Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

Shifting Generics To The Super Side

Some generic drug makers aim to innovate and create differentiated products in a competitive market

by Ann M. Thayer

October 17, 2011

| A version of this story appeared in

Volume 89, Issue 42

Patents soon expiring on many billion-dollar drugs will lead to a glut of compounds that generic drug producers can duplicate. As a result, near-term generics sales are projected to grow two to three times faster than the overall pharmaceutical market. Yet the drug industry’s current new product drought means a slowing in growth in generics is inevitable.

Large, diversified generics companies may still be able to make money on low-cost, high-volume products, but other companies are looking for different ways to compete. These firms are trying to increase value, not volume, in the fast-growing segment known as supergenerics.

Many small firms, as well as divisions of some bigger ones, are creating differentiated products rather than copycat generics or are targeting difficult-to-make active pharmaceutical ingredients (APIs). To succeed, they will have to prove to regulators, the market, and maybe even the courts that they have something superior.

“There is definitely innovation in the generics industry because companies are looking for ways to differentiate themselves from the crowd,” says Peter Wittner of London-based Interpharm Consultancy. “They are moving away from the ‘pile it high and sell it cheap’ approach and looking for something where there is a technological barrier to entry, and preferably a specialized technology that they can patent themselves to protect against big pharma, or even big generic, firms copying the products.”

Despite the name, most supergenerics aren’t generic at all. To create a specialized product using a generic API, developers may alter the formulation, delivery, or action, or they may combine it with another active ingredient. Playing with process chemistry, they might devise a new synthetic route or produce a different polymorph, salt, or enantiomer. Such changes can help them circumvent patents on existing product forms and even create opportunities for getting new patents.

As the generics market becomes more competitive, “the natural tendency is for the new players to quickly seize what they can do to get a share of the pie,” says Amit Biswas, executive vice president for the integrated product development organization at India’s Dr. Reddy’s Laboratories, a leading global generics firm. In supergenerics, by contrast, “more established generics players, especially ones with global footprints, are trying to get to a higher ground by leveraging their growing competencies.”

When Dr. Reddy’s pursues supergenerics, Biswas says, it considers the interplay of value, volume, and technical challenge, along with leveraging its low-cost position in India. For example, value can be achieved through new combinations and formulations. Volume increases can be achieved by extending products to other parts of the world, especially the emerging markets (see page 15). And leveraging R&D to make differentiated products can lift a company above the competitive fray.

Like many of the large generics firms, Dr. Reddy’s also has a proprietary products business, which includes differentiated formulations and generic biologics known as biosimilars, as well as API manufacturing. “We look at the entire value chain starting from the key raw materials to the APIs, formulations, and our understanding of the regulatory environment,” Biswas explains.

At Sandoz, the generics arm of Novartis, 45% of its portfolio is in differentiated products, says Don DeGolyer, president of Sandoz’ U.S. arm. Products include oral solids, transdermal patches, implants, complex injectables, inhalables, and biosimilars. With three approved products, Sandoz claims a nearly 50% share of biosimilars sales in regulated markets.

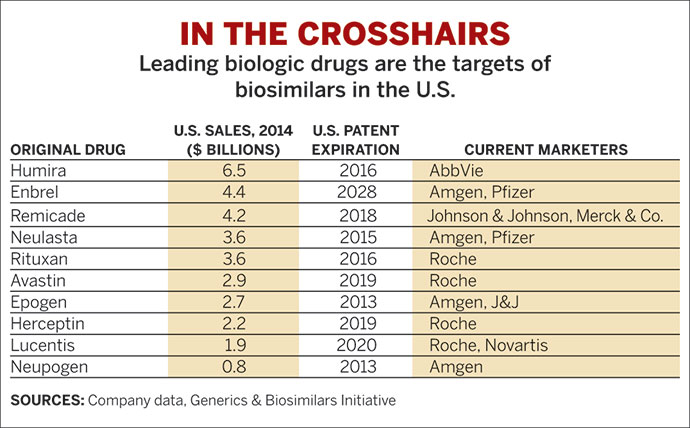

Highly lucrative, biosimilars are expected to sell for only 20–30% less than the full-priced patented product. For some developers, further improved-upon versions, sometimes referred to as “biobetters,” will be the ultimate high-value supergeneric drugs. They also anticipate fewer competitors. Because of the clinical and manufacturing investments that are required in biologics, “the cost of entry is monumental,” Wittner adds.

In July 2010, Sandoz and its partner Momenta Pharmaceuticals launched enoxaparin, a generic version of Sanofi’s Lovenox, a low-molecular-weight heparin sold as a blood thinner. “The complex molecule has remained the only product on the market for more than a year, and we believe it is the world’s first generic to have achieved blockbuster success,” DeGolyer says. Sales in the first half of 2011 were $531 million. Last month, after the Food & Drug Administration approved a version from Watson Pharmaceuticals and Amphastar Pharmaceuticals, Momenta sued to defend its patents.

Although not often credited with being innovative, the generics industry is generally recognized for specific skills. When it comes to processes, crystal forms, and formulations, more patents per product have been issued to generic drug firms than to the originator companies, according to Malcolm Ross of Generapharm, an advisory firm in Basel, Switzerland. Technologically, he says, supergenerics are well within the capabilities of most midsized generics firms.

Small companies with a technology focus such as formulation or drug delivery are contributing to supergenerics development. Some even look to sell an improved product to the originator company, Wittner points out. In turn, the originators collaborate with these firms to get access to technology while providing them with help in clinical trials, manufacturing, regulatory approval, and marketing.

It typically takes longer to develop a supergeneric than an ordinary copycat drug. “Even though you may have much larger technical challenges, it becomes a matter of doing it smartly or more efficiently,” Biswas says. “When the technical challenges are really quite steep, and you cannot have all the competencies in-house, we strongly believe in working with partners.”

Other supergenerics can be made relatively simply, Ross says, but the reintroduced form must still outperform the original drug or it is just another generic. Pediatric-dosage forms, modified-release versions, and fixed-dose combinations of two or more drugs frequently prescribed together have become popular routes for extending product life.

Drug originators have been making such supergenerics for years, only they call the practice “life-cycle management.” As Ross says, most “new” pharmaceuticals in recent years have been product line extensions of this sort. In fact, a recent analysis by the market research firm Business Insights suggests that developers of supergenerics have been forced to focus on less obvious areas because the originator companies have already gotten to the low-hanging fruit.

Sometimes the practice of life-cycle management is called “evergreening,” a term that is used pejoratively to imply abuse of the legal system by patenting minor improvements to existing drugs to hinder competition. In a statement on its website, GlaxoSmithKline (GSK) takes issue with the assumption that such changes are never justifiably patentable or medically important and that they delay generic competition.

“There is no difference in my mind between a supergeneric and life-cycle management,” Ross says. “A modified-release product coming from the innovator company and one from a generic firm have the same possibility of patent protection.” However, since a 2007 Supreme Court decision adjusted the criteria for determining what is considered an obvious change, getting or keeping a patent may be harder. Modified-release products, for example, “are now very challengeable in court,” he says.

“The science is easy; it’s the marketing that is going to be tough,” Ross points out. Originator companies are already well equipped for marketing if they extend an existing brand. But success or failure for generic firms will likely arise in their strategic thinking and ability to market supergenerics, Ross says. “There is nothing really, except mind-set, which prevents them from being in the market.”

Unlike traditional generics, supergenerics are not all about low cost or being the first approved. And opportunities to sell them will be better in some markets than others. In commodity generics markets such as the U.S. where products are sold by compound name, generics companies typically have no sales force or experience marketing products, Ross explains. They do, however, in most overseas countries, where it’s the norm to sell generics under a brand name.

“The majority of generics in the U.S. are made in India,” Ross notes. “Although the Indian companies certainly have all the capabilities, and maybe in their home markets understand branded generics, you have to ask whether they’ll make the investment in setting up an effective sales force in the U.S., especially for one product.”

Although supergenerics require more development work and larger investments, they offer the possibility for high profits. Ross estimates that a supergeneric on the U.S. market might garner a 65% gross profit margin, which is close to that for a branded generic overseas, versus the 10–20% margin typical for a commodity U.S. generic.

Generic drugs can be developed at low risk because generally the job is showing them to be bioequivalent to an already tested and approved drug. For some supergenerics this may be enough, but others will require more clinical testing depending on how much and in what ways they have been modified.

Still, the risk is significantly less than for developing a new chemical entity, Ross says. “You can predict that there is an opportunity there. Nine times out of 10 you can technically achieve it, and another nine times out of 10 it will have some clinical significance.”

Pozen, founded in 1996 in Chapel Hill, N.C., saw an opportunity to make supergenerics by combining drug ingredients to treat pain. “The idea is to combine products in a way that optimizes each of the individual components,” explains John G. Fort, the firm’s chief medical officer. After creating and testing multiple combinations, Pozen signed a $160 million deal with GSK in 2003 and a $375 million pact with AstraZeneca in 2006.

Pozen wanted partners that “understand the product and the marketplace to be able to launch these products successfully,” Fort says. Its deal with GSK involves the anti-inflammatory sumatriptan, on which GSK lost patent protection in 2009. Treximet, approved by FDA in 2008 as a migraine treatment, combines sumatriptan and the painkiller naproxen sodium. Formulated using a GSK fast-release technology, the dual-action product provides superior sustained pain relief compared with the separate components, the companies say. GSK’s first-half 2011 sales of the drug were $45 million.

Making Supergenerics

Altering key aspects of drugs can help in creating specialized products.

Combinations

Synergistic or improved activity

Reduced dosages

Decreased side effects

More convenient use

Formulation or dosage form

Improved efficacy or compliance

Modified or controlled release

Transdermal, inhalation, or injectable delivery

Pediatric doses

Chemical or physical properties

New salt or polymorph

Different enantiomer

Prodrug

Manufacturing

More cost-effective process

Difficult-to-make or difficult-to-handle products

Pozen’s next drug, Vimovo, was approved in both the U.S. and Europe in 2010. A combination of naproxen and AstraZeneca’s single-enantiomer antiulcer drug esomeprazole, or Nexium, it is designed for chronic pain relief without the associated gastric upset. Contrary to how esomeprazole is usually delivered, Vimovo is designed to release it immediately as a protective agent before the naproxen. Sales of the drug were $10 million in the first half of 2011.

Development times can be fairly fast, Fort says. In the U.S., many developers of supergenerics take advantage of FDA’s 505(b)(2) filing process, which relies in part on existing data and can reduce the need for repeat clinical trials. Another incentive of this route is three to five years of market exclusivity, depending on the level of innovation or change brought to an existing drug.

“Typically we have to do some Phase I studies to test the components from a pharmacokinetic perspective and a Phase III program including a long-term safety study of the combination product,” Fort says. Clinical and regulatory success is not guaranteed. “When you put two products together in a combination, you don’t know what’s going to happen with their adverse-event profile,” he adds.

Whereas a new compound must be compared to a placebo, the “bar is higher” in clinical trials for combination products, explains Elizabeth A. Cermak, chief commercial officer at Pozen. Trial populations can be smaller and clinical development time shorter than for new drugs, “but you have to prove a significant benefit over the individual components,” she explains.

With two Phase III trials under way and a long-term safety study done, Pozen plans to file for approval in 2012 of its next product. PA32540 is a coordinated-delivery tablet of immediate-release racemic omeprazole layered around pH-sensitive aspirin for secondary prevention of cardiovascular disease. Recently, the company announced that it is looking for a commercial partner. Cermak says the plan is to price PA32540 at about $1.00 per day, which is competitive with the separate generics.

The thinking behind Pozen’s products has never really been about whether they are generic or not but about whether they improve therapy, Cermak maintains. “The coordinated-delivery attributes of these products are what make them unique and unlike the separate components and, in fact, not even bioequivalent to the separate components.” The combinations are novel enough, she points out, that Pozen has several patents on each of the two approved products.

Advertisement

In August, Pozen successfully defended its patents against several generics companies that had filed for FDA approval to market copies of Treximet. If the ruling is upheld, GSK and Pozen won’t face generic competition until 2018 and possibly 2025. Similarly, Pozen and AstraZeneca have sued Anchen Pharmaceuticals and Dr. Reddy’s for patent infringement, since both have made moves to launch generic versions of Vimovo.

Although pharmaceutical companies have traditionally focused on new drugs, many opportunities exist for supergenerics, including combinations like those developed by Pozen. “These novel combination products are not always rewarded from an innovation perspective with patents, regulatory approval, or exclusivity,” Fort says. “But they can play an important role in advancing medicine.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter