Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Construction: Activity Will Lag In Developed Economies But Will Grow In Emerging Ones

by Marc S. Reisch

January 12, 2012

| A version of this story appeared in

Volume 90, Issue 2

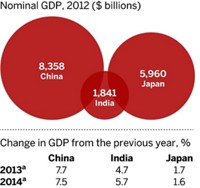

Housing, commercial, and civil construction projects will continue to abound this year in Asian countries such as China, Thailand, Vietnam, and India. With economic growth in the high single digits, paint demand will continue to rise in those booming economies.

COVER STORY

Construction: Activity Will Lag In Developed Economies But Will Grow In Emerging Ones

In developed countries, the opposite will be true. In the U.S., for instance, economic growth rates of 2–3% over the next few years and a nearly comatose residential construction market mean paint sales will lag, according to Phil Phillips, managing director of paint industry consultants Chemark Consulting. The situation will be worse in Europe, where debt woes will likely translate into little or no growth.

Andrew Bonham, president of W. R. Grace’s construction chemicals business, predicts Europe will display a split personality next year. In Northern Europe, where government debt has been better managed, demand for construction chemicals will grow 1–2%. But demand will likely contract 2–4% in Southern Europe where Greece, Italy, Spain, and Portugal have serious debt problems. Government austerity programs in those countries will force cutbacks in civil projects, he adds.

In China, where the government is putting the brakes on economic expansion, Bonham expects that construction chemical demand won’t be as robust as it was in the past few years but will still grow 6–8% in 2012. His prediction for Japan, which is still recovering from last year’s earthquake, is for growth of 2–3%. As Bonham sees it, the Japanese government is likely to focus more on repairs to the country’s energy and distribution network in 2012 and less on civil projects.

Dow Chemical predicts construction industry growth this year of 7% or more in China and South Asia. Colin Gouveia, general manager of Dow Construction Chemicals, says an increase in quality requirements in Asia for premixed mortars, tile adhesives, grouts, and cement-based plasters is boosting demand for cellulose ethers, which thicken products and increase adhesion. About 70% of the firm’s global cellulose ether output goes into construction, he adds. The rest is used in markets such as pharmaceuticals and personal care, which are also growing.

Overall demand for cellulose ethers in construction rose about 15% in 2011 over year-ago levels, outstripping supply, Gouveia says. Dow now has a feasibility study under way to determine a site in Asia where it might build a plant to supply regional customers.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter