Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Molecular Electronics

Long History Of U.S. Energy Subsidies

Report shows centuries of government support for fossil fuels, much less for renewable energy

by Jeff Johnson

December 19, 2011

| A version of this story appeared in

Volume 89, Issue 51

U .S. government subsidies for energy are as old as the nation, says Nancy Pfund, a managing partner at DBL Investors, a venture capital firm, and an anthropologist. In a recent study for DBL Investors, Pfund and coauthor Ben Healey, a Yale University economics graduate student and former Massachusetts legislative committee director, trace U.S. government energy incentives back to 1789, when leaders of the new nation slapped a tariff on the sale of British coal slipped into U.S. ports as ship ballast.

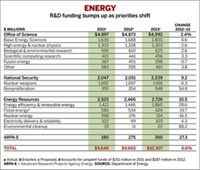

Using government documents, academic papers, and a mix of other data and reports, Pfund and Healey offer a historical perspective on today’s debate over energy subsidies. Their study finds a paucity of government support for renewable energy sources compared with past government investment in coal, gas, oil, or nuclear energy sources, which helped the country transition to new energy technologies and infrastructures.

The study comes as President Barack Obama continues to push for more government support for renewable, non-fossil-fuel energy sources. This push is intended to mitigate climate-change impacts of energy generation by cutting emissions of carbon dioxide from fossil fuels, as well as to create new jobs and industries. However, with the failure of solar energy manufacturer Solyndra and the loss of $535 million in taxpayer money that supported the company, Republicans and a few Democrats in the House of Representatives have attacked federal programs that support a transition to renewable energy (C&EN, Oct. 3, page 28).

Pfund and Healey favor government investments in energy, and their research supports the view that over the years new transitional energy sources have spurred U.S. economic growth and innovation. But their study, “What Would Jefferson Do? The Historical Role of Federal Subsidies in Shaping America’s Energy Future,” also finds that federal support of renewable energy falls short of the aid the federal government has given to oil, gas, coal, and nuclear energy when they were new. In fact, they say, backing for renewable energy is trivial in size.

In comparing current support for renewable energy with past aid for today’s traditional energy sources, the report focuses on two types of assistance: funding during the first 15 years of support and annualized expenditures over the life of the energy source.

The first 15 years, the report says, are critical to developing new technologies. It finds that oil and gas subsidies, including tax breaks and government spending, were about five times as much as aid to renewables during their first 15 years of development; nuclear received 10 times as much support.

Federal support during the first 15 years works out to $3.3 billion annually for nuclear energy and $1.8 billion annually for oil and gas, but an average of only $400 million a year in inflation-adjusted dollars for renewables.

For coal, which generates half the nation’s electricity, the authors were unable to quantify government support for the first 15 years, which includes federal and state aid. Coal, Pfund notes, benefits from a host of centuries-old programs that signal a rich history of aid, which is intertwined with the development of the nation. The aid runs deep and comes in many forms—state and federal tax breaks for mining and use; technological support for mining and exploration; national resource maps to encourage exploration and development; tariffs on foreign coal; and aid to steel smelters, railroads, and other industries that burn coal to encourage greater use and develop a steady market for coal.

“It has been a long heyday for coal,” she says, describing states and workers vying for jobs and business.

Pfund and Healey also found that some types of government support—particularly tax breaks—don’t go away because they are embedded in the tax code.

“These subsidies have been huge, and they are the gift that keeps on giving for many energy sources,” Pfund says. Temporary tax incentives intended to spur exploration or development of fossil fuels have become a permanent part of the country’s economic system, Pfund notes.

For example, coal companies can still take advantage of a measure passed in 1950 that originally allowed them to “temporarily” avoid a tax increase enacted to help fund the Korean War, the study says.

Similarly, several measures to aid oil companies passed in the early 1900s remain of key importance to the industry, Healey notes. These include one provision passed in 1916 to speed up depreciation of drilling costs. A second one, the oil depletion allowance, which became law in 1926, gives oil companies a tax break for depleting an oil reservoir. President Obama has sought to end these breaks but has been overwhelmed by the opposition from industry and its congressional allies.

Nuclear power plants also benefit strongly from subsidies, Healey says, particularly from the Price-Anderson Act of 1957, which requires the federal government to indemnify utilities in case of a nuclear disaster. The study quotes utility officials speaking in the 1950s who warned that without federal accident indemnification the industry could not exist.

The study does not include the nearly $40 billion in energy stimulus spending under the American Recovery & Reinvestment Act of 2009. The omission weakens its conclusions, but the money was not allocated when the report was being prepared. Even now, only about half of the $36 billion in stimulus money from the Department of Energy’s allocation has been spent. These funds are spread throughout old and new energy forms—renewables, coal cleanup technologies, vehicles, and nuclear projects. The largest loan guarantee in DOE’s controversial program would go to nuclear energy development, some $8 billion to back up a new nuclear power plant planned to be built in Georgia.

The biggest support for renewables comes from tax credits. Currently, investors can recover 30% of the cost of a wind or solar installation. But Congress has let these credits expire multiple times since their creation in the early 1990s, the study notes. It warns that without consistent, stable support during the initial 15-year period, a new technology will find success difficult.

Another hurdle for developers of renewable energy sources and one avoided by promoters of now-established energy technologies is strong opposition from entrenched, competitive industries, Pfund notes.

When railroads shifted from burning wood to coal for fuel, no powerful timber lobby fought this change, nor was there a well-heeled influential whale-oil lobby blocking fledgling oil producers as they developed kerosene and petroleum products, Pfund adds. Renewable energy developers face a tough battle to get a toehold in the marketplace when facing a traditional energy supplier with a fully depreciated power plant and a complete infrastructure in place to supply electricity. Without government support or a price on carbon emissions, the hurdle is even higher.

“A century’s worth of subsidies is going to put a damper on new product innovation and make it extremely costly to switch energy sources,” Pfund says. A huge driver for renewable energy development in the U.S. would be a price on carbon or the threat of one, which the coal and oil industries vehemently oppose.

When quizzed about the Solyndra failure, Pfund says it is consistent with the history of energy transitions in America.

“Today, we see a very stable and concentrated oil industry. But history tells us there used to be plenty of wildcatters and small oil and coal companies,” Pfund explains. “Many failed and went out of business or were long ago absorbed into larger companies. That is part of the innovative cycle—you make bets that don’t work and weed out the weaker participants. It is a destructive cycle. I don’t think you can make progress without accepting that there will be failures.”

Government support, Pfund adds, has resulted in cheap energy and is needed to continue meeting America’s future energy demands and continued economic growth. If anything, she argues, the study shows renewables have been undersubsidized.

“Subsidies are a proven tool. And there is money to be made out there,” Pfund says. “Subsidies are really the American way.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter