Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

The great styrene comeback

Pitiful performers in the 2000s, styrenic resins are now among the chemical industry’s hottest businesses

by Alexander H. Tullo

June 12, 2017

| A version of this story appeared in

Volume 95, Issue 24

A decade ago, if someone asked, “What is the worst business in the chemical industry?,” styrenics would have been a fantastic answer.

Styrene and polystyrene perennially lost money for chemical makers as demand ebbed and producers maintained too much capacity. Major industry players shuttered plants, and some even unloaded their businesses on companies still willing to try their luck at it.

The industry reorganization paid off. Styrene and its derivatives are making money again. Companies are expanding. But with memories of the lean times still fresh, executives are trying not to repeat the mistakes the industry made more than a decade ago.

Styrenic resins are polymers made from the aromatic monomer styrene. Foremost among them is polystyrene. It is the polymer of choice for insulation and packaging foam. Clarity and attractive surface properties make it a common plastic in everyday items such as toys, pens, and disposable cutlery.

Acrylonitrile-butadiene-styrene (ABS) is polystyrene’s tougher, higher-end cousin. It is made by polymerizing styrene and acrylonitrile in the presence of polybutadiene, forming a strong graft copolymer familiar in applications such as electronics housings and automotive interiors. Styrene is also used to make elastomers such as styrene-butadiene rubber.

And then there were four

Consolidation has shrunk the roster of major international players in styrenics.

Drag timeline left or right

a Formed through the merger of BP’s and Nova’s European polystyrene businesses and Ineos’s purchase of BP’s Innovene chemical business.

b Formed through Ineos’s buyout of Nova’s interest in Ineos Nova followed by a merger with BASF’s styrenics unit.

c Bain Capital purchased Dow’s styrenics business in 2010.

d Saudi Basic Industries purchased GE’s plastics business in 2007.

As ubiquitous as some of these plastics are, business wasn’t so good in the 2000s. Nova Chemicals, for example, lost money in styrenics every year from 2001 until 2009.

“There was at least a decadelong period where styrene, not only in the U.S. but globally, was just not faring that well,” says Ryan Macaluso, a research analyst for benzene and styrene at the consulting firm PCI Wood Mackenzie.

Demand, overcapacity, and escalating raw material costs all combined to vex styrene and its derivatives in the 2000s. Alexander Glück, president of Ineos Styrolution America, remembers in particular the shrinking demand.

“One of the big contributing factors was the phaseout of video cassettes and CD jewel boxes,” Glück says. In packaging and other nondurable applications, polystyrene lost ground to plastics such as polyethylene and polypropylene. “This led to a situation where we had quite some overcapacity, and industry results were quite bad,” he says.

In addition, Macaluso recalls, the U.S. styrenics industry was impacted by offshoring of consumer goods manufacturing to Asia, which was garnering most of the world’s growth in the polymers.

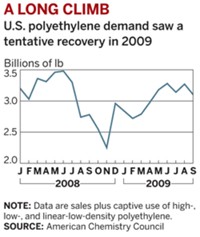

The demand situation came to a head during the Great Recession. From 2007 to 2009, Macaluso says, U.S. styrene consumption plummeted by as much as 25%.

Styrene was getting hit on the supply side as well. Most styrene is made by reacting ethylene and benzene to yield ethylbenzene, which is then converted into styrene. An alternate route involves starting with ethylbenzene and propylene and making styrene and the polyurethane precursor propylene oxide.

In the 2000s, propylene oxide was in high demand, and companies responded by building multiple propylene oxide-styrene monomer (POSM) plants.

But every metric ton of propylene oxide yields more than two metric tons of styrene, and the new plants swamped the styrene market. “The impact from the POSM plants, which were quite popular in the early 2000s, almost killed the styrene business because styrene was just a waste product,” Styrolution’s Glück says.

In the mid- to late 2000s, Macaluso says, styrene plant operating rates were between 70 and 80%, well below the 85% rate needed for improved profitability.

The bad times set the stage for the recovery. Longtime players sought a way out of the business. Dow Chemical and Chevron Phillips Chemical merged their polystyrene businesses in the Americas. Dow later sold its joint venture stake, along with the rest of its styrenics business, to Bain Capital to form today’s Trinseo. Through a series of transactions, BP, Nova, Lanxess, and BASF divested their operations to Ineos to create Ineos Styrolution.

Tim Stedman, president of basic plastics and feedstocks at Trinseo, says the reshuffling put the industry in the hands of companies focused on the fortunes of styrene and its derivatives. Under the old regime, integrated chemical companies viewed styrenics as a way to get rid of excess benzene and ethylene made in ethylene crackers.

“Styrene was considered a noncore business,” he says. “Today, in Trinseo, we talk about it as a foundational business. We have to stand on our own two feet.”

When Styrolution was formed in 2011, one of the company’s first tasks was to evaluate its fleet of plants, Glück recalls. “We realized that given the market conditions, we had quite a lot of overcapacity.” The firm closed polystyrene plants in Massachusetts, Sweden, and Germany.

Companies took action on styrene as well. Sterling Chemicals and Dow both shuttered styrene plants in Texas, taking a combined 1.3 million metric tons of annual capacity off the market, Macaluso says. Concurrent rationalization in Europe reduced capacity by another 700,000 metric tons. Global capacity today is about 33 million metric tons per year.

New styrene capacity, primarily in China, was added in recent years, but it doesn’t worry Trinseo’s Stedman. The plants, he notes, tend to be smaller than those in the U.S. and are not back-integrated into raw materials. They are relatively high cost and “struggling to run hard,” he says.

Moreover, at least in Europe and North America, the industry is no longer being harassed by new POSM plants because the pendulum has shifted away from the technology. LyondellBasell Industries, for example, is building a propylene oxide plant in Texas that makes tert-butyl alcohol as a coproduct, even though it is a prominent operator of POSM plants. Other firms are making propylene oxide with newer technologies that don’t yield coproducts.

Overall, thanks to steady annual growth of 1.5 to 2.0% and the improved supply situation, the styrene industry is enjoying healthy operating rates of more than 90%, Macaluso says.

One hitch for U.S. styrenics producers is high prices for benzene, which is made as a coproduct in ethylene crackers, refineries, and p-xylene plants. “Nobody really sets out to make benzene,” explains Simon Palmer, director of aromatics at PCI Wood Mackenzie. “Benzene arises from making some other primary product.”

Since the shale oil and gas era began in the late 2000s, ethylene crackers in the U.S. have shifted their raw material slates toward ethane and away from naphtha, making less coproduct benzene in the process. Separately, refineries are also producing less benzene. As a result, Palmer says, benzene prices have been steadily climbing, and the U.S. is increasingly importing the monomer.

However, lower ethylene prices and utility costs in the U.S. more than make up for the higher benzene rates.

Profit margins in styrene are now good all over the world, Macaluso says, and “margins for U.S.-based producers have been outstanding.”

The big multinational styrenics makers are investing again. Trinseo will start up an ABS facility in China later this year. It is also expanding a styrene-butadiene rubber plant in Germany.

Styrolution recently purchased the K-Resin joint venture between Chevron Phillips and Daelim Industrial in South Korea. Styrolution is also building an acrylonitrile-styrene-acrylate (ASA) polymer plant in Texas, where it operates its largest styrene plant. The move will free up ABS capacity at its plant in Mexico, allowing it to boost production.

Despite the cost advantage in North America, new styrene plants are conspicuously absent from industry planning. Trinseo’s Stedman says his company’s investment dollars are better spent on higher-end derivatives.

Styrolution has plenty of styrene, Glück says. “Once we decide to invest in new capacity, we really need a good business case behind it,” he says. ASA has that and styrene doesn’t.

“You learn to be a little cautious if you’re in the styrenics industry,” Glück says. Still, he’s optimistic. “We might see a correction at some point, but I don’t think by any means we will go back to the old times.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter