It was a bustling year for the drug industry, filled with acquisitions, substantial investment in promising technologies, and a steady stream of new drug approvals.

Mergers & Acquisitions

The return of the megamerger

Drug companies went on a buying spree in 2019 as they sought to dominate the cancer market and offset competition from generics

by Lisa M. Jarvis

After a year in which deals were few and far between, major drug firms made up for lost time in 2019. This year, big pharma companies brought back the megamerger, inking several mammoth deals that will reconfigure the industry ranks. They also made a slew of midsize purchases meant to add technology or bolster a key therapeutic portfolio.

M&A mania

Drug firms sought to gain leadership in specific therapeutic areas and to compensate for patent losses on key products.

| Date announced | Acquirer | Target | Value ($ billions) | Aim of deal |

|---|---|---|---|---|

| January | Bristol-Myers Squibb | Celgene | $74 | Leadership in oncology therapeutics |

| January | Eli Lilly and Company | Loxo Oncology | 8 | Portfolio of small-molecule cancer drugs |

| February | Roche | Spark Therapeutics | 4.8 | Approved gene therapy Luxturna, gene therapy pipeline, and manufacturing capacity |

| April | Catalent | Paragon Bioservices | 1.2 | Gene therapy manufacturing capabilities |

| May | Merck & Co. | Peloton Therapeutics | 2.2 | Clinical-stage HIF-2α inhibitor for renal cell carcinoma |

| June | AbbVie | Allergan | 63 | Offsetting revenue loss from expiry of AbbVie's Humira patent |

| June | Pfizer | Array BioPharma | 11.4 | Portfolio of small-molecule drugs and productive research team |

| September | H. Lundbeck | Alder BioPharmaceuticals | 1.95 | Pipeline of migraine treatments |

| September | Sobi | Dova Pharmaceuticals | 0.91 | Expansion into hematology with approved product Doptelet |

| September | Vertex Pharmaceuticals | Semma Therapeutics | 0.95 | Stem cell-derived therapy for type 1 diabetes |

| November | Novartis | The Medicines Company | 9.7 | Cholesterol-lowering drug in late-stage studies |

Date announced: January

Acquirer: Bristol-Myers Squibb

Target: Celgene

Value ($ billions): $74

Aim of deal: Leadership in oncology therapeutics

Date announced: January

Acquirer: Eli Lilly and Company

Target: Loxo Oncology

Value ($ billions): $8

Aim of deal: Portfolio of small-molecule cancer drugs

Date announced: February

Acquirer: Roche

Target: Spark Therapeutics

Value ($ billions): $4.8

Aim of deal: Approved gene therapy Luxturna, gene therapy pipeline, and manufacturing capacity

Date announced: April

Acquirer: Catalent

Target: Paragon Bioservices

Value ($ billions): $1.2

Aim of deal: Gene therapy manufacturing capabilities

Date announced: May

Acquirer: Merck & Co.

Target: Peloton Therapeutics

Value ($ billions): $2.2

Aim of deal: Clinical-stage HIF-2α inhibitor for renal cell carcinoma

Date announced: June

Acquirer: AbbVie

Target: Allergan

Value ($ billions): $63

Aim of deal: Offsetting revenue loss from expiry of AbbVie's Humira patent

Date announced: June

Acquirer: Pfizer

Target: Array BioPharma

Value ($ billions): $11.4

Aim of deal: Portfolio of small-molecule drugs and productive research team

Date announced: September

Acquirer: H. Lundbeck

Target: Alder BioPharmaceuticals

Value ($ billions): $2

Aim of deal: Pipeline of migraine treatments

Date announced: September

Acquirer: Sobi

Target: Dova Pharmaceuticals

Value ($ billions): $0.9

Aim of deal: Expansion into hematology with approved product Doptelet

Date announced: September

Acquirer: Vertex Pharmaceuticals

Target: Semma Therapeutics

Value ($ billions): $1

Aim of deal: Stem cell–derived therapy for type 1 diabetes

Date announced: November

Acquirer: Novartis

Target: The Medicines Company

Value ($ billions): $9.7

Aim of deal: Cholesterol-lowering drug in late-stage studies

Companies

According to an analysis done by the investment firm SVB Leerink, global pharmaceutical merger and acquisition activity is on track to hit a 10-year peak in 2019. Leerink expects total transaction value for the year to reach or exceed $250 billion.

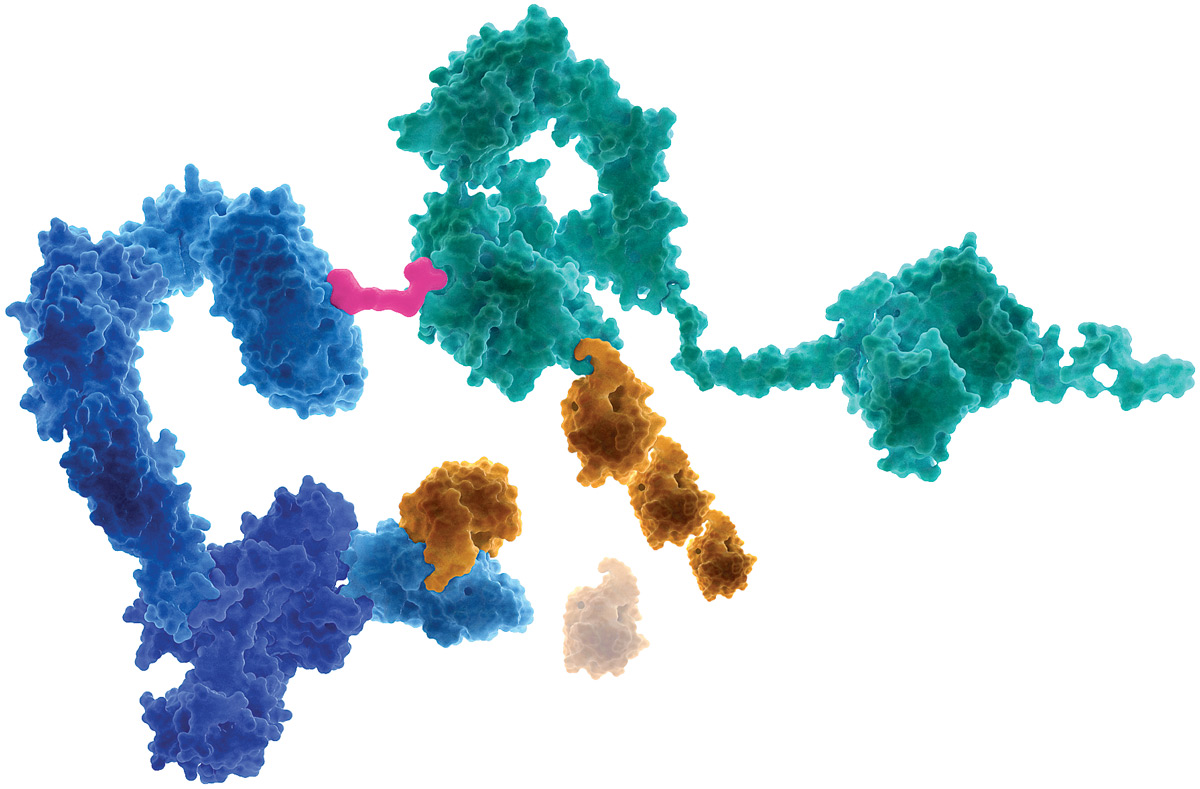

Bristol-Myers Squibb kicked off the bustling year by announcing it would pay $74 billion to acquire Celgene in a deal designed to create a leader in cancer and immunology, areas where the companies have complementary drug portfolios. That deal led to another sizable one: in August, Celgene agreed to sell its psoriasis treatment Otezla to Amgen for $13.4 billion, an arrangement intended to satisfy the US Federal Trade Commission’s concerns about the dominance of BMS and Celgene’s combined immunology franchise.

Other notable deals

Amgen acquires Celgene’s psoriasis drug Otezla in a deal worth $13.4 billion.

Amgen pays $2.7 billion for a roughly 20% stake in the Chinese biopharma firm BeiGene.

Gilead Sciences pays Galapagos $5.1 billion as part of a 10-year research pact.

Novartis pays Takeda Pharmaceutical $3.4 billion to acquire the dry-eye treatment Xiidra.

Pfizer merges its generic-drug business with Mylan to create a generics-focused firm with annual sales of close to $20 billion

Sources: Companies.

As the year unfolded, several other large deals were proposed. AbbVie, anticipating patent loss on its lucrative Humira immunology franchise, announced plans to buy the specialty pharmaceutical firm Allergan. And Pfizer unveiled plans to combine its Upjohn generics business with Mylan, forming a stand-alone firm with about $20 billion in annual revenues. Pfizer, meanwhile, beefed up its innovative medicine business with the $11.4 billion acquisition of Array BioPharma.

A few factors motivated this year’s surge in activity, says Glenn Hunzinger, pharma and life sciences deals leader at the consulting firm PwC. Among them was a shake-up in the leadership at many big pharma companies. Pfizer, Novartis, and Gilead Sciences, for example, all have new CEOs. “Once people get in their seat, they start to put their new strategy to work,” Hunzinger says.

And medium biotech firms were more affordable in 2019. In 2018, “the biotech markets were pretty rich, and a lot of deals at that time were a $10–$20 billion binary bet,” meaning early-stage drug candidates being acquired had an equal chance of succeeding or failing, Hunzinger says. But the market is less heady today, in part because the release of clinical data for hyped drug candidates is bringing values down to reality. Those same assets this year cost closer to $5 billion or $10 billion. “That’s a much more palatable risk to take,” Hunzinger says.

The analyst expects 2020 to continue to be an active year for M&A. One or two more megamergers are possible, he says, and companies will continue to build their pipelines through midsized purchases.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter