Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

European Chemical Firms Are Hampered By Choppy Markets

Chemical Earnings: First quarter presents difficulties, but optimism is undimmed

by Alex Scott

May 6, 2013

| A version of this story appeared in

Volume 91, Issue 18

Despite a mixed first quarter, most European chemical firms say that they are optimistic about their prospects for the full year and that they are on track for 2013 to be better financially than 2012.

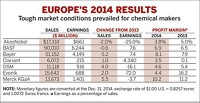

Several of Europe’s largest chemical companies reported higher sales for the first quarter of 2013 compared with the same period a year ago. Increases to the bottom line, however, were harder to come by, with BASF, Wacker Chemie, and Kemira all reporting a dip in net profits. Bayer is one of just a few European chemical firms to increase its profit margin and even then only with a positive contribution from its pharmaceutical business and a strong showing in agricultural chemicals.

BASF has had a “solid start to 2013,” said Chairman Kurt Bock. Agricultural products and oil and gas were BASF’s fastest-growing divisions, posting sales increases of 17.3% and 19.7%, respectively. In a report to clients, Laurence Alexander, a stock analyst at the investment firm Jefferies & Co., described BASF as “bucking choppy end markets.”

BASF is concerned, however, about the global economic outlook. “Economic growth would be impaired by an intensification of the debt crisis in the eurozone and the U.S. as well as by lower demand in Asia. Increasing raw material costs could also put pressure on our margins,” the firm said in its earnings report.

Strong demand for agricultural chemicals also provided a boost for Syngenta. The Swiss agchem giant experienced sales growth across all regions. High points for the firm included a 30% increase in insecticide sales in Brazil for soybean and cotton crops. “Business momentum was sustained in the first quarter of 2013,” said CEO Michael T. Mack. “For full year, we expect the impact of currencies and chemical raw materials to be broadly neutral and cost efficiencies to help offset lower licensing income and higher production costs in seeds.”

Bayer said growth was spurred by new pharmaceuticals and strong development in its crop sciences division. “We continue to see attractive perspectives for 2013 overall,” said Chairman Marijn Dekkers. He is maintaining a positive outlook despite cost pressures in the firm’s materials science division. Those pressures pushed the division’s sales down 0.4% in the first quarter compared with the year-ago periodd.

There was also cost pressure on the polysilicon made by Wacker. The material is used to manufacture solar panels. Although its profit margins are in the doldrums, Wacker said it is experiencing an upturn of sorts with “noticeably higher customer demand” for many products, including polysilicon.

Clariant also painted a mixed picture that includes only pockets of growth. Clariant expects to become more profitable thanks to changes in its portfolio, but it warned that a soft macroeconomic environment will persist during 2013.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter