Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Water

Ecolab to buy ion exchange resin maker Purolite for $3.7 billion

Acquisition bolsters Ecolab’s pharma support aspirations and its existing water treatment business

by Craig Bettenhausen

November 3, 2021

| A version of this story appeared in

Volume 99, Issue 41

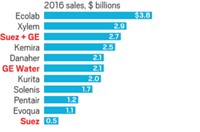

The water treatment and cleaning chemistry company Ecolab has agreed to pay $3.7 billion for Purolite, a privately held firm that makes ion exchange resins for separation applications. Ecolab says the purchase will take it further into the healthcare market while bringing new technology it can offer core customers in cleaning and water treatment.

Ecolab reported $525 million in profits in the third-quarter on $3.3 billion in sales. Most of its business is in industrial markets. Healthcare and life sciences represent only about 10% of sales, but they are areas that CEO Christophe Beck described in announcing the deal as high growth, high margin businesses.

Purolite makes millimeter-scale beads from styrene, ethylene, methacrylate, divinylbenzene, and agarose polymers, tuning their chemistry to what customers want to remove or retain, generally from aqueous streams. Brothers Steve and Don Brodie founded in the company, based in King of Prussia, Pennsylvania, in 1980. Pharmaceutical applications were added in the early 2010s and now account for about 40% of sales.

The amount Ecolab was willing to pay for Purolite, nearly 10 times its annual sales of about $400 million, caught industry watchers by surprise. “Purolite is a great acquisition,” says Sanchit Sharma, a water treatment engineering consultant, “but the price Ecolab paid is eye-opening.” Roughly $800 million will come from cash Ecolab has on hand, and the rest from loans.

Ecolab is not alone in trying to play in the pharmaceutical market, Sharma says, and the bioprocessing segment where Purolite is active can be especially lucrative. Indeed, Ecolab’s Beck specifically called out resins for purifying mRNA vaccines and monoclonal antibodies for cancer-treatment drugs.

The acquisition also fits with other growth goals that Ecolab’s chief sustainability officer, Emilio Tenuta, laid out in a recent interview with C&EN. Though the industrial resins in Purolite’s portfolio are not as fast-growing as the ones for the life sciences, they complement Ecolab’s offerings in its bread and butter markets.

For example, groundwater purification has been part of Purolite’s business from the beginning. New standards for municipal water systems and industrial plants call for a net-positive flow of clean water into local aquifers, Tenuta said, a goal that requires efficient purification technology.

In the related area of potable water, Purolite has resins that remove contaminants such as metals, sulfates, perchlorates and per- and polyfluoroalkyl substances (PFAS). Sharma says growing global water scarcity makes investments there a smart long-term move.

Purolite’s presence in water treatment for nuclear power and electronics creates another area of overlap between the two firms. Tenuta said Ecolab is working with firms developing small, modular nuclear reactors, a next-generation power technology favored by the US Department of Energy, and with semiconductor makers.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter