Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Persistent Pollutants

3M says it will end PFAS production by 2025

The company says the phaseout is a response to increasing regulatory pressure on the fluorinated chemicals

by Alexander H. Tullo

December 20, 2022

UPDATE:

An updated version of this story was published on Dec. 29, 2022, to include comments from additional companies and an analyst.

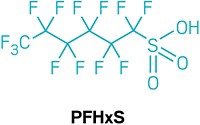

Under mounting regulatory and financial pressure, 3M says it will end the manufacture of per- and polyfluoroalkyl substances (PFAS) and discontinue their use in its products by the end of 2025.

The move means that the conglomerate will cease producing all fluoropolymers, fluorinated fluids, and PFAS-based additives. Such products include polymers sold under the Dyneon name like polytetrafluoroethylene, polyvinylidene fluoride (PVDF), and fluoroelastomers.

Overall, 3M generates about $1.3 billion in sales and earns about $200 million annually from the sale of PFAS products. However, the business represents a relatively small part of its annual sales, which were $35.4 billion in 2021. With the exit, the company expects to accrue financial charges of $2.3 billion.

“While PFAS can be safely made and used, we also see an opportunity to lead in a rapidly evolving external regulatory and business landscape,” 3M CEO Mike Roman says in a statement.

PFAS are known to persist in the environment and have been linked to human health effects, including cancer. As a result, they are subject to increasingly stringent regulations, which 3M cites as a consideration for exiting the business. It notes that PFAS could be restricted in Europe by 2025. And the US Environmental Protection Agency may place limits on PFAS in drinking water.

PFAS have been a liability for 3M due to numerous legal settlements and other expenses. In 2019, the company took $449 million in charges related to PFAS. It made $142 million in PFAS-related payments in 2021.

Investors have been applying pressure as well. For instance, in September a group of 47 investment firms that manage or advise on $8 trillion worth of assets called on companies to publish a phase-out plan for persistent chemicals such as PFAS.

So far, 3M is the only major fluorochemical producer planning a wholesale exit from PFAS. And other firms have been going in the opposite direction, as some fluoropolymers, such as PVDF, have become increasingly important in growing sectors such as in lithium-ion batteries for electric cars. Solvay and Orbia recently announced an $850 million plan to build an integrated PVDF plant in the southeastern US to serve the battery industry.

Noting that different fluorochemicals can have different properties, Solvay says it does plan to phase out the use of fluorinated surfactants by 2026. “Fluorosurfactants used in the manufacture of fluorinated polymers are a challenge for the industry due to their toxicologic profile,” a Solvay spokesperson says in an email.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter