Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

ACC Bulks Up

Membership Drive: Trade group seeks smaller members as chemical industry's fortunes improve

by Marc S. Reisch

December 7, 2009

| A version of this story appeared in

Volume 87, Issue 49

As the chemical industry recovers from a bruising recession, the American Chemistry Council plans to add small and medium-sized companies to its membership to make the trade group a broader and more effective government advocacy organization.

According to ACC CEO Calvin M. Dooley, the membership drive is not an attempt to poach members from the Society of Chemical Manufacturers & Affiliates (SOCMA), a trade group that represents nearly 300 mostly small and medium-sized batch chemical companies. ACC represents 135 generally larger chemical firms.

Instead, Dooley told reporters at the group’s year-end press conference, ACC wants to broaden its membership base with “a few hundred” smaller chemical companies. To attract them, ACC will waive their dues for three years. He also wants to add affiliate members “along the chemical-value chain,” including plastics compounders, film extruders, and trade groups such as SOCMA and the National Petrochemical & Refiners Association.

Letter-writing efforts just aren’t effective with legislators anymore, Dooley noted. “We need to have more credible engagements with elected officials” to influence Congress and state legislatures on issues important to the chemical industry, he said. These issues include toxic chemical regulation, inherently safer technology, climate-change legislation, and plant security.

ACC’s membership drive is ramping up as the chemical industry and the economy revive. “Our outlook is better than a year ago,” T. Kevin Swift, ACC’s chief economist, told the press conference.

“Most segments of the U.S. chemical industry are showing some recovery, but there is no uptick yet in specialties,” Swift said. Overall, he expects that U.S. chemical production will be off 6.2% this year compared with last year, but up 3.4% in 2010.

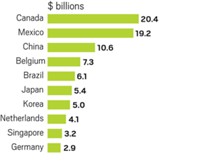

On the positive side, Swift predicts that the U.S. chemical industry’s trade balance will show a $2.4 billion surplus in 2009, the first in nine years, and a $3.9 billion surplus in 2010. But he projects a turn back in 2011 because of imports of active pharmaceutical ingredients, mostly from China and India.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter