It’s hard to believe from the vantage point of December, but the start of 2022 brought the peak of the Omicron SARS-CoV-2 wave. The antiviral Paxlovid was new to the scene. Many people were seeking their third messenger RNA (mRNA) vaccine dose—and many had yet to receive a first.

Infectious Disease

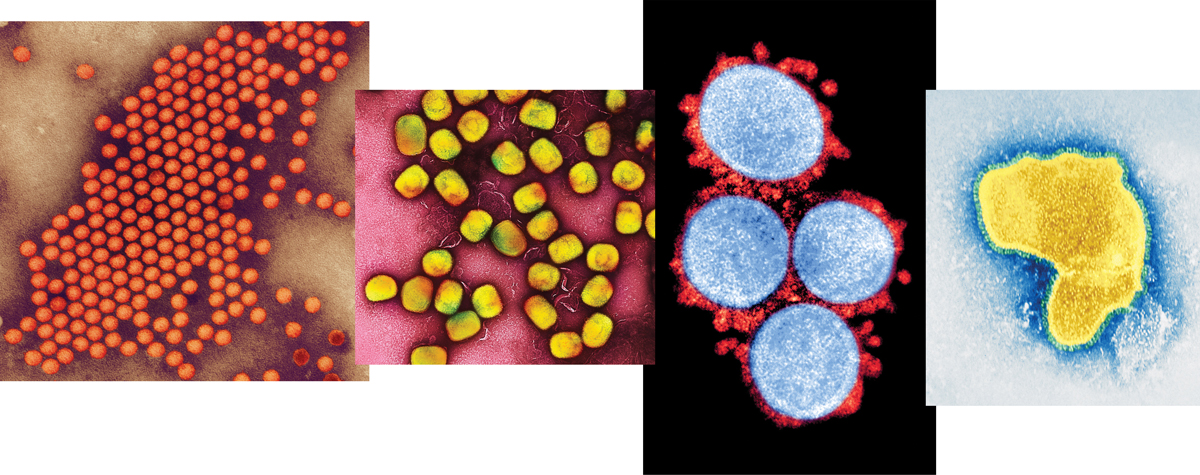

Viruses weren’t done with us

2022 reminded us that SARS-CoV-2 isn’t the only viral threat

by Laura Howes, C&EN Staff

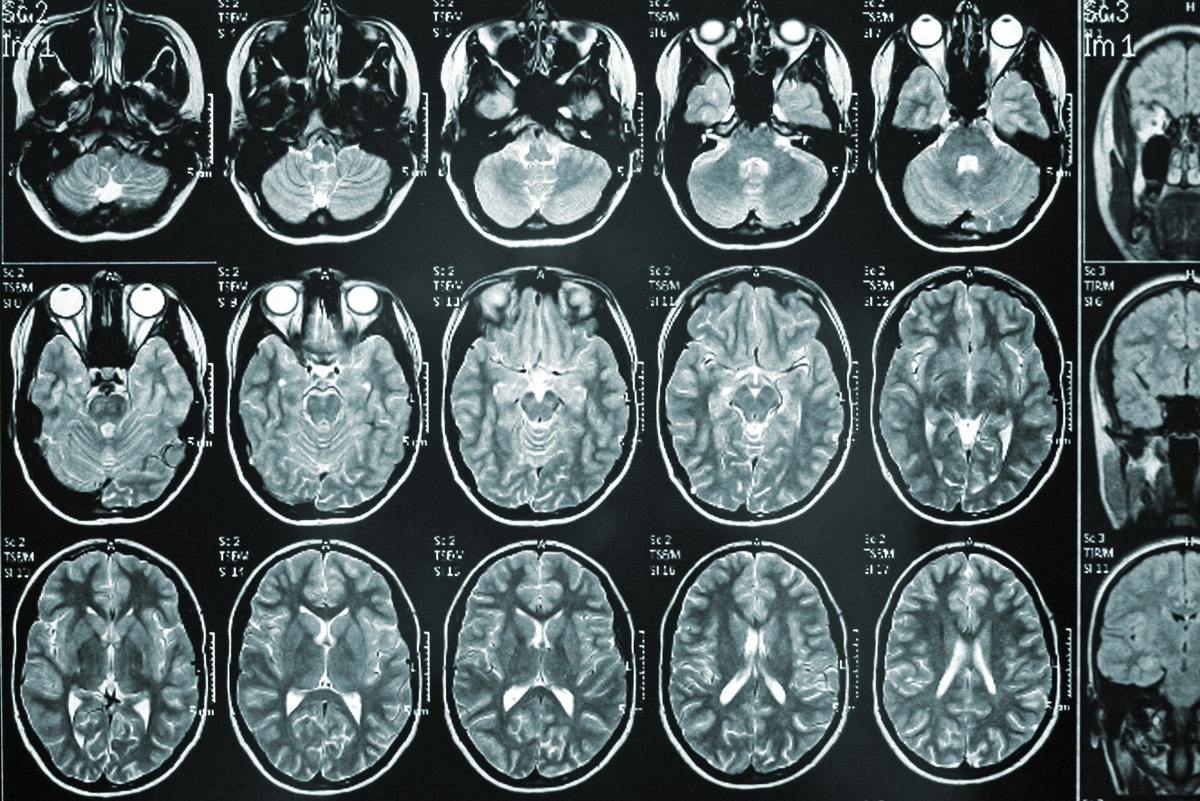

The start of 2022 showed us that SARS-CoV-2 still had tricks up its sleeve as the Omicron variant of the COVID-19-causing virus flew around the globe within months, causing cases to skyrocket. Of the more than 630 million confirmed cases to date, most were caused by Omicron. But in 2022, SARS-CoV-2 wasn’t the only virus in the news.

One of the other viruses to spread in 2022 was mpox, previously called monkeypox. Bavarian Nordic, the only producer of a smallpox vaccine that can also be used to protect against mpox, received millions of dollars of orders from world governments. Smallpox antivirals received renewed research attention as possible mpox treatments.

Taking lessons from their work on COVID-19, UK-based researchers formed a consortium to develop better diagnostics, identify treatments, and study the mpox virus and vaccine effectiveness. Case numbers were falling globally as of August, but during an October press conference to announce the consortium’s launch, team members said that researchers need to be prepared for the next outbreak.

Polio also reemerged as a public health threat. British health authorities found evidence of local spread of the disease during the summer. Sewage monitoring in New York City and Jerusalem also found evidence of polio circulation in wastewater. The new cases were vaccine-derived polio. In areas of low vaccine coverage, the weakened poliovirus contained in the oral polio vaccine can begin to circulate. The UK and Israel have since been working to boost polio vaccination rates in children. The COVID-19 pandemic dramatically decreased global numbers of childhood vaccinations against many different diseases.

COVID-19 wasn’t done either, as new, faster-spreading Omicron subvariants picked up immune system–dodging mutations in the spike protein. This growing immune evasion negated the effectiveness of many monoclonal antibody treatments developed to protect the most vulnerable or help treat hospitalized patients.

In June, the US Food and Drug Administration told vaccine manufacturers that it wanted a bivalent vaccine to contain an Omicron component to target the emerging BA.5 subvariant, recalls David C. Montefiori of the Duke Human Vaccine Institute. “Two months later, they rolled out a BA.5 bivalent,” he says. “That’s phenomenal.”

A recent report by the consulting firm McKinsey says, “COVID-19 laid bare the gaps in the global vaccine supply” but also helped shift expectations of what is possible among drug developers and regulators. Messenger RNA (mRNA) vaccine technology has proved its worth and shown how quickly it can be adapted. Companies are now turning the success of the mRNA platform to many other diseases, not just flu and other virus-based illnesses but also cancer and autoimmune diseases. Montefiori, who has been working on HIV vaccines for nearly 35 years, says he thinks the mRNA platform may lead to a vaccine against HIV.

Building vaccine manufacturing capacity for new applications is a key focus for the pharmaceutical industry, the McKinsey report and Montefiori say.

Another area of pharma development is in fighting the respiratory viruses that are back after an initial retreat during the pandemic. As winter approaches in the Northern Hemisphere, influenza viruses and respiratory syncytial virus, or RSV, have returned. But the public may have reduced immunity after two winter seasons with little exposure to these viruses.

This year might be the last for severe RSV, though. While an RSV vaccine candidate from Novavax that was backed by the Bill and Melinda Gates Foundation disappointed earlier in 2022, better news came from the late-stage trials of GSK and Pfizer candidates. Phase 3 trials showed that Pfizer’s bivalent vaccine for infants has over 81% efficacy, and GSK’s vaccine for older adults has efficacy of over 82%. The firms have filed data with various regulators for approval. AstraZeneca and Sanofi’s nirsevimab, a monoclonal antibody against RSV, received a green light from European regulators in November, while Pfizer acquired ReViral, a UK company developing small-molecule RSV antivirals.

The pandemic’s sway over the fortunes of certain drug companies remained in 2022. Pfizer rolled out its COVID-19 antiviral, Paxlovid, generating huge sales this year. On an earnings call Nov. 1, Pfizer CEO Albert Bourla said that while sales of the firm’s COVID-19 products may fall next year, “we believe our COVID-19 franchises will remain multibillion-dollar revenue generators for the foreseeable future.”

.jpg)

.png)

.png)

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter