserts. And he is proud of EcoRock’s rare gold-level Cradle to Cradle certification from McDonough Braungart Design Chemistry, a green materials consulting firm. “One philosophy that’s really important in Cradle to Cradle,” he remarks, “is the concept of upcycling”—when waste material finds use in a higher quality product. “Slag is a waste product, and I can turn it into higher performance building product,” he explains.

Serious Materials plans to produce EcoRock at its headquarters in Sunnyvale, Calif., and to introduce the product to western U.S. markets in 2010.

The company got its start when founder Marc Porat was inspired to expand the uses of a cement technology developed at Argonne National Laboratory for nuclear applications. Porat stuck with the same theme when he later founded CalStar Products, a firm that produces bricks and pavers primarily with fly-ash waste from coal-fired power plants.

Traditional clay bricks are fired for 24–48 hours in an energy-sucking 2,000 °F kiln. CalStar claims its fly-ash bricks require 90% less energy to make and contain 40% post-industrial recycled material. The manufacturing process takes advantage of the presence of lime in class C fly ash. Combining the lime, water, and proprietary additives initiates a chemical reaction that hardens the bricks without the need for firing.

Unlike steel slag, however, fly ash contains a number of trace metals, including aluminum, mercury, chromium, barium, and selenium. CalStar says its tests have shown that the metals are bound in a crystalline matrix and do not leach in amounts high enough to cause concern for health or the environment. Still, the presence of the metals could give pause to the company’s green-building target market.

In general, industry watchers warn that this is a difficult time for construction-related businesses, regardless of their green qualities. For example, the Gypsum Association reports that U.S. shipments of drywall fell from 30 billion cu ft in 2007 to an estimated 18 billion cu ft in 2009. And this year is not likely to bring an improvement. “It’s going to be a while before the government can lead the way in new, green construction,” ABI’s Fisher says.

Meanwhile, traditional materials players are well aware of their CO2 liabilities. Members of the Portland Cement Association, for instance, are targeting a voluntary 10% reduction in CO2 emissions by 2020 from 1990 levels.

Fisher points out that traditional firms are handicapped by their enormous capital investments in old technology. He says they might look to new companies to develop new materials and then use their deep pockets to either license them or acquire them outright. “These start-ups,” he says, “might raise expectations of what traditional manufacturers should be able to do.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter