Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Energy Storage

A solid opportunity for lithium-ion batteries

How switching from liquid to solid electrolyte could bring a sea change in electric vehicle battery safety and performance

by Alex Scott

September 2, 2021

| A version of this story appeared in

Volume 99, Issue 32

It has taken years of toiling away in their labs, but developers of lithium-ion batteries made with solid electrolytes—known as solid-state batteries or SSBs—are moving toward commercialization of the technology for markets that include portable electronics and electric vehicles.

The nascent technology has the potential to trump the current incumbent—lithium-ion batteries made with liquid electrolytes—by being stable at high temperatures, which enables safer operation and better performance.

The promise of SSBs is that electric vehicles and mobile phones will no longer be at risk from batteries that catch fire. The solid electrolyte itself doesn’t improve performance, but its stability and barrier properties allow the safe use of energy-dense anode materials such as lithium metal and silicon that help the SSBs outperform the lithium-ion batteries in use today.

SSB developers have attracted a wave of investment and hype. But despite the huge sums of money pouring into SSBs, developers have yet to show that they have solved all the scientific challenges associated with using solid electrolytes. And critically, they have yet to prove they can make SSBs at commercial scale.

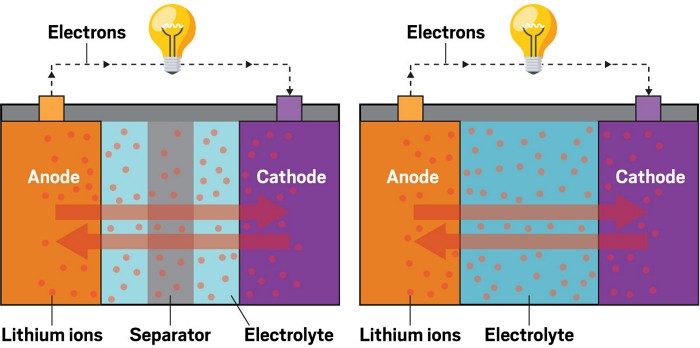

A traditional lithium-ion battery has an anode, a separator immersed in a liquid electrolyte, and a cathode. During discharge, lithium ions flow from the anode to the cathode through the electrolyte and across the separator.

In an SSB, there is no need for a separator, since the solid electrolyte acts as a physical barrier between the anode and cathode. The electrolyte is typically made of sulfide, ceramic, or polymer material. They all have shortcomings—some solids are unstable in the presence of air, while others are brittle and can crack—but companies say they have fixes in place.

“A lot of the promises are still at the developmental stage,” Michael Sanders, senior adviser for the technology information provider Avicenne Energy, said at Cambridge EnerTech’s recent Solid-State Battery Summit. “Even when we see press releases and so forth by the various leaders or start-ups in this space, we see very incomplete data.”

Liquid- versus solid-electrolyte batteries

And some SSB developers, unable to keep their promises, have given up. Among them, Dyson wrote off $90 million worth of investment in SSB technology from Sakti3, a company it had acquired, while Bosch wrote off $70 million after acquiring SSB developer Seeo. Many more companies, though—from start-ups to big battery companies such as CATL, Panasonic, and Samsung—are still racing to develop SSBs.

If the technology challenges can be resolved, the potential for SSBs to boost the energy density of lithium-ion batteries makes the approach a “game changer,” the technology information provider IDTechEx states in a recent report. The rate of technology rollout and its uptake could be rapid, according to IDTechEx. It predicts that annual SSB sales could reach $8 billion by 2031, from basically nothing today.

The automakers BMW, GM, Toyota, and Volkswagen have already forged partnerships with solid-electrolyte technology developers. VW disclosed this spring that it is tripling its investment in US-based SSB start-up QuantumScape to $300 million. QuantumScape’s approach is to use a solid-state ceramic electrolyte separator in an anode-free cell in which lithium flows through the battery to form the anode on the first charge.

With this approach the company is eyeing an energy density in excess of 400 W h/kg. Conventional lithium-ion batteries featuring a standard graphite anode max out at about 250 W h/kg.

QuantumScape says its battery charges to 80% in less than 15 min because it eliminates a lithium diffusion bottleneck experienced in standard batteries. Battery life is increased by eliminating capacity loss at the anode interface. Furthermore, by avoiding a series of manufacturing steps associated with conventional batteries, QuantumScape can reduce battery cell production costs by 15–20%, said Tim Holme, the firm’s chief technology officer, at the Cambridge EnerTech event.

“The key to enabling this lithium-metal anode is the solid-state separator,” Holme said. The firm’s ceramic separator—the equivalent of the liquid electrolyte in a traditional battery—protects against the formation of small spikes of lithium, known as dendrites, during battery cycling that could short circuit the battery.

The electrolyte has to be thin and processed at low cost over a large area, Holme said. “It is really a difficult challenge” that companies have been trying to solve for decades, he said. Another hurdle that QuantumScape and other SSB developers must overcome is ensuring that the electrolyte has a good surface contact with the cathode so the battery’s power potential is achieved.

QuantumScape makes multiple, thin layers of the electrolyte and electrodes to create a battery cell large enough to power an electric vehicle. The firm’s key tasks ahead are to improve the separator production process, increase the number of layers in a multilayer battery cell, and improve high-volume manufacturing. “There’s going to be a lot of challenges to get it to manufacturing,” Holme said.

QuantumScape at least has the luxury of an abundance of cash. Since its inception in 2010, the firm has raised $1.5 billion in funding. After its 2020 stock-market entry via a merger with a special purpose acquisition company, QuantumScape’s market value briefly eclipsed that of Ford Motor and it is still worth nearly $10 billion. Its goal is to be producing at commercial scale in 2024, Holme said.

Solid Power, another US SSB start-up, is taking a different approach. It is simultaneously developing SSBs with lithium-metal and silicon anodes, both of which will use a sulfide electrolyte. The firm has raised $130 million from investors and partners including BMW, Ford, Hyundai, and Samsung. Its sights are set on beginning commercial production in 2026.

Solid Power is also going to become a publicly traded company later this year via its own merger with a special purpose acquisition company.

The firm is targeting a lithium-metal anode SSB with an energy density of 440 W h/kg. But next-generation cathode materials could yield a battery with an energy density of 560 W h/kg, said Josh Buettner-Garett, Solid Power’s chief technology officer, at the Cambridge EnerTech event.

“You’ll never beat lithium metal in terms of energy stored per unit mass, and lithium should also deliver low cost long-term,” Buettner-Garrett said. “But silicon is also important because it offers the quickest path to meeting all of the charge rate and low-temperature cycling requirements for next-generation electric vehicles.”

Handling Solid Power’s solid electrolyte, though, is no cakewalk. “The main drawback of the firm’s sulfide material is that it is moisture sensitive, so we need to make it in a dry room and store it in an inert atmosphere,” Buettner-Garrett said. Once the material is in the cell stack, however, its reactivity goes down dramatically, he said.

While technology firms are aiming for commercial production, some automakers, including Solid Power–investor Ford, continue to be cautious about the performance issues of SSBs. More work on chemistry and cell design is needed for SSBs to operate effectively at lower temperatures, Asma Sharafi, a research engineer with Ford Motor, said at the conference. More study is also needed to understand the role of particle size, composition, porosity, and electrode thickness for high-performance composite electrodes. “There is a lot more progress that needs to be made with this technology,” Sharafi said.

Pros and cons of different solid electrolytes

Polymer

▸ Pros: Moderate thermal stability, good moisture stability, excellent suitability for mass production

▸ Cons: Poor conductivity, poor lithium metal stability

Oxide

▸ Pros: Good conductivity, excellent thermal and lithium metal stability, moderately suitable for mass production

▸ Cons: Moderate moisture stability

Ceramic

▸ Pros: Excellent thermal, lithium metal, and moisture stability

▸ Cons: Poor conductivity, cell processability, and suitability for mass production

Sulfide

▸ Pros: Excellent conductivity, good cell processability, moderate suitability for mass production

▸ Cons: Poor lithium metal and moisture stability

Hybrid

▸ Pros: Excellent conductivity, good thermal and lithium metal stability, good suitability for mass production

▸ Cons: Poor moisture stability

Sources: IDTechEx, C&EN research.

While Sharafi is calling for greater understanding of the fundamentals associated with SSBs, developers are publishing ever more impressive data indicating commercialization could be around the corner.

One such firm, Factorial Energy, a start-up based in Woburn, Massachusetts, only emerged from stealth mode in the spring of this year but has since unveiled the largest SSB cell the industry has made to date. Initial testing shows that at 25 °C the firm’s cell demonstrates 97.3% capacity retention after 675 charge-discharge cycles. Factorial has yet to disclose details about the type of solid electrolyte it has developed.

The UK’s Ilika plans to start manufacturing SSBs in 2022. The firm’s first product will be its Stereax microbatteries, designed for applications such as blood-pressure sensors that are so small that, for the first time, they can be placed within an artery. Its SSB is based on a ceramic oxide electrolyte and silicon anode.

For Ilika, delivering the substantially greater energy required to power electric vehicles will necessitate a shift to bigger battery cells and different cell architecture and chemistry. Potential problems include a drop in conductivity and voids in the electrolyte that can reduce battery performance, said Denis Pasero, product commercialization manager for Ilika.

One thing Ilika has learned is that the SSB development process is not a linear one. “You have to fail a lot to succeed,” Pasero says.

As well as trying out different solid electrolyte materials, developers are working on different ways of depositing layers of electrolyte and other battery components. San Jose, California’s Sakuú recently started building a pilot plant to make SSBs for its partners using 3D printing. The firm says 3D printing overcomes many of the issues limiting SSBs and will enable it to make batteries that are up to 50% smaller and 30% cheaper to produce than today’s lithium-ion batteries.

In the last year, “we have improved our battery energy capacity by a factor of 100 and our volumetric energy efficiency over 12 times,” Sakuú’s CEO and founder, Robert Bagheri, says in a recent press release.

Progress among SSB developers is making producers of electrode materials for standard batteries sit up and take notice. US start-up Group14 Technologies is one of a number of companies developing cathode or anode materials that are suitable for pairing with both standard and next-generation batteries. “We are currently working with a number of solid-state companies,” says Rick Luebbe, CEO and founder of Group14, developer of a highly energy-dense silicon anode material.

Luebbe expects demand for batteries for the electric vehicle sector will be so strong that both liquid- and solid-electrolyte technologies will be used. “In order to meet market demand for [electric vehicles] alone we will need a plethora of battery technologies to commercialize and reach scale rapidly,” he says.

The UK firm Johnson Matthey, developer of a nickel-rich cathode material for liquid-electrolyte batteries, is also eyeing a shift into SSBs. JM’s cathode material could be tuned to work with SSBs, says Neil Collins, the firm’s technology director for battery materials. Collins’s intuition is that SSBs will play an important role in the battery space but that any shift to them will be “evolutionary, not revolutionary.”

In a bid to bolster its SSB know-how, JM recently joined six other UK organizations in signing an agreement to make a prototype SSB. Other members of the consortium include the start-up battery firm Britishvolt; the Faraday Institution, a government-funded battery technology hub; and the University of Oxford. The consortium plans to build a prototyping facility that will enable SSB technology to emerge from UK university labs.

“Solid-state is the holy grail of battery solutions,” states Allan Paterson, Britishvolt’s chief technical officer. “Solid-state batteries have the potential to increase energy density significantly over battery technology available today and could dramatically, and positively, change the world of electric vehicles.”

By 2030, SSBs are likely to take a 7% share of the consumer electronics battery market and a 4% share of the electric vehicle battery market, the Faraday Institution forecasts.

Companies in Asia are also working on SSBs. Among them, Toyota is known to be developing sulfide-electrolyte batteries. Toyota has also invested in APB, a Japanese start-up developing an SSB with a polymer electrolyte. APB claims that it can substantially shorten the battery manufacturing process and that its polymer technology enables increased cell size and greater versatility in cell shape.

While Asia-based companies dominate the manufacture of batteries for electric vehicles, that could change for SSBs, said Ines Miller, senior consultant for the consulting firm P3 Automotive, at the Cambridge EnerTech event. There is very little lithium-ion battery manufacturing in Europe and North America, but governments are pushing to add capacity, and this gap could be filled by SSB production, Miller said.

Yet Miller echoed QuantumScape’s Tim Holme in warning that much work is needed to move smoothly into commercial production. “Upscaling from prototypes to large, multilayered cell design could lead to substantial delay of commercial production,” she said.

Advertisement

Another issue for SSB developers is that traditional battery developers are not about to unplug anytime soon. Among others, Stanford University spin-off Cuberg reckons it has gotten around the safety issues with liquid electrolytes and that it can make a stable battery with an energy-dense lithium-metal anode. The Swedish battery maker Northvolt was convinced enough of Cuberg’s promise that in March it agreed to buy the company for an undisclosed sum.

Emerging hybrid technologies could also resolve the safety issues with liquid-electrolyte batteries. SES, a Massachusetts Institute of Technology spin-off previously known as SolidEnergy Systems, had been developing SSBs but is now advancing a hybrid battery with concentrated salt and liquid solvent electrolytes and a lithium-metal anode. Combined with a proprietary anode coating, this hybrid electrolyte inhibits lithium dendrite growth that could otherwise damage the battery, SES says.

SES projects that the energy density of its battery will be 400 W h/kg, making it comparable with some SSBs. In July SES disclosed plans to list on the New York Stock Exchange. It expects to raise about $3.6 billion from the flotation, enough to fund its commercial aspirations.

With an abundance of developments in liquid-electrolyte, solid-state, and hybrid batteries underway, all three technologies could be winners in the electric vehicle market. As Solid Power’s Buettner-Garrett said, “The consumer doesn’t really care what chemistry is in their EV.”

CORRECTION

This story was updated on Sept. 17, 2021, to correct Rick Luebbe's title. He is CEO, not CTO, of Group14 Technologies.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter