Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Materials

As computer chips shrink, cleaning needs grow

Suppliers of electronic cleaning chemicals seek to remove even trace contaminants

by Michael McCoy

October 9, 2017

| A version of this story appeared in

Volume 95, Issue 40

New materials deserve a lot of credit for helping miniaturize the computer chips that make our smartphones smart and keep our data centers humming. Hafnium-based dielectric materials, for example, are helping shrink transistors in Intel’s latest chips. Cobalt-containing organometallic thin films are protecting delicate chip features.

But credit should also go to the high-purity cleaning and particle-removal chemicals that underpin the chip-making process. After every application of an exotic material to a silicon wafer, a meticulous cleaning step is needed to remove leftover particles and other unwanted gunk. While new chip fabrication materials get the headlines, ultra-high-purity cleaning chemicals are unsung heroes making them possible.

They may not get respect, but these chemicals are profitable, and demand for them is growing. Manufacturers are investing in both new facilities and new technologies for making them as pure as possible so they don’t contribute unwanted gunk of their own. As they get down to part-per-billion and part-per-trillion impurity levels, however, the purification task gets ever harder.

“We’re at a point now where we have to detect particles that are a similar challenge to finding a handful of quarters in the state of Massachusetts,” says James O’Neill, chief technology officer of Entegris, a Massachusetts-based firm that makes high-purity process chemicals and systems for handling them.

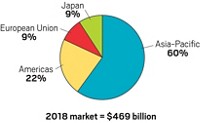

High-purity cleaning chemicals for electronics are low profile in part because they constitute a modest-sized business. Global sales are about $1.5 billion annually out of an estimated $12 billion market for semiconductor materials overall, says KMG Chemicals, a U.S. firm that calls itself the world’s leading supplier of high-purity process chemicals.

KMG built its business largely by acquiring high-purity chemical lines from companies such as Air Products & Chemicals and OM Group. In its latest fiscal year, KMG had electronic chemicals sales of $262 million; its largest customer is Intel.

Other firms are investing in new production with an eye to capturing growth in the business. Japan’s Mitsubishi Gas Chemical recently announced plans to spend $60 million by 2019 to build two super-pure hydrogen peroxide plants in the U.S. The facilities are set to open in Oregon and Texas, home to semiconductor plants operated by Intel and Texas Instruments.

And in August, a U.S. company, Gas Innovations, said it will build a facility in La Porte, Texas, that upgrades industrial anhydrous hydrogen chloride to a purity level of more than 99.999%. It expects to begin high-volume production early next year.

Mitsubishi Gas Chemical is already a leader in high-purity hydrogen peroxide with plants in Singapore, South Korea, Taiwan, and Mesa, Ariz.

Scott Hancock, chief financial officer of MGC Pure Chemicals America, a U.S. subsidiary, explains that the new plants will use a homegrown purification process to turn out hydrogen peroxide with trace contamination in the part-per-trillion level. “Our best advances and state-of-the-art technology will be incorporated into the new plants,” he says.

Hydrogen peroxide’s main use in the semiconductor industry is to create two standard cleaning compounds known as SC1 and SC2. SC1, a mixture of hydrogen peroxide and ammonium hydroxide, removes organic matter and particles from silicon wafers. SC2, a mixture of hydrogen peroxide and hydrochloric acid, removes residual trace metals and metal hydroxides.

Gas Innovations, meanwhile, is targeting its anhydrous HCl at the dry-etching process, in which unwanted material is selectively removed from a silicon wafer’s surface using a mask.

Ashley Madray, president of Gas Innovations’ eHCL Innovations unit, explains that his company got into the anhydrous HCl business in 2009 to supply high-purity product to customers in the electronics and drug industries. But the increasing purity standards of the electronics industry eventually caught up with Gas Innovations. “We had a product that was subpar,” Madray acknowledges.

When new purification equipment is installed later this year, eHCL will be able to satisfy its customers’ heightened needs, Madray says. It will also install gas chromatographs and inductively coupled plasma mass spectrometers to test all contaminants to part-per-billion levels and 20 individual metals to part-per-trillion levels.

Hydrogen peroxide and HCl—both anhydrous and hydrous—are two of the bulk high-purity chemicals used in semiconductor processing. Others, explains Michael Corbett of the electronic materials advisory firm Linx Consulting, include isopropyl alcohol, ammonium hydroxide, and sulfuric, hydrofluoric, nitric, and phosphoric acids.

Cleaning up

CMP = chemical mechanical planarization.

Source: Linx Consulting

CMP = chemical mechanical planarization.

Source: Linx Consulting

Together, Corbett says, these eight products represent 70% of the bulk wet cleaning chemicals business. The rest consists of formulated products that carry out niche residue removal and stripping tasks.

Corbett figures that the semiconductor industry’s move from 28-nm to 16-nm circuitry increased the number of cleaning steps required from 30 to 62. And that shrinkage continues: The circuitry in today’s most advanced chips is single-digit-nanometers wide.

One source of the increased number of cleaning steps is multiple patterning, a technique for doubling, tripling, or even quadrupling circuit line density by overlaying one lithographic pattern on top of another. Another is the introduction of three-dimensional chip features that require more processing steps to implement. “Additional processing steps mean more cleaning steps,” Corbett adds.

Moreover, as chip architecture shrinks, the purity demands on cleaning chemicals increase. Jeff Handelman, KMG’s senior vice president for electronic chemicals, explains that even the minutest particles can block or inhibit electrical connections in modern chips. “Because line width in integrated circuits is so small now, particle filtration and process management have become critical considerations in chemical performance,” he says.

Entegris’s O’Neill points out that merely manufacturing an ultra-high-purity chemical is no longer enough. Purity must be maintained along the chemical’s entire supply chain by use of the right filtration, packaging, and fluid-handling equipment.

“If I make it in Texas and ship it to Taiwan, it better be the same when it gets there,” he says. “There’s an enormous opportunity to mess up this chemistry.”

As purity requirements ratchet up, new technology is often required, O’Neill says. Take filtration. The strategy of reducing filter pore size is reaching the limits of its effectiveness because flow rates are getting too low. Increasingly, Entegris and other firms are using a process that O’Neill calls affiliative filtering in which a membrane surface is functionalized to remove a targeted contaminant.

But that requires engineering filtration media to match the specific chemicals that need to be purified. “No longer can you take a filter off the shelf, throw it on your favorite chemistry, and expect it to work,” O’Neill says.

The introduction of new materials into chips can cause big changes to long-standing cleaning formulas. For example, the emerging use of cobalt in barrier films has forced the reformulation of residue-removing solvents to avoid galvanic corrosion between copper chip circuitry and cobalt, O’Neill points out. New tungsten-based barrier layers further complicate cleaning.

Environmental concerns can force change as well. Since 2013, Entegris has requalified thousands of fluoropolymer materials-handling products to ensure they are free of the carcinogen perfluorooctanoic acid. At the request of customers, Entegris has also been removing tetramethylammonium hydroxide, a solvent that poses neurotoxicity concerns, from post-etch residue removers, O’Neill says.

These changes are taking place as Entegris and other companies are removing cleaning chemical contaminants down to sub-20-nm sizes that are extremely difficult to detect with current analytical equipment. “We are effectively operating in a regime where we can’t directly see the stuff we are trying to remove,” O’Neill says.

During a presentation at the Semicon West trade show in July, O’Neill warned that the next generation of semiconductor manufacturing will require purity levels measured in parts per quadrillion—like finding one minnow in San Francisco Bay. Maybe the cleaning chemicals industry does deserve a little more respect.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter