Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Solar Power

The US solar industry has a supply problem

China’s control of solar manufacturing puts the sector at risk of disruption

by Matt Blois

September 18, 2022

| A version of this story appeared in

Volume 100, Issue 33

Credit: Hemlock Semiconductor | Making polysilicon requires lots of power, but Hemlock Semiconductor says it uses renewable energy to run its operations in Michigan.

In brief

Chinese companies produce over three-quarters of the world’s polysilicon, which is at the heart of solar panels. Some solar industry groups and researchers say that level of concentration poses a risk to the solar supply chain. They also argue that moving production elsewhere could decrease solar’s carbon footprint and avoid companies accused of using forced labor in China’s Xinjiang Uyghur Autonomous Region. In the US, the Inflation Reduction Act promises funds for restarting idle polysilicon factories and investing in manufacturing of other solar components. But companies must still turn that momentum into solar panels.

Wacker Chemie’s chemical plant in Charleston, Tennessee, is large enough to have its own street system. Lettered streets run roughly east to west, intersecting numbered avenues at perfect 90° angles.

The 220-hectare site produces polysilicon, a key material used to make solar panels and computer chips. Two pipe-covered distillation systems the length of football fields tower over Second Avenue, while reactors used to make polysilicon occupy an entire block between C Street and D Street.

Site Leader Ken Collins says Wacker has already invested nearly $3 billion in the plant, and the site is still growing. “We’re actively looking at things in F,” he says, pointing to the location of a future street on the edge of the facility. “And then long term, it goes well beyond.”

Wacker is in the midst of spending $200 million to add the production of silicone polymers. Collins says the property is also laid out to allow for polysilicon expansion. Wacker hasn’t announced specific plans for new polysilicon infrastructure, but national governments and the solar industry are pushing to increase production in places like Tennessee.

Most of the world’s polysilicon is made in China, and the US solar industry is encouraging suppliers to increase production elsewhere. Solar companies argue that a less-concentrated supply chain will be more resilient, emit less carbon, and circumvent companies accused of using forced labor in China’s Xinjiang Uyghur Autonomous Region. The US and Indian governments recently added momentum to this endeavor, pledging billions of dollars to scale up domestic solar manufacturing and guarantee future access to clean energy.

Some companies are already responding. Reliance Energy says it will spend $7.5 billion on a green energy manufacturing hub in India that will include polysilicon production. The other two companies that make polysilicon in the US—Hemlock Semiconductor and REC Silicon—are also ramping up production. Hemlock turned on idle capacity for solar-grade polysilicon at its plant in Michigan this summer, and REC Silicon plans to reopen a polysilicon facility in Washington. “Producers don’t want to rely upon unstable sources,” REC Silicon CEO James May says.

Even with all that momentum, challenging China’s preeminence in solar manufacturing will not be easy. In addition to its massive polysilicon capacity, Chinese companies control the subsequent steps in the supply chain: the production of silicon ingot and wafers, solar cells, and final solar panels. Supply chain experts say other countries must build up capacity in those parts of the supply chain as well if they are to decrease the risk of disruptions. And polysilicon makers outside China must prove they can compete with rivals in China that have access to ample government support.

The Solar Energy Industries Association (SEIA), an industry group, argues that incentives in the recently passed Inflation Reduction Act will kick-start US solar production, eventually making it competitive with China. Over the next 8 years, SEIA hopes companies will build US factories capable of making 50 GW of solar panels per year, nearly enough to power every home in Texas.

“Maybe half of that crosses the finish line,” Collins says. “That’s still a lot of polysilicon demand. Much more than the three producers in the US make today.”

The process

Polysilicon is at the heart of a solar panel. Small amounts of other elements are added to polysilicon so that one side of the material has extra electrons. When sunlight hits a solar cell, it displaces those extra electrons. They flow to the opposite side of the cell, which has molecules that can accept them. The flow of electrons creates an electric current.

The process for making polysilicon starts in mines extracting quartzite, which is essentially gravel with high levels of silicon dioxide and low levels of impurities like iron. Many of those mines are in China, but quartzite reserves are abundant in Brazil, Norway, and the US. The gravel is melted down in a furnace with a carbon source, usually coal or charcoal, to produce silicon metal, silvery-gray rocks that are at least 98% silicon.

Companies like Wacker use the Siemens process to remove the remaining impurities. The resulting polysilicon is a crystallized form of silicon that needs to be at least 99.9999% pure for solar applications—and even purer for computer chips. “It’s a really technical plant that turns silver rocks into silver rocks,” Collins says of the facility he leads.

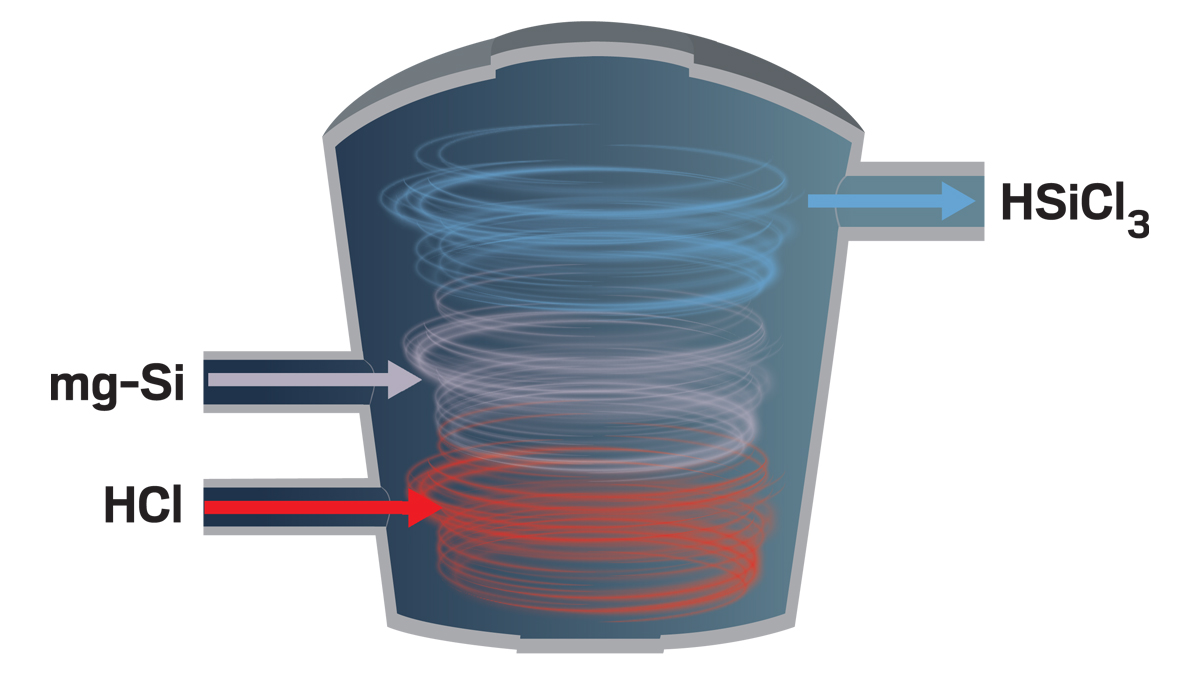

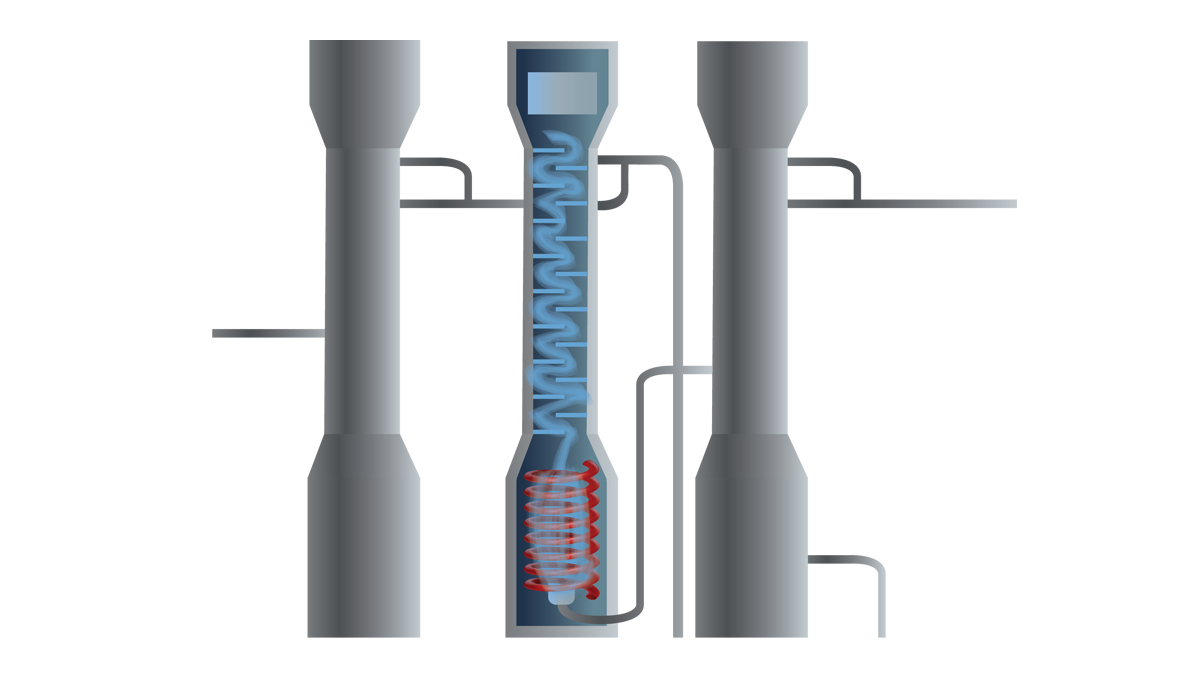

In the first step at the Tennessee plant, the silicon metal is crushed into a powder and combined with hydrogen chloride at high temperatures to form liquid trichlorosilane. Wacker distills the liquid in spiraling columns several stories tall to increase the purity. “It’s very similar to what you do to a bourbon,” Collins says.

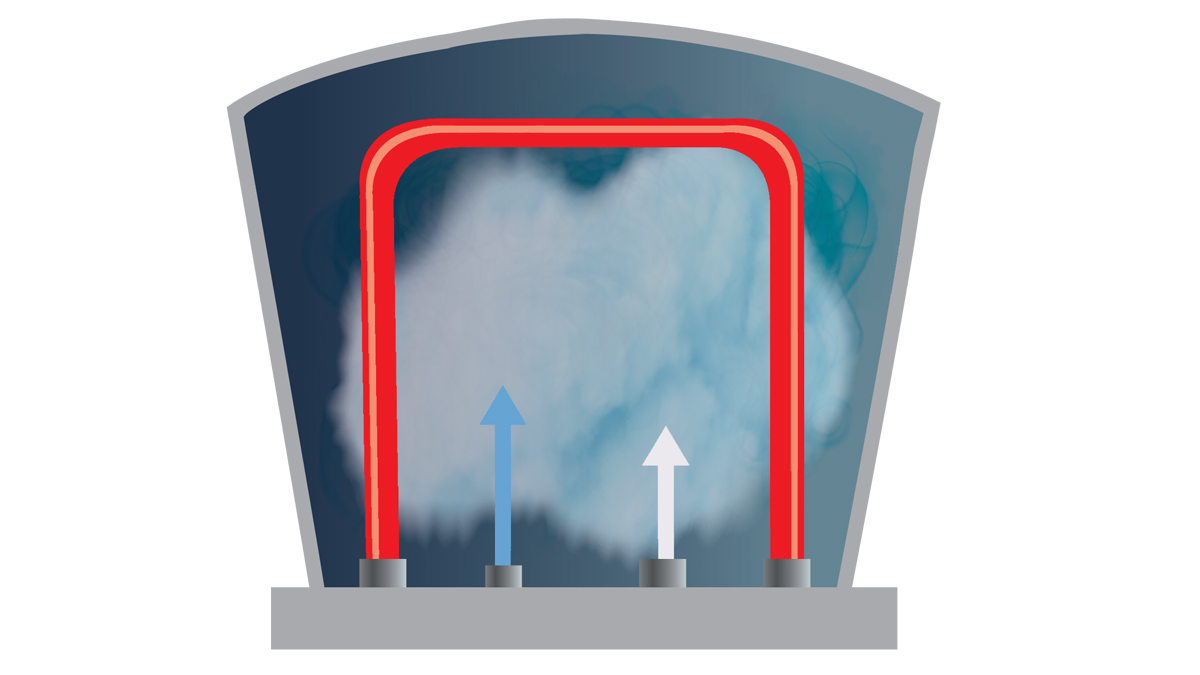

The purified trichlorosilane is converted to gas and pumped into horseshoe-shaped chambers that contain a filament of polysilicon about the diameter of a pencil. Some companies use silane gas instead. Electricity runs through the filament, illuminating it like a light bulb and increasing its temperature to 1,000 °C. At those high temperatures, silicon from the trichlorosilane slowly deposits onto the filament, gradually turning it into a thick rod. As a final step, the rod is broken into chunks.

MAKING POLYSILICON

To create the polysilicon—a crystallized form of nearly pure silicon—needed for solar panels, manufacturers begin with quartzite gravel, a compound that contains silicon dioxide. The multistep process results in 99.9999% silicon.

Step 1: Quartzite gravel containing silicon dioxide is the starting material for polysilicon.

Step 2: The quartz is melted down to silicon metal, which is at least 98% pure silicon.

Step 3: Silicon metal is combined with hydrogen chloride to form liquid trichlorosilane.

Step 4: Impurities are removed by distilling the trichlorosilane.

Step 5: Trichlorosilane is pumped into horseshoe-shaped chambers that contain a thin filament of polysilicon. Electricity runs through the filament, heating it to 1,000 °C.

Step 6: The silicon deposits onto the filament, turning it into a thick rod that is at least 99.9999% silicon.

Step 7: The rods are broken into chunks and sold to companies that make silicon wafers for solar panels.

Source: Adapted from Wacker Chemie.

Some companies, such as REC Silicon, use a slightly different method, called the fluidized-bed reactor (FBR) process. REC Silicon says the FBR process uses less energy. Companies using the Siemens process have to use lots of energy to heat the filament, but they also have to use additional energy to cool the walls of the reaction chamber so that silicon doesn’t deposit there.

At the start, the FBR process looks similar to the Siemens process, with conversion of silicon metal into silane. But then the gas flows through a column seeded with tiny polysilicon beads rather than a chamber with a filament. Silicon deposits on the beads, which grow into polysilicon spheres a few millimeters wide.

Beads from the FBR process or chunks from the Siemens process are sold to companies that turn them into cubed ingots, which are sawed into paper-thin wafers. The wafers are textured and treated with other elements to turn them into individual solar cells. Multiple cells are soldered and sandwiched between a glass panel and a plastic back sheet to form solar panels.

Outsourcing

It’s a complex process, and China dominates nearly every step of it. The country makes more than three-quarters of the world’s polysilicon, according to data compiled by polysilicon consultant Johannes Bernreuter. A report by the International Energy Agency (IEA) estimates that China also manufactures over 80% of all solar cells and assembled solar panels. The country produces virtually all the wafers used for solar panels.

It wasn’t always this way. In 2010, polysilicon production was split almost evenly among the US, Europe, South Korea, Japan, and China. In 2014, the US had nearly a dozen factories producing ingots and wafers, according to SEIA data. Today, there are none. The IEA estimates that companies in China have invested more than $40 billion in solar manufacturing since 2014, 15 times what companies in North America have invested.

Bernreuter says the Chinese government fueled the growth of the country’s solar industry by offering favorable loans, affordable land, and cheap electricity. “China early on recognized that solar will be a huge market,” he says. “They have strategically bet on that industry and supported it.”

US polysilicon producers also suffered a blow in 2014 when China imposed an import tariff, cutting off US facilities from some of their most important customers.

Hemlock and Wacker were both building polysilicon plants in Tennessee when the tariffs took hold. Hemlock abandoned its $1 billion project in Clarksville in 2014 as it was on the verge of starting up. Wacker originally intended to focus on the solar market but shifted production to semiconductor-grade silicon when its plant came on line in 2016. In 2019, the tariffs forced REC Silicon to mothball its $1.7 billion polysilicon plant in Moses Lake, Washington.

Heymi Bahar, an IEA analyst who directed the organization’s report, says China’s investment helped decrease the price of solar panels but also concentrated too much production in one place.

The report notes that a single factory in China produces 14% of the world’s polysilicon. In 2020, an explosion at a plant operated by China’s GCL-Tech temporarily halted a tenth of the world’s production capacity, according to a report from the US National Renewable Energy Laboratory. “If there is a supply chain disruption, the whole world is affected,” Bahar says.

Xinjiang

Because China gets much of its electricity from coal-fired power plants, making polysilicon and other solar materials outside China would also reduce the industry’s carbon footprint, some companies and sustainability researchers argue.

Michael Parr, executive director of the Ultra Low-Carbon Solar Alliance, an industry group, says the heat used to deposit silicon from trichlorosilane onto the rod requires enormous amounts of power, so production is usually located in places where electricity is cheap.

“In China, that means western China, in Xinjiang . . . and increasingly, Inner Mongolia, where the grid is almost entirely coal based,” Parr says.

He estimates that polysilicon made in China is three times as carbon intensive as polysilicon from other countries, largely because of the Chinese electricity grid’s reliance on coal. The IEA reports that even the most carbon-intensive solar panels make up for all their manufacturing-related emissions in less than a year by generating carbon-free electricity, but Parr still wants to see production move to places that have access to cleaner electricity grids. He says cheap power from hydroelectricity plants works especially well for polysilicon production.

Dominating solar

REC Silicon’s Washington plant will run on hydropower, and the company boasts that the FBR process it uses will further reduce greenhouse gas emissions. Hemlock, the largest single energy user in Michigan, also says it has access to renewable energy that reduces polysilicon’s carbon footprint.

Reliance on coal-based power isn’t the US solar industry’s only concern with the Xinjiang region. In May of last year, Laura Murphy, a human rights professor at Sheffield Hallam University, coauthored a report accusing four of the largest polysilicon makers in Xinjiang, as well as companies that supply them with silicon metal, of participating in a forced labor program operated by the Chinese government.

Murphy says the labor program, conducted ostensibly to increase economic prosperity in a poor region, forces everyone in Xinjiang with Uyghur or Kazakh background to have a job. “That’s the case even if they have to be forcibly placed there by a government agency,” she says. “There are government agents who go door to door.”

Murphy says China’s government will separate Uyghur and Kazakh families, take away their land, and even demolish whole villages, essentially forcing them to leave their homes and work in their assigned jobs.

An environmental, social, and governance report from Daqo New Energy, a polysilicon maker with operations in Xinjiang, denies that the company uses forced labor and says its suppliers have signed declarations attesting that they don’t use forced labor. A spokesperson for the company declined to answer specific questions. Other major polysilicon makers in Xinjiang—GCL-Tech, Xinte Energy, and East Hope Group—did not respond to emailed questions.

The evidence of forced labor use was strong enough that earlier this year, the US government started enforcing a ban on essentially all products made in Xinjiang. Parr expects the ban to have a big effect. “The game has changed, and easy access to Chinese solar is a thing of the past,” he says.

Polysilicon consultant Alan Crawford says polysilicon is made in other places in China without forced labor and with a lower carbon footprint. The problem is that ethically produced polysilicon—from other parts of China or other countries—must flow through ingot factories in China where it’s blended with polysilicon from Xinjiang, making it almost impossible to say with certainty whether a solar panel was made without forced labor. “There is no silicon-based solar panel you can buy today that is not suspect,” Crawford says.

Advertisement

Jill Engel-Cox, director of the Joint Institute for Strategic Energy Analysis at the US National Renewable Energy Laboratory, says companies buying solar panels are starting to pay more attention to such issues. She says there’s an expectation that renewable energy projects will benefit the world broadly—not just its climate.

“We’ve been so focused on economics, making them as cheap as possible, which is important because they need to be able to compete with other types of energy,” she says. “But now, how do we consider the social benefit and the environmental benefit?”

REshoring

The US’s ban on solar products from Xinjiang, the ongoing trade war between China and the US, and the current difficulties of shipping products across the ocean are problems for AES Clean Energy, a power company that buys lots of solar panels. President Leonardo Moreno says the supply of panels coming from China has become unreliable. “We have to build hundreds of megawatts of renewables in the US. We want a supply chain that’s stable,” he says.

AES is part of a consortium of solar companies trying to incentivize a more resilient supply chain in the US. The consortium is promising to spend more than $6 billion on solar panels, as long as suppliers set up US manufacturing operations. “That’s what gives them certainty,” Moreno says. “They can build, and the demand will be there.”

To encourage production outside China and avoid supply chain risks, IEA analyst Bahar says, governments also need to offer solar manufacturers support. He says they should use tax policies or incentive schemes to reduce the start-up costs for polysilicon manufacturers and ensure that they have access to cheap electricity, just as China has done.

In August, US president Joe Biden signed the Inflation Reduction Act into law. It offers a direct tax credit for the production of solar-grade polysilicon and also offers incentives for other parts of the supply chain, like ingot and wafer manufacturing.

In an investor call the day after the signing, REC Silicon’s May said the tax credits were a big part of the company’s decision to restart operations at its plant in Washington. The company expects to receive $48 million in credits annually once the facility is operating at full capacity.

The South Korean company Hanwha Solutions, which made a major investment in REC Silicon earlier this year, is scouting out sites in Texas, South Carolina, and Georgia for a facility to produce ingots, wafers, and solar panels, according to documents filed with the Texas comptroller’s office. If the project moves forward, the company says, it would begin operating in 2025. SPI Energy hopes to set up wafer production in the US by 2023, and Convalt Energy hopes to be producing wafers in upstate New York by 2024.

Building wafer manufacturing in the US would have a domino effect, Bernreuter says, and likely complete a solar supply chain outside China. “If you solve that step of the value chain, I think a lot of the other steps could follow relatively easily,” he says.

The US could also avoid silicon-based solar panels altogether by using another technology: thin-film cadmium telluride, which makes up about 5% of the global solar market. First Solar, the largest producer of cadmium telluride panels, has operations in the US, Malaysia, and Vietnam, and will soon add a base in India.

The same forces fueling the growth of silicon-based solar manufacturing outside China are also boosting cadmium telluride. The US Department of Energy recently announced $20 million in funding for a consortium to advance the technology, and First Solar says it will invest $1.2 billion in US manufacturing now that the Inflation Reduction Act has passed.

Other countries are also hoping to build up their solar industries. In 2021, for example, India started offering incentives to help expand its capacity. Shirdi Sai Electricals, Reliance Energy, and Adani Infrastructure have all committed to building at least 4 GW of manufacturing capacity—from polysilicon to finished panels—before 2024.

“Considering the economies of scale and to be more cost competitive, most manufacturers are actually planning for probably 10 GW plus, especially for the polysilicon,” says Balachander Krishnan, who is overseeing the launch of Shirdi Sai Electricals’ planned ingot, wafer, and module plant.

REC Silicon’s May welcomes the Inflation Reduction Act, but he notes that the clock for adding the new capacity started ticking as soon as the tax credit was approved. “It’s designed to promote investment,” he says. “The caveat is that it’s got a time limit: 10 years.” After that, May says, US solar companies will have to be able to compete on their own.

Moreno says the tax credits will give companies the confidence they need to scale up solar manufacturing in the US. That should reduce costs, he says. When the countdown hits zero, the US will be ready, he thinks. “The reason the Chinese panels became very cheap, over the years, is not technology itself,” he says. “It’s the scale.”

At Wacker’s Tennessee plant, Collins says the company is focused on the long-term opportunity for polysilicon rather than the Inflation Reduction Act.

The US plant is modeled after Wacker’s flagship industrial park in Burghausen, Germany, which started operating in 1916 with 450 employees. Today, the facility has 10,000 employees and an app to help them navigate the sprawling campus.

The company wants to replicate Burghausen in Tennessee. “When the Wacker family . . . came to this site, they said this is the Burghausen of the US,” Collins says. “That’s their vision.”

Driving around the plant in Tennessee, Collins points to all the empty spaces where buildings may rise in the decades to come. Given the pace of solar’s growth, it’s a good thing Wacker left some room to build.

“We’re looking at potential layouts that will take us into 2040,” Collins says. “This site, fully built out—maybe that’s 20 years, maybe it’s 30 years from now—is a massive industrial park.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter