Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Big Deals Tapered Off In 2012

Specialty chemicals, particularly paints and coatings, drove mergers, but total deal values declined

by Melody M. Bomgardner

February 25, 2013

| A version of this story appeared in

Volume 91, Issue 8

Chemical deal-making in 2012 outpaced 2011 by a respectable margin; 132 transactions were announced, compared with 114 in the prior year, according to a new report from the consulting firm PricewaterhouseCoopers (PwC). But industry observers say the overall selling and buying climate was partly cloudy, very much like in 2011. Indeed, the total value of deals worth $50 million or more was down significantly to less than $65 billion in 2012 compared with $82 billion the year before.

Client interest in deal-making was strong, say consultants who assist firms in chemical mergers and acquisitions, but uncertainty about the larger economy encouraged them to take a wait-and-see approach when it came to high-priced acquisitions.

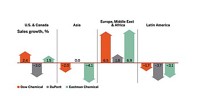

Since the start of the Great Recession in late 2007, chemical firms have worked hard to streamline operations and reduce capacity where demand was weak. By 2012, the desired economic rebound had still failed to arrive, and chemical companies seemed to lose their appetite for acquiring competitors. “The companies have stayed lean. You continue to see—especially given Europe’s troubles and Asia, which is not as hot as it once was—more cautious optimism,” observes Anthony J. Scamuffa, U.S. chemicals leader for PwC.

Chemical firms have plenty of money to spend, but in recent years most have used it to strengthen their balance sheets. Many chief financial officers used funds to pay down debt in 2012 while they waited to see if Greece, Portugal, or Spain might default, or if growth in China would be compromised by asset bubbles or the change in power. In the U.S., the presidential election and fiscal cliff only added more reasons to hold off.

The upshot is that 2012 yielded no huge deals comparable to Berkshire Hathaway’s $8.8 billion purchase of Lubrizol and DuPont’s $6.8 billion acquisition of Danisco; both were highlights of 2011. Last year, the largest deal was the sale of DuPont Performance Coatings to the Carlyle Group, a private equity firm, for $4.9 billion.

Buyers of chemical assets did write a number of decent-sized checks in 2012. The year saw a baker’s dozen of deals worth at least $1 billion. In January, Eastman Chemical agreed to buy Solutia for $4.8 billion. Still, that was the only example of a large traditional chemical firm buying another in a multi-billion-dollar move. In contrast, 2011 saw Solvay buy Rhodia, Ashland purchase International Specialty Products, Clariant snap up Süd-Chemie, and Lonza absorb Arch Chemicals.

Two trends were notable in the acquisitions market in 2012. One was that businesses were not targeted specifically to increase sales but rather for strategic reasons, such as to capture a larger portion of the supply chain, to consolidate markets, or to expand geographically. “In prior years there was more of a tendency to conglomerate, but that was not the goal in the industry last year,” says Christopher D. Cerimele, director of the chemicals practice at the investment banking firm Houlihan Lokey.

The other trend, among larger, diversified chemical companies, was the continuation of moves to increase holdings in specialty chemicals. “A lot of the big North American companies are trying to reconfigure their portfolios, and they do that by acquiring specialty firms and divesting commodity ones,” Cerimele notes. “Specialty chemicals bring higher profits, and for public firms the thought is the market will value them more highly. The perception is they will be less cyclical, enhance earnings, and be more sustainably competitive.”

That appeared to be Eastman’s playbook. “The acquisition of Solutia is a significant step in our growth strategy and one that I am confident will strengthen Eastman as a top-tier specialty chemical company with strong, stable margins,” said James P. Rogers, Eastman’s chief executive officer, when announcing the deal.

Even within specialties, the big companies jettisoned businesses in segments that were not profitable enough. During the year, two large coatings businesses were sold to private equity firms; in addition to DuPont’s coatings sale to Carlyle, Cytec Industries sold its coatings resins business to Advent International for $1.2 billion. Cytec said the deal would allow it to focus on faster-growing composite, mining chemical, and industrial material businesses.

The decorative paints business, aimed at the housing construction, renovation, and do-it-yourself markets, was an active area of consolidation with big acquisitions by Sherwin-Williams and PPG Industries. The sector is driven more by brand and distribution than by technical innovation, Cerimele notes. He contrasts that market with performance coatings aimed at auto and industrial markets, where innovation is still alive because it helps firms differentiate their products.

Two megadeals illustrated the few segments in the chemical industry where growth is strong. Ecolab increased its offerings of chemicals for oil and gas drilling with its $2.2 billion purchase of Champion Technologies. And BASF added to its growing portfolio of seeds and agricultural chemicals, including biobased ones, when it bought Becker Underwood for about $1 billion.

The desire to increase holdings in agriculture and food spurred a number of other deals in 2012. Syngenta agreed to buy Devgen, a Belgian hybrid rice seed and biological insect control firm, for $517 million. Bayer CropScience bought biological pest control firm AgraQuest for $500 million. DSM expanded its nutrition business by adding the omega-3 oils company Ocean Nutrition for $530 million and the dietary supplement ingredient firm Fortitech for $634 million. The acquisitions are set to boost DSM’s nutrition division to about $6 billion in annual sales.

Similarly, sector-specific trends are likely to add some steam to deal-making in 2013, suggests Telly Zachariades, a partner with the Valence Group, an investment firm. “The megatrends around food, water and water treatment, electronic gadgets and lithium-ion batteries, and lightweight composite materials for energy efficiency are still bubbling around.”

So far, however, merger and acquisition activity in January and February has been light, Cerimele says. “I don’t think anybody really knows for sure, but the conventional wisdom right now is that a lot of deals were pulled forward into 2012 due to uncertainty about the tax cliff,” he muses. “People assumed tax rates would go up and did deals in the fourth quarter that would have otherwise been done in the first half of this year.”

But economic indicators reported by trade group American Chemistry Council and others have stabilized somewhat, and financing for acquisitions is readily available. Outside of chemistry, megadeals have heated up for the first time in five years. In recent announcements, Berkshire Hathaway and other investors agreed to buy ketchup maker Heinz for $23 billion. American Airlines and US Airways agreed to merge in a deal worth $11 billion. And Michael Dell and private investors are putting together a $24 billion pot of money to buy out computer maker Dell.

Cerimele suspects that deal-making in the chemical industry will also pick up. “A lot of foreign companies are looking to make acquisitions in North America now, more aggressively than last year, to get access to shale gas or other specific sectors. Domestically, firms are being selective and careful.”

Both Cerimele and Zachariades say that the pace of deal-making in 2013 will likely be steady and without a sense of urgency. “Executives are much more focused on profitability than top-line growth. They will look to either sell or improve nonperforming assets,” Zachariades says. “That’s where they see a correlation between stock price and performance.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter