Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Pharmaceuticals

Arming Antibodies

Antibodies loaded with highly potent drugs are finally making their way into the clinic

by Lisa M. Jarvis

September 25, 2006

| A version of this story appeared in

Volume 84, Issue 39

A doctor prescribing chemotherapy to a patient is forced to walk a delicate line between wiping out cancer cells and inflicting damage on healthy cells. The inherent promiscuity of chemotherapy drugs restricts dosing and, in some cases, has knocked potent therapies out of development because they are just too toxic.

Several companies believe they can overcome that therapeutic hurdle by loading a cytotoxic compound onto an antibody that then delivers the drug directly to its target. A slew of such antibody-drug conjugates (ADCs) are making their way through clinical development; the goal of drug developers is to lower toxicity, increase cancer cell death, and minimize the unpleasant side effects associated with chemotherapy.

"The limitation we have with our cytotoxic cancer treatments is that you have to give enough to kill the cancer cells, but not too much to kill the normal cells," says Lee Allen, vice president for oncology clinical research and development at Wyeth.

But hitching a ride on an antibody isn't as easy as sticking out a thumb and hopping aboard: The vehicle not only needs to be going in the right direction, but it also must let its passengers off once they arrive at their destination. Scientists must carefully select the best antibody to carry the drug to its target while choosing a linker that keeps the drug tethered to the antibody in the blood but releases it once it reaches the tumor cell.

The complexity of designing a system that can accomplish that feat has made for a long road to commercialization. Although other types of antibody conjugates have made it to market-two antibody-radiolabel conjugates are approved-only one ADC has reached patients. And that inaugural ADC, Wyeth's Mylotarg, approved in 2000 to treat patients with acute myeloid leukemia, has not enjoyed the commercial success that inspires investor confidence in a technology.

Several companies−most notably Seattle Genetics, ImmunoGen, and Wyeth−have made great strides in improving the underlying conjugation technology. The field has yet to completely mature, but the process of working out the technological kinks has led to a new crop of ADC drugs that are finally making their way into the clinic.

The antibody, cytotoxic, and linker that make up an ADC all carry their own unique development challenges. When researchers are choosing an antibody, the goal is to find a protein that has a strong binding affinity for antigens on tumor cells but minimal binding to normal tissues. "We're trying to find the best threshold between normal and tumor," says Clay B. Siegall, president and chief executive officer of Seattle Genetics.

The small-molecule part of the equation is a highly potent cytotoxic, generally a compound that was found to be too toxic when tested as a stand-alone chemotherapy agent but could be therapeutically effective if delivered directly to the tumor. Wyeth's conjugates use calicheamicin, which "is many-fold more toxic than some of our most potent standard chemotherapy agents," Allen says.

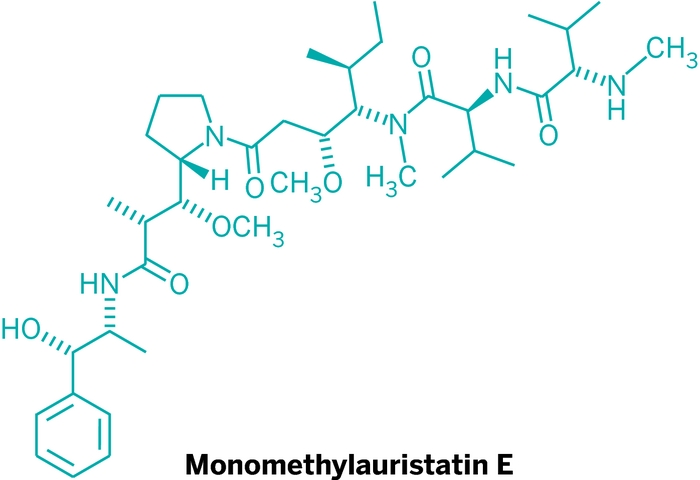

The cytotoxic that ImmunoGen employs, maytansin, was shelved by the National Cancer Institute years ago after tests found the therapeutic window to be nonexistent: The toxicity showed up before efficacy could be demonstrated. Seattle Genetics, for its part, has developed potent derivatives of a class of compounds called auristatins. Like maytansin, auristatins inhibit the formation of microtubules, which are the target of approved cancer drugs such as taxanes.

The next step is to bind that powerful chemotherapy agent to the antibody, a feat that has proven to be the biggest challenge for researchers. "One of the major stumbling blocks of the antibody conjugates is to design a linker that works successfully," Allen says.

Indeed, an inefficient linker system is viewed as the culprit behind Mylotarg's modest success. "The problem with Mylotarg is that the linker technology that links that toxin to the antibody is not very stable, and because of that, the approved therapeutic dose of Mylotarg is very low," says Bryan Rye, a biotech stock analyst at Janney Montgomery Scott.

The goal with any conjugation system is to find a linker that is "conditionally cleavable," Siegall notes. In other words, the entire system must be stable in the blood and then release the active component from the antibody only once it is inside the target cell.

Early researchers used conjugations that could be cleaved by pH-dependent mechanisms. Linkers were chosen that would be stable in the blood's neutral pH environment, but would cleave once the ADC entered the lower pH environment inside the cell. In that system, however, too much of the drug was being released in the bloodstream.

"A linker system that is based on pH-only cleavage is too promiscuous. You get some nonspecific release of the targeted drug, which results in toxicity," Siegall adds.

Seattle Genetics is trying to improve that specificity through a linker that is cleaved by cathepsin C, an enzyme found inside the cell whose activity is pH dependent. Thus, even if a small amount of cathepsin finds its way into a patient's blood, the drug won't be released because low pH is required for cleavage.

Drug companies developing ADCs will discuss their linker technology only in general terms. Walter A. Blättler, ImmunoGen's executive vice president for science and technology, says his company uses two types of linkers for its products: one joins the drug to the antibody through a thioether bond, and the other employs a disulfide bond. The company is focusing on the disulfide linker; in the cell, the linker is cleaved through a disulfide exchange, generating a potent methyl derivative of the cytotoxic drug.

That methyl derivative is neutral, enabling it to pass back out through cell membranes to broaden its attack; the drug not only kills from inside the cell but also knocks out adjacent cells within the tumor that are not targeted by the antibody. "Not every cell expresses the antigen, so other parts of the tumor would otherwise continue to grow," Blättler says. "Now we're effective at eliminating tumors which express the antigen in a heterogeneous manner."

Once all the proper materials for conjugation are chosen, the assembly still requires a bit more work. Companies must also figure out how many drug molecules to tack onto the antibody. The idea is to find a balance between activity and the monoclonal antibody's affinity for its target, Blättler says.

The ADC should behave like a naked antibody when circulating in the plasma. If too many cytotoxic molecules are attached to the antibody, the body recognizes the conjugate as a damaged form of the protein and quickly clears it from the system, he notes.

Seattle Genetics conducted a drug-loading study that found that linking more than eight drugs to the antibody is an exercise in diminishing returns. The ADC is no more effective but is much more toxic. "Most of the time, it looks as if four drugs per antibody gives the best therapeutic window with the most activity and the least toxicity in the mix," Siegall notes.

In reality, the manufacturing process results in a mixture of conjugates with anywhere from one to eight drugs attached, with the majority of the antibodies carrying four drugs.

Now that they have assembled effective combinations of antibody, drug, and linker, drug companies are finally starting to see ADCs progress into the clinic.

ImmunoGen has the most advanced ADC candidate, huN901-DM1, a maytansin-loaded antibody that targets the CD56 antigen, which is overexpressed in some neuroendocrine and all small-cell carcinoma tumors. The drug is currently in Phase II trials for small-cell lung cancer, as well as Phase I trials for multiple myeloma and solid tumors. The Phase II trial initially involved 14 patients, but after two patients partially responded to the drug, the trial is now being expanded to 35 patients.

The company's second candidate, huC242-DM4, involves an antibody that binds to an antigen found on tumors associated with the gastrointestinal tract. The drug is in Phase I trials for antigen-positive tumors and is expected to be advanced into Phase II trials once the pharmacokinetics and dosing are worked out, Blättler says.

Meanwhile, Seattle Genetics recently filed an Investigational New Drug application for SGN-35, which links an antibody targeting the CD30 antigen to an auristatin; SGN-35 has shown promise in preclinical trials in treating hematological malignancies. The company expects the first patient to be dosed in a Phase I trial before the end of the year. A second ADC, SGN-75, is in preclinical studies to treat kidney cancer.

Both Seattle Genetics and ImmunoGen are also seeing their ADC technologies validated through the pipelines of partner companies. In June, Seattle Genetics partner CuraGen initiated a Phase I trial of CR011-vcMMAE, its lead ADC, for metastatic melanoma. CuraGen expects to unveil results from the trial in the fourth quarter of 2007.

Sanofi-Aventis, which has a broad collaboration with ImmunoGen, started Phase I trials for AVE9633, a maytansin-loaded anti-CD33 antibody, for acute myeloid leukemia in March 2005. The drug targets the same antigen as Mylotarg, but the companies hope that by attacking with a different antibody and linking system, their therapy will prove more effective than the Wyeth drug.

Genentech, another ImmunoGen partner, is conducting Phase I trials of trastuzumab-DM1 among patients with metastatic breast cancer. The drug, which links maytansin to the antibody used in the breast cancer treatment Herceptin, represents the first ADC ImmunoGen has worked on that involves an antibody with demonstrated chemotherapeutic activity of its own. In May, Genentech expanded its arrangement with ImmunoGen to include development of a commercial-scale manufacturing process for trastuzumab-DM1.

Wyeth has several ADCs in clinical development and two in human trials. Each compound combines the same linker and drug, calicheamicin, with varying antibodies culled from partners. A Phase I study of CMC-544, an antibody targeting the CD22 antigen that is linked to calicheamicin, showed preliminary efficacy in patients with B-cell non-Hodgkin's lymphoma.

Antibody-drug conjugation is one of three key platforms for Wyeth's oncology discovery and development group, Allen notes. "This is an area we expect to continue to develop, with a focus around both solid tumors and hematologic malignancies," he adds.

Though there has been a long gap between the launch of Mylotarg and the clinical development of other ADCs, the technology has advanced enough in that period to warrant interest from both biotech and big pharma firms. Analysts say Genentech's development and manufacturing agreements with ImmunoGen represent a strong show of faith in the technology.

"Mylotarg has clearly paved the way-we're fortunate we have a pioneering molecule. Now we're building the field and data sets to improve upon that," Siegall says.

The release of additional Phase I and II trial data over the next six to nine months will be important validation for the technology, Janney Montgomery Scott's Rye says, adding that moving a drug into Phase III trials will be critical to opening the door for companies with ADC technology.

"There are so many antibody companies out there with a naked antibody that shows very little efficacy on its own," Rye says, but those antibodies could still find utility as vehicles for drugs. "It's just a matter of time, hopefully sooner rather than later, until we see that proof of concept."

Custom Manufacturing

Antibody-Drug Conjugates Offer Niche Custom Market

As antibody-drug conjugates (ADCs) wind their way through the pipeline, a niche opportunity is emerging for custom manufacturers. Because ADCs involve several complex parts-an antibody, a highly potent cytotoxic compound, and a linker that binds the two-there are multiple points where a manufacturer can help build the drug.

One example of how several companies come together to assemble an ADC is the manufacture of CuraGen's CR011vcMMAE, which is currently in Phase I trials for metastatic melanoma. Two contract manufacturers, Cambrex and Albany Molecular Research, contributed to getting the first batches of the drug to patients: Albany Molecular made the cytotoxic and associated linker through a relationship with Seattle Genetics, whose conjugation technology is used in the molecule, while Cambrex performed the cell culture work to make the antibody, then combined it with the cytotoxic.

Albany Molecular does not have biologics manufacturing capacity, and it focused on making the cytotoxic and the linker. "Cytotoxins are a strength of ours from a process development standpoint," says Eric W. Smart, the firm's vice president of business development. He notes that much of the company's high-potency capabilities came through its 2003 acquisition of Organichem.

Though Cambrex manufactured only one-half of the CuraGen compound, the company says it has the technology to offer customers a complete ADC. "We have small-molecule and large-molecule capabilities, so we have in-house expertise to handle all the challenges across the board," says Ryan Scanlon, a marketing manager at the firm.

Cambrex can make cytotoxic compounds at its sites in North Brunswick, N.J., and Charles City, Iowa, where capacity is currently being upgraded to handle compounds of even higher potency.

Though the technical challenges make ADCs an interesting custom manufacturing niche, companies say the commercial opportunity is somewhat limited. Because ADCs are so targeted, they require much lower dosing and, thus, relatively modest manufacturing capacity. Even when commercialized, just a few kilograms of the compound can supply the entire market.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter