Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Canada Stays Strong

After a large growth in 2011, Canada will see modest growth in 2012

by Alexander H. Tullo

January 12, 2012

| A version of this story appeared in

Volume 90, Issue 2

The past year was a strong one for Canadian chemical producers, and 2012 looks to be shaping up nicely as well.

COVER STORY

CANADA Industry expects more gains

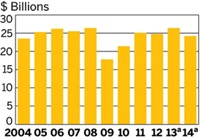

Canadian chemical sales climbed 18% in 2011 to more than $25 billion, according to the Chemistry Industry Association of Canada. The industry performed well by most other measures, too. Production volumes increased 10%. Exports rose 20%. Combined operating profits for chemical companies climbed 61% to a record $4 billion.

“The numbers are really strong,” says John Margeson, manager of business and economics for CIAC. “We’re almost back to where we were before the recession hit us, which is pretty good considering we lost some plants.”

A survey of CIAC members reveals that Canadian chemical makers anticipate a modestly positive 2012. They expect sales to increase by 2%, volume to rise by 5%, but operating profits to decline by 11%.

Shale gas, which has caused a petrochemical revolution in the U.S., has had a mixed impact on the Canadian chemical industry. On one hand, it has reduced feedstock costs in Canada by bringing natural gas prices down. On the other hand, it has led to shortages of ethane in the country’s petrochemical hub of Alberta because the province is producing less natural gas for export to the U.S. Ethane is extracted from this gas for use in Alberta.

The country’s largest chemical producer, Nova Chemicals, is taking matters into its own hands. The company has signed a supply agreement with Williams Cos. to get a stream of ethane from Alberta’s oil sands. And it is planning a pipeline that will bring ethane up from oil fields in the Williston Basin in North Dakota.

Nova is also seeking to tap into U.S. natural gas shale. It has signed supply agreements with Range Resources and Caiman Energy for ethane from the Marcellus Shale and a deal with Sunoco Logistics to transport the ethane from Pennsylvania to its chemical complex in Corunna, Ontario.

By lining up these agreements, Nova beat U.S. competitors to the punch, says Grant C. Thomson, Nova’s president of olefins and feedstocks. “It was a coup for Nova to really be in there first and put the first agreements together,” he notes. The company is executing a $250 million revamp of the Corunna plant so it can handle the extra ethane feedstock.

Nova is now conducting feasibility studies for potentially $1.5 billion in projects to expand the Corunna facility and build polyethylene plants in Ontario and Alberta. It expects to complete the studies by mid-2012.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter