Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Demand Remains Strong

Earnings: Firms capitalize on rebound for another winning quarter

by Melody Voith

November 1, 2010

| A version of this story appeared in

Volume 88, Issue 44

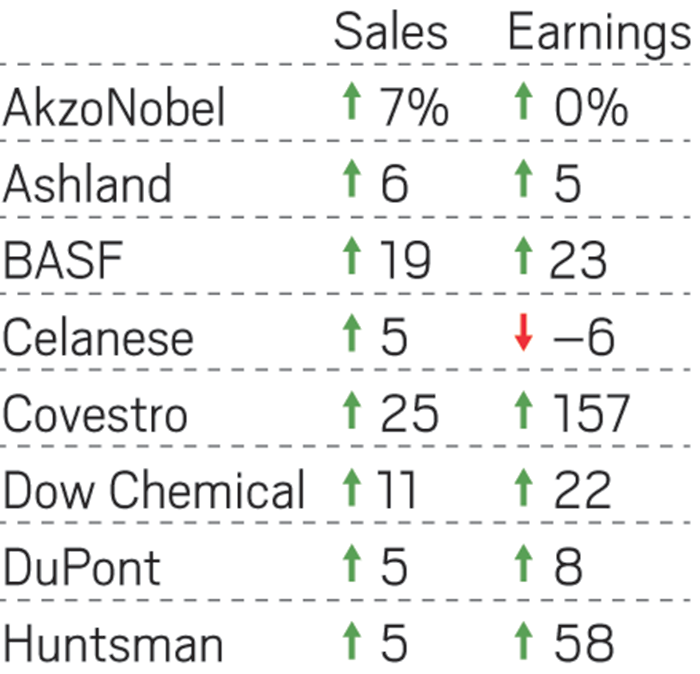

The third quarter is shaping up to be stellar for U.S. and European chemical companies. The industry’s sales and profit gains are building on similar improvements in the second quarter, creating confidence among company executives that the recession is in the rearview mirror.

Quarterly sales were up by 10 to 20% year over year at most of the companies reporting so far, and earnings shot up significantly. Results from Air Products & Chemicals, Albemarle, Cabot, Celanese, Cytec Industries, Dow Chemical, W.R. Grace, Lubrizol, Nalco, PPG Industries, and Praxair were almost identical to those of this year’s second quarter, when the industry finally jumped out of the recessionary trough.

At Dow, earnings of $705 million were almost double what they were in 2009’s third quarter, thanks to a recovery that started in Asia and is now reaching the economies of the West. In the second quarter of this year, the company racked up a similar $707 million in profit.

“Continued solid demand recovery in North America and Europe—coupled with sustained momentum in emerging geographies, which represented more than $4 billion of our overall sales in the quarter—drove robust revenue gains across all of our operating segments and in every geographic area,” boasted Dow CEO Andrew N. Liveris in an earnings report.

Dow reported a modest 6.8% increase in sales, but when the divestitures of stakes in two overseas ventures are excluded, the company’s sales growth jumped to 23.4%. Of that, 14% was due to volume and 9% to higher prices.

Analysts took note of Dow’s improved operating rate of 86%, up 6% from last quarter, when outages dampened productivity. Its earnings per share of 54 cents beat consensus expectations by 13 cents. Citigroup stock analyst P. J. Juvekar wrote in a report to investors that Dow’s performance products, basic plastics, and basic chemicals divisions all delivered earnings well above his expectations.

DuPont’s earnings of 40 cents per share are lower than last year’s, hampered by the loss of license money due to pharmaceutical patent expirations. Still, the company also beat consensus expectations by 6 cents. Sales of $7.0 billion were 17.4% higher than in last year’s third quarter, powered by 14% higher volumes.

After the second quarter, DuPont CEO Ellen J. Kullman told analysts that electronic materials was the first business to see a demand rebound. In the third quarter, it was what she called the “midcycle” businesses in the firm’s safety and protection unit that showed improvement. “Nomex sales were up more than 80%, with growth driven by infrastructure spending and increased protection of workers,” Kullman said in a conference call with analysts. Nomex is a flame-resistant fiber produced by DuPont.

At Albemarle, fire safety also contributed to a good quarter in the form of strong demand for brominated flame retardants. Overall, Albemarle’s sales increased 13.6% and its earnings jumped 80.8% from last year’s third quarter.

At industrial gas supplier Air Products, the strengthening economy and robust sales of high-tonnage gases pushed earnings per share to $1.35, which is 3 cents over analysts’ consensus expectations. New plants built to meet demand helped the company capture an 11% increase in operating income.

In Germany, heavy hitters BASF and Bayer both reported strong sales and earnings compared with last year’s third quarter. BASF posted $28.9 billion in sales, a 23% increase from last year, and it raised earnings by $1.39 billion to $1.55 billion. Bayer sold $11.9 billion worth of products, a 16.1% improvement from last year, and increased its earnings by 24.2% to $345 million.

The two German firms joined U.S. companies Air Products, Celanese, DuPont, Grace, Lubrizol, Nalco, and Praxair in raising their earnings guidance for the full year.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter