Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Latin America: Buoyant Chemical Companies Keep A Cautious Eye On The Rest Of The World

by Alexander H. Tullo

January 10, 2011

| A version of this story appeared in

Volume 89, Issue 2

When the developed world slumped during the Great Recession, Latin America merely stumbled. Now, the region is resuming a boom that began earlier in the decade.

COVER STORY

Latin America: Buoyant Chemical Companies Keep A Cautious Eye On The Rest Of The World

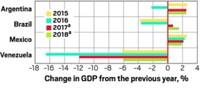

The International Monetary Fund estimates that Latin America will end 2010 with 5.7% economic growth after a mere 1.7% decline in 2009. IMF predicts that the region will enjoy a healthy 4.0% growth next year.

Brazil is leading the regional charge. IMF projects it will post China-like growth of 7.5% in 2010, followed by a 4.1% expansion in 2011. Mexico is a different story because it is closely linked to the still-weak U.S. economy. Still, IMF estimates growth in the country at 5.0% in 2010 and 3.9% in 2011.

The chemical sector’s growth in the region has likewise been strong. Brazil’s largest chemical maker, Braskem, reported that domestic demand for its plastic resins increased by 11% through September of 2010. Mexican national oil company Pemex reported that its output of basic petrochemicals rose by 8.7% during the first 10 months of the year.

One challenge for the region is new petrochemical capacity in the Middle East and Asia flooding into national markets. But in a recent conference call with investors, Rui Chammas, head of Braskem’s polymers business, asserted that the firm will stem the potential import flood through better products and customer service. “There is no reason to have imports increasing in our market,” he said.

Chemical producers are planning a number of major projects to meet burgeoning regional demand. Braskem wants to build ethylene units in Peru, Venezuela, and Mexico. Brazil’s state oil firm Petrobras is building a refining and petrochemical complex, dubbed Comperj. And Colombia’s Ecopetrol is planning ethylene and polyolefin capacity.

Among these projects, the Mexican cracker and the Comperj project have the greatest potential to move forward, according to Rina Quijada, CEO of Houston-based Intellichem. But even they aren’t likely to be completed before 2015, she says.

Quijada warns that the region’s chemical industry has to reevaluate its projects in light of Middle Eastern capacity and a newly competitive North American industry being fed by cheap shale-based natural gas.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter