Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Environment

Phthalates Face Murky Future

As Europe moves toward a ban on some phthalates, producers of the plasticizers look to diversify

by Paige Marie Morse

May 30, 2011

| A version of this story appeared in

Volume 89, Issue 22

Concern about the use of phthalates as plasticizers for polyvinyl chloride has persisted for several years. The perception, right or wrong, that some phthalates could have reproductive toxicity in humans has led to reduced use in the U.S. and Europe. And the planned European Union phaseout of three phthalates could be the death knell for these products.

Chemical producers are not bowing out quietly. France-based Arkema is leading a consortium of European producers intent on getting approval for continued regional use of one of the products targeted for phaseout, di(2-ethylhexyl) phthalate. Known as DEHP, it is the largest-volume phthalate globally. At the same time, chemical associations in Europe and the U.S. are trying to combat what they see as misperceptions about these products by clarifying research findings and redefining product types.

But as these activities proceed, phthalate producers are positioning themselves to survive any market upheaval. Most have begun to produce alternative phthalates, and some are exploring new plasticizers to add flexibility and softness to vinyl. PVC compounders and end users, meanwhile, are just trying to keep up with all of the changes.

“The plethora of products now available has made the overall plasticizers market much more complex than it used to be,” says Ross Law, R&D manager at Ineos Compounds. Law, who reformulates and develops products for Europe and the U.S., says, “It is a challenge for a compounder in terms of logistics.”

More than 12 billion lb of plasticizers is sold globally each year, with 96% used to produce flexible PVC. DEHP represents about 40% of that volume, according to data from SRI Consulting, but regional use varies significantly. In the U.S. and Europe, DEHP consumption has been falling as it is displaced, primarily by higher molecular weight phthalates. In Europe, which consumes one-fifth of global phthalates output, DEHP represents about 15% of plasticizer sales, down from nearly 40% a decade ago.

Plasticizers are used primarily in durable applications, such as wire and cable insulation and coatings, roofing materials, and flooring, according to the European Council for Plasticizers & Intermediates (ECPI), a division of the European Chemical Industry Council (CEFIC). Only 4% of plasticizers used in Europe end up in so-called sensitive applications such as medical bags and tubing, food packaging, and toys.

And it is largely concern about these sensitive applications that has raised consumer alarm and prompted regulatory changes in recent years. “It is mostly the weight of the legislation that forces converters to seek other choices that have less paperwork and hassle attached to them,” notes Maggie Saykali, sector manager for plasticizers at ECPI, adding that concern for the welfare of their workers and clients is also a factor.

The European Union banned the use of the lower molecular weight phthalates DEHP, di(n-butyl) phthalate, and benzylbutyl phthalate in cosmetic applications in 2004. Restrictions on use in toys and child-care articles followed in 2007. The EU also restricted DEHP use in food-contact materials for fatty foods or in single-use applications in 2007.

U.S. lawmakers placed a permanent ban on these products in toys and child-care articles in 2008. A temporary restriction on the higher molecular weight phthalates di(n-octyl) phthalate, diisononyl phthalate, and diisodecyl phthalate in these applications is in place until a science panel completes its review, which is expected in mid-2012. No similar constraints on cosmetics or food-contact materials exist in the U.S., although they could happen soon, warns Steve Risotto, senior director of the Phthalate Esters Panel at the American Chemistry Council, a U.S. industry trade organization. The Consumer Product Safety Commission and the Environmental Protection Agency are reviewing phthalates, and Risotto expects an update in the next two years. “It is difficult to predict the impact of these activities at this point,” he adds.

The EU’s latest action is to phase out DEHP and the di(n-butyl) and benzylbutyl phthalates by February 2015 under the region’s Registration, Evaluation, Authorization & Restriction of Chemical substances (REACH) program, unless businesses can show that the compounds do not pose a risk to human health or the environment (C&EN, Feb. 28, page 10). As a first step, a consortium of European DEHP producers—Arkema, Perstorp, Polynt, Zak, Deza, Oltchim, and Boryszew—is compiling information on its safe use in current PVC applications.

Arkema was the lead registrant for DEHP through the REACH registration process last year and is leading this next step. “Arkema remains very committed to DEHP,” spokeswoman Sybille Chaix says. “There is no single general-purpose plasticizer that can be used across such a wide range of applications.”

Producers are also expected to file for similar coverage for the other two targeted phthalates. Requests for authorization must be submitted to the European Chemicals Agency, which implements REACH, by August 2013. Additionally, importers of articles containing the targeted phthalates must notify the agency beginning next month.

One application that receives a lot of media coverage is medical devices. DEHP is the dominant plasticizer used in products such as blood bags and dialysis tubing because its performance goes beyond just softening PVC. “DEHP increases the stability of blood,” ECPI’s Saykali explains, “which is very helpful when shipping blood to warmer climates” or when it needs to be stored for a long period of time. She also highlights the antikink properties of PVC tubing made with DEHP.

Medical device applications are overseen by the health and consumer protection division of the European Commission, the executive body of the EU. This means that the potential ban through REACH will have no impact on these applications. In its 2008 report on DEHP, the EU Scientific Committee on Emerging & Newly Identified Health Risks found no conclusive evidence of harmful effects from DEHP exposure; at the same time, the committee acknowledged the high value of flexible PVC in medical devices. Plasticizer producers and PVC compounders have been working to find an alternative product for medical uses, but none has yet provided this breadth of performance.

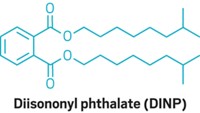

For industrial applications, replacements for DEHP include higher molecular weight phthalates such as diisononyl phthalate (DINP), diisodecyl phthalate (DIDP), and dipropylheptyl phthalate (DPHP), which have low volatility, fewer toxicity concerns, and are assumed to migrate less in final formulations.

To highlight these differences, industry experts now separate phthalates into two distinct classes according to the length of the carbon backbone of the precursor alcohol, Saykali says. The lower molecular weight products, including DEHP and the dibutyl and benzylbutyl esters, are made from alcohols with a backbone of three to six carbons.

The so-called high phthalates, such as DINP, have more than six carbons in the backbone. The reproductive toxicity concerns are confined to the “low” phthalates, Saykali stresses.

Working with the American Chemistry Council, CEFIC launched a public awareness campaign in 2010 to clarify the differences between the phthalate esters. “There has been a lot of confusion in the past year because of everything happening on the REACH front,” Saykali explains, “so we started this ambitious program to convey the facts, not emotions, in language that is easy to understand.”

Some of this confusion has been created by companies that are lax in naming conventions and use general terms in their marketing. For example, DEHP is often referred to as DOP, for dioctyl phthalate, a misnomer because DEHP is not made from a linear C8 alcohol but rather a branched C8 alcohol, 2-ethylhexanol. Differentiating between the six- and eight-carbon chains is critical to distinguishing between low and high phthalates. Additionally, some marketing documents state that new materials are “phthalate-free” when they are actually higher molecular weight phthalates. Such misinformation makes the clarification story more difficult, especially with a lay public that struggles just to pronounce the word “phthalate,” let alone understand molecular-weight distinctions.

Producers of all types of plasticizers are trying to refine the phthalates message, either to clarify why the larger derivatives are better or to explain why alternative chemicals offer a preferred solution.

“It is important to understand that not all phthalates are created equal,” says Paul J. Galasso, global advocacy director at Exx onMobil Chemical. The company produces several higher molecular weight phthalates, including DINP and DIDP, which are used primarily in durable goods such as flooring, roofing, and wire and cable insulation.

“DINP and DIDP are among the most thoroughly tested phthalates in the world,” Galasso claims, “with ExxonMobil proactively investing over $30 million and three decades in testing these products.” These chemicals were some of the earliest products registered under REACH because of the long history of testing.

Germany-based Evonik Industries is another producer of DINP and says the product continues to gain market share. “Europe is seeing a major shift to DINP,” says Norbert Scholz, vice president of product stewardship at Evonik. ECPI data reflect this progress: Together, DINP, DIDP, and DPHP now account for 75% of the plasticizer market in Europe.

Evonik also produces the related isononyl benzoate, which Scholz says is especially useful as a secondary plasticizer to facilitate processing.

“The high phthalates have a clean bill when it comes to toxicity,” says Jerker Olsson, oxo vice president at Sweden’s Perstorp. “The debate today is on the total phthalate family, when in fact the concern is with the 2-ethylhexyl derivative only.”

Perstorp had been a major producer of DEHP, but it has gradually reduced output in recent years, shifting its resources to DPHP. The company recently announced that it will build new plants for DPHP and the precursor alcohol at its Stenungsund, Sweden, site by 2014. According to Olsson, marketing efforts are targeting large DEHP applications including wire and cable and flooring. The company will cease making DEHP within five years, he adds.

BASF halted its DEHP production in 2005 and now manufactures a variety of higher molecular weight phthalates and plasticizers based on other chemistries. Spokesman Andreas Gryger reports that interest in nonphthalate plasticizers has increased sharply because of regulatory activity. BASF’s most well-known alternative, diisononyl cyclohexane-1,2-dicarboxylate, is a saturated version of DINP that goes by the acronym DINCH. BASF also markets adipates, trimellitates, and other aliphatic carboxylic acid derivatives as phthalate replacements.

Another German firm, Oxea, switched to making alternative plasticizers after ending DEHP production in 2009. The company launched di(2-octyl) adipate in 2009 and added trioctyl trimellitate last year. It is upping its capacity for these specialty esters by 40% later this year and plans to build a second unit at its Oberhausen, Germany, site in 2012. “People are asking for phthalate-free products, so we are investing in new capacity to make sure that the product is available,” says Jacco de Haas, Oxea global marketing manager for specialty esters.

Similarly, Eastman Chemical has announced that it will exit low phthalates, ceasing production of diethyl phthalate and dibutyl phthalate by the end of the year. The company is focusing instead on benzoate and terephthalate alternatives.

And the latest plasticizers are those based on renewable materials. Roquette’s customers are showing interest in starch-derived products, says Franck Thumerel, the firm’s business development manager. “First, they want a product that is phthalate-free; then they request our product because it is biobased.” Roquette received REACH approval for its first isosorbide diester product in April and is currently testing it with customers.

With the growth of alternative plasticizers, PVC compounders have to juggle multiple choices. “Cost versus benefit is the key issue,” Ineos’ Law says, noting that high prices for alternative products have pushed him to use other formulating tools to keep costs down.

And when alternatives are developed, customers do not always follow, says Ted Fisher, general manager at Michigan-based Harman Corp., which produces flexible vinyl products for consumer and industrial markets. “We developed nonphthalate formulations a few years ago, but demand has been very limited, going primarily to specialty applications with regulatory requirements.”

Like these formulators, chemical companies know that being alert to end-user needs is necessary. “The industry is trying to listen,” Perstorp’s Olsson says. “You cannot sit by and stubbornly say that the scientific basis shows the products are not dangerous, because you will lose that battle in the end.”

_live-1-1?$responsive$&wid=300&qlt=90,0&resMode=sharp2)

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter