Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

U.S. Growth of U.S. manufacturing, global economy will turn up chemical demand

by Melody M. Bomgardner

January 13, 2014

| A version of this story appeared in

Volume 92, Issue 2

COVER STORY

U.S. Growth of U.S. manufacturing, global economy will turn up chemical demand

Strong auto sales and an uptick in housing starts, which combined to spur modest growth in U.S. chemical production in 2013, will continue this year. What will be new and notable in 2014 is a manufacturing revival in the U.S. and economic expansion around the globe that will buoy demand for basic chemicals.

“Manufacturing needs and exports will drive demand for basic chemicals, especially where shale gas drives competitive advantage. Europe and many emerging markets will be stronger in 2014,” says T. Kevin Swift, chief economist at the American Chemistry Council, a trade group. Combined, the positive trends should impact most segments of the U.S. chemical industry including plastics, basic chemicals, and specialties, according to ACC.

Compared with the 1.6% growth in chemical production that the U.S. saw in 2013, this year’s expected growth rate of 2.5% will be rather robust. But the acceleration won’t happen until mid-2014 or later, says Sergey Shchepochkin, chemical industry analyst at credit insurance provider Euler Hermes. By then, the rise in construction will have had downstream effects on demand for appliances and other durable goods. Consumer spending will also create more demand for plastics and electronics, Shchepochkin says; paper and textile markets, in contrast, will continue to underperform.

Consumers around the world, not just in the U.S., will demand more autos and homes, which will boost chemical exports by 6.6% this year, according to Swift. He expects a continuing trade surplus, with basic and specialty chemical exports more than offsetting imports of pharmaceuticals and agricultural chemicals.

Last year’s slowdown in demand from China’s manufacturing sector is likely to turn around this year, to the benefit of U.S. chemical exporters. Meanwhile, the Society of Chemical Manufacturers & Affiliates, a trade group for smaller firms, has turned its eye to Europe as it advocates for the U.S. and European Union to agree early in the year on the trade-enhancing Transatlantic Trade & Investment Partnership.

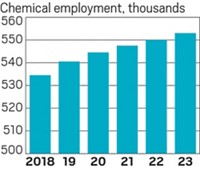

Another big change for the U.S. chemical industry this year should be in employment, where expansion is helping to reverse what had been more than a decade of workforce decline. Chemical jobs grew by an estimated 1.3% in 2013, says Swift, who expects additions to continue through 2018. Employment will follow the large capital investments in the U.S. brought by shale gas; the tally of new projects has reached 135 with a combined value of more than $90 billion.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter