Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Agriculture

How to catastrophe proof fertilizers

Companies are considering new ways to make fertilizer as inflation, disease, and war push prices to all-time highs

by Matt Blois

May 6, 2022

| A version of this story appeared in

Volume 100, Issue 16

Surrounded by 2,400 hectares of tomatoes, peppers, and other vegetables near Fresno, California, the white shipping container looks small. Inside, light flashes through the porthole windows of a buzzing plasma reactor powered by two rows of adjacent solar panels.

The plasma oxidizes nitrogen from the air and sends it to absorbtion colmns where it bubbles up through water. Nitrogen oxides react with hydrogen and oxygen in the water to form a nitric acid solution, which is stored in tanks. A pipe connected to the farm’s irrigation system delivers the diluted nitric acid as an alternative to conventional nitrogen fertilizer.

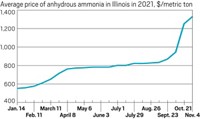

Nitricity, the start-up operating this pilot-scale fertilizer factory, says its technology is one way to shorten a supply chain that has recently been pummeled by hurricanes, winter storms, export controls, coal shortages, high prices for natural gas, and a viral pandemic. Those disruptions sent costs for nitrogen, phosphorus, and potassium fertilizers to historic highs in 2021. Heavy sanctions on Russia and Belarus after the attack on Ukraine in February 2022 further increased the price of natural gas and cut off a major source of fertilizers, pushing up prices even more.

“It goes well beyond Ukraine. . . . Fertilizer is produced in only a few hundred factories in the world,” Nitricity CEO Nicholas Pinkowski says. “This centralized model is so vulnerable to volatility, and that’s the last thing farmers want.”

The series of calamities over the last year is prompting farmers, governments, and fertilizer makers to take a closer look at ways to spread production geographically to make it more resilient to catastrophes while reducing carbon emissions and runoff. Approaches include synthesizing fertilizer closer to farms, harvesting nutrients from wastewater, designing microbes that replenish soils, and modifying conventional fertilizers to make them more efficient.

These technologies are more expensive than conventional routes, and some are years away from commercialization. They also produce fewer greenhouse gas emissions. While high prices are currently shining a spotlight on production, the climate crisis is likely what will provide sustained pressure to change how fertilizers are made.

Nitrogen

Nearly all nitrogen fertilizers start with ammonia, which is made via the Haber-Bosch process, an energy-intensive technique that combines hydrogen from natural gas with nitrogen from the air. The method’s reliance on fossil fuels also means that nitrogen fertilizer production is concentrated in areas that have lots of natural gas, such as the US and Russia.

The war in Ukraine is highlighting that centralized nitrogen fertilizer production can be a problem. Countries without much access to natural gas are scrambling for alternatives.

Vulnerable markets

Brazil gets about 19% of the nitrogen fertilizer it uses from Russia, according to data compiled by the International Food Policy Research Institute (IFPRI). A caravan of technicians from a state-owned agriculture organization in Brazil is now traversing the country to demonstrate how farmers can conserve fertilizer as a short-term solution. In March, Brazil also introduced a long-term strategy encouraging research on domestic fertilizer production. The country aims to reduce its reliance on all fertilizer imports from 85% of consumption to 45% by 2050.

Pinkowski argues that nitrogen fertilizer production doesn’t need to be so centralized. The essential component comes from the air, which everyone has access to. The challenge is getting enough cheap energy to turn nitrogen into fertilizer. “Fertilizer is an energy product, and it should be universally available,” he says.

Nitricity’s pilot-scale plant has a 50 kW solar array. Pinkowski says the technology won’t be economically competitive until the company reaches multiple megawatts of solar power.

While Nitricity relies on plasma to break nitrogen bonds, the Icelandic start-up Atmonia wants to produce fertilizer near farms by using a catalyst to mimic the way microbes pull nitrogen from the air enzymatically. Atmonia’s chief business officer, Hákon Örn Birgisson, says in an email that the company has seen an uptick in inquiries about its technology because of the recent disruptions in fertilizer supplies. But he says Atmonia’s technology is still at the lab scale and likely several years away from commercialization.

Yale University chemist Robert Crabtree, who has proposed using an electrocatalytic route that could make nitrogen fertilizer production more geographically distributed, says the principles behind both Nitricity’s and Atmonia’s processes make sense. Crabtree is optimistic that distributed fertilizer plants running on renewable energy could someday replace the Haber-Bosch process used at large, centralized production plants. But he says it will be difficult to make these technologies commercially viable, and the transition will take decades.

Given that time frame, Crabtree says, the supply chain and price disruptions of the past year won’t affect these technologies’ success. Rather, it’s their ability to reduce carbon emissions that makes the methods attractive long term. “Ukraine is a momentary thing, one hopes,” he says. “The climate crisis is a permanent thing.”

Aaron Smith, an agricultural economist at the University of California, Davis, says governments can play an important role in helping distributed fertilizer approaches overcome the economic challenges. These technologies could provide major societal benefits, but businesses on their own probably can’t make them successful.

“There’s a long line of evidence that public investment in research and development, along with private [investment], yields really big technological benefits down the line,” Smith says.

A nearer-term solution might be using engineered microbes to put atmospheric nitrogen into the soil. Some plants, like legumes, have bacteria on their roots that pull nitrogen out of the air, break it down, and deposit it in the soil in a form that plants can use. But cereal crops like corn, wheat, and rice don’t have these bacteria.

Several companies are trying to create microbes that would replicate this nitrogen-fixation process for cereals. “The high cost of nitrogen fertilizer in today’s market creates a lot of tailwind for this opportunity,” says Mark Trimmer, who heads Dunham Trimmer, a market research firm focused on biologicals.

Pivot Bio and Corteva Agriscience have already introduced microbial nitrogen products. Joyn Bio, part of Ginkgo Bioworks, hopes to create a seed coating with nitrogen-fixing microbes that would allow farmers to reduce conventional fertilizer use by 40%. CEO Michael Miille says Joyn is about a third of the way toward that goal and hopes to have a product in the next few years.

Today’s sky-high prices for fertilizer make it easy to argue that nitrogen-fixing microbes could save farmers money, Miille says. But he’s not counting on prices staying at this level. Instead, he expects the adoption of microbes to be driven by future regulations limiting the use of conventional nitrogen fertilizers.

“The environmental concerns, and challenges that it brings, aren’t going to go away,” Miille says. “You can make the Haber-Bosch process a little more efficient so you don’t have quite as much greenhouse gas production, but you’re still not going to fix the runoff.”

Charlotte Hebebrand, communications director for the IFPRI and former director general of the International Fertilizer Industry Association, says the fastest and easiest solution is to focus on fertilizer efficiency.

In most cases, less than 50% of the nitrogen fertilizer applied to a crop is taken up by a plant. Conducting soil tests to monitor which nutrients a field needs can help farmers apply fertilizers more judiciously, according to Hebebrand. Farmers can also apply specialty fertilizers that use time-release mechanisms to increase efficiency. They are expensive, but as prices for conventional fertilizers rise, the gap is shrinking.

“They have been used primarily in high-value crops, especially fruits, vegetables, ornamentals, and turf,” she says. “Perhaps this also provides an opportunity for those to be used more broadly.”

Phosphorus

The raw material for phosphorus fertilizers is phosphate ore extracted from mines. Morocco has the world’s largest reserves of phosphate ore, but China produces more than any other country, and Russia accounts for about 6% of the world’s production, according to data from the US Geological Service (USGS). The US imported about 13% of its phosphate ore in 2021, most of it from from Peru.

Hunter Swisher, CEO of Phospholutions, says the nonrenewable nature of phosphate ore means improving efficiency is the most important goal for the agriculture industry.

“Phosphorus is not in the air,” he says. “You have to use finite resources to make up for what the crop is ultimately depleting from the soil.”

Phosphorus fertilizers are even less efficient than their nitrogen counterparts, Swisher says. Phosphate ions bind easily with other materials in the soil, making them less available for plants. Phospholutions, which Swisher founded in 2016 before he graduated from Pennsylvania State University, produces an additive that makes the phosphorus in conventional fertilizers last longer in the soil.

Phospholutions’ product—based on a patent Swisher stumbled across as a college sophomore—is made of a porous material that has a high affinity for phosphate. The material grabs the phosphate so it can’t bind with anything else in the soil but preserves it in a form that plants can actually use. Swisher claims that the technology could help farmers reduce phosphorus fertilizer use by 50%.

Phospholutions is running farm trials across the US Midwest and plans to start selling its product next year. Swisher says that though expensive fertilizer is a tailwind reinforcing the company’s argument, Phospholutions would be launching a product even if prices were lower.

“The reality is there is only so much phosphorus out there,” he says. “It’s the second-largest nutrient needed for food production, and we’re wasting all of it. That is not changing.”

Mines aren’t the only places to look for phosphorus, however. Chris Schott, a researcher at Wetsus, a research institute in the Netherlands funded by private businesses, is developing a method for recycling phosphorus from wastewater. He says the finite supply and uneven geographic distribution of phosphorus make recycling especially important.

Schott uses an anaerobic digester to treat a highly concentrated stream of sewage or animal waste. Microbes in the digester break down sugars and amino acids. That process produces methane, which is collected during the process, and also frees up phosphorus. Adding calcium to the reactor while carefully controlling temperature and flow rate stimulates the formation of calcium phosphate granules that can be harvested for use in fertilizers.

The challenge is creating just the right conditions to simultaneously encourage microbial activity and optimize the precipitation and granulation of calcium phosphate. That prevents the phosphate from binding to unwanted products like iron or magnesium, which would make it harder to use in fertilizer. “You need to steer the microbial community . . . to do the stuff that you need,” Schott says.

He is also working with fellow Wetsus researchers Mariana Rodrigues and Philipp Kuntke to investigate connecting his digester to a system they’re developing to extract nitrogen from wastewater. Their system forms ammonium sulfate or ammonium nitrate, which can be used as fertilizers.

Advertisement

The Dutch engineering firm Oosterhof Holman is interested in employing Schott’s recovery system. And in a recent communication about the Ukrainian crisis’s impact on food security, the European Union—which gets about 13% of its phosphorus fertilizer from Belarus and Russia—suggested that recovering phosphorus from wastewater could be one way to reduce dependence on imports.

Schott says recovering nutrients from wastewater has a long way to go before it’s cost competitive with mined phosphorus. But he notes that stopping phosphorus from entering the environment also has value. “If we could put a price tag on environmental benefits, we would almost always have a business case,” he says.

Potassium

Potash, or potassium chloride, the main potassium fertilizer, also comes from mines. Canada is the world’s biggest producer. Russia and Belarus account for nearly 37% of the world’s potash supply, according to USGS data. As a result, the war in Ukraine is hitting the supply of potassium fertilizers especially hard.

Brazil’s agriculture minister recently met with officials from the Canadian government and executives from potash companies to try to secure supplies for her country. And the US Department of Agriculture reports that India will quickly need to find new sources of potassium fertilizers to avoid negative impacts on its winter planting season.

The US used to have significant potash production in New Mexico but now imports almost all its potash. Citing the war in Ukraine, the USDA in March announced that it would offer $250 million in grants to support domestic fertilizer production.

That was welcome news to Michigan Potash & Salt, a mining firm formed in 2011 with the goal of reviving US potash production. The company says that within the next 4 years it could extract enough potash from its site in Michigan to replace imports from Russia and Belarus. The USGS reports that the mine would more than double current US potash production.

The US gets the vast majority of its potash from its geopolitically stable neighbor Canada and about 10% from Belarus and Russia. However, Michigan Potash CEO Theodore Pagano says the crisis in Ukraine is forcing more countries to seek potash from Canada, which could make those supplies increasingly expensive for US farmers.

“We are construction ready, potentially at the most opportune and necessary time,” Pagano says.The

IFPRI’s Hebebrand says that, amid crises like the war in Ukraine or the COVID-19 pandemic, most national governments are concerned with ensuring that farmers have the materials needed to grow food now. In that sense, the recent disruptions will encourage the use of conventional fertilizers because most new technologies don’t offer an immediate solution.

But the time is ripe for a different kind of disruption, according to Hebebrand. In the early 1900s, concerns about feeding a growing population spurred research into synthesizing ammonia, which led to the Haber-Bosch process. She says it’s possible that the climate crisis will provide a similar motivation for the next breakthrough in fertilizer technology.

“If we say we’ve got to break our dependence on fossil fuel . . . then perhaps we need a bigger research effort,” Hebebrand says. “You need another Fritz Haber who has the next brilliant idea about how to do this at a decent cost and at scale.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter