Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

C&EN’s Global Top 50 chemical companies of 2013

The world’s largest chemical firms are growing and enjoying stronger profits

by Alexander H. Tullo

July 28, 2014

| A version of this story appeared in

Volume 92, Issue 30

To read the current Global Top 50 Chemical Companies article, please click here.

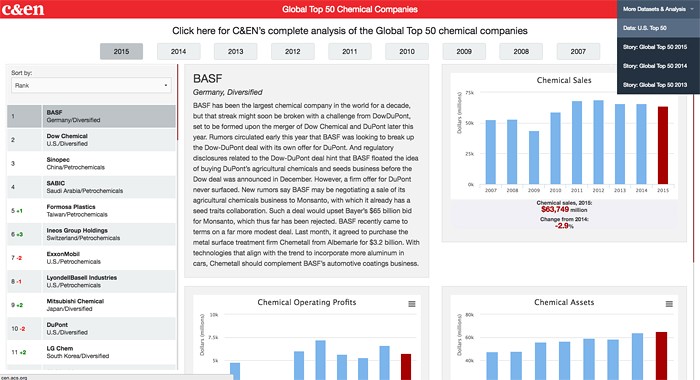

Germany won soccer’s World Cup championship final earlier this month. The country also won—or at least Germany’s BASF did—C&EN’s Global Top 50 ranking of the world’s largest chemical producers.

But unlike in the soccer tournament, where Germany was a main contender but not the hands-down favorite, there was little doubt that BASF would come out on top of the C&EN survey. After all, the firm has been there for 9 consecutive years.

BASF is truly an enormous chemical company. Its $78.6 billion in chemical sales for 2013, the year on which the survey is based, is $17.8 billion more than the sales recorded by the second-largest firm, China’s Sinopec. The differential is bigger than the sales of the number 20 company in the ranking, India’s Reliance Industries. BASF’s sales amount to 8.0% of the combined revenue of all of the companies on the list.

Furthermore, BASF is big in every region of the world. Its North American business alone would be number 14 on the global list. Any economic factor that would put a damper on BASF’s sales would take most every other large chemical firm down with it.

So BASF will likely be the world’s largest chemical company for years to come. Few acquisitions among large chemical makers would be big enough to dislodge the German firm. And given that Verbund, a German word meaning something like “integration,” is a core BASF value, a breakup of BASF isn’t likely.

If the Global Top 50 can be considered a competition, it is a contest among the 49 firms that aren’t BASF. This group has actually experienced some jostling for position.

This is Sinopec’s first year in the number two slot, having edged out Dow Chemical. Sinopec was a close third last year, but a 5.0% increase in sales and a strengthening Chinese renminbi combined to lift the company over Dow, which experienced a paltry 0.5% increase in sales.

In his annual letter to shareholders, Sinopec Chairman Chengyu Fu noted that the firm’s chemical business “successfully mitigated the impact of difficult market conditions.”

As for the future, Fu echoed the kind of optimism that will sound familiar to China watchers. “China’s economy will become all the more vibrant as economic reforms allow markets to play a more decisive role in resource allocation,” he wrote. “The continuous pursuit of industrialization and urbanization will support steady growth in demand for oil and petrochemical products.”

Also at the top of the ranking, Saudi Basic Industries Corp. overtook Shell Chemicals to claim the number four slot. SABIC’s 3.1% increase in sales was only a modest improvement, but Shell’s sales declined 7.6%.

The Swiss firm Ineos broke into the top 10, but only because of a technicality. In previous years, C&EN counted only the results of Ineos Group Holdings, which comprises mainly its petrochemical and polyethylene businesses. This year, the company provided results that aggregated other operations, such as its polyvinyl chloride business. If C&EN had counted those operations last year, Ineos would have been ranked 10 instead of 12.

Despite the jostling at the top, 48 firms on this year’s list were also present last year. Only two firms dropped off. One is Momentive, which C&EN now considers two separate companies—Momentive Specialty Chemicals and Momentive Performance Materials—because the latter, the former silicones business of General Electric, declared bankruptcy. As separate firms, neither is big enough to make the ranking.

Japan’s Showa Denko fell off the list because its sales weren’t large enough. Curiously, Showa’s sales, as measured in Japanese yen, increased 13.3%. But the yen depreciated 22.0% against the dollar in 2013, hurting the company’s sales when measured in dollars.

This is a pattern that repeated itself for Japanese firms throughout the ranking. Out of eight Japanese firms, just one, DIC, failed to post double-digit revenue growth in yen. However, all but one, Mitsui Chemicals, fell in the ranking. It should be noted that the weakening yen was generally a positive for the Japanese firms because it helped their competitiveness in international markets in 2013.

In fact, 2013 wasn’t a bad year for the chemical industry overall. Combined revenues for the Global Top 50 firms increased 1.7% to $980.5 billion.

The combined chemical profits for the 47 firms that disclose such figures rose 3.7%, to $93.8 billion. The average profit margin for the group was 10.3%, the highest mark since 2011 and above the 9.0% it averaged since 1991.

To judge from C&EN’s survey, European firms were mostly weak performers, with many showing declines in revenues. That shouldn’t be surprising given that the region is only haltingly coming out of an economic slowdown.

However, a different view holds that European companies have been strong performers, according to Andreas Gocke, who recently wrapped up a study of value creation in the chemical industry for Boston Consulting Group (BCG), in Munich, where he is a senior partner and global leader of its chemical practice. The more European firms focus on specialty chemicals, Gocke says, the better off they are. They are worse off if they make a lot of basic chemicals and plastics, especially now, given the competition from shale-gas-fueled production in the U.S. “That is not a stronghold for European companies,” he says.

It isn’t hard to find examples in C&EN’s survey consistent with Gocke’s point. The petrochemical business of the Italian oil giant Eni is the only company that posted a loss. On the other hand, specialty chemical maker DSM is one of the few European firms that managed to increase revenues.

The U.S. firms on the list didn’t see a lot of growth, but their profit margins are among the strongest in the industry. Cheap shale gas isn’t the only reason for the country’s success, says Andrew Taylor, who heads the North America chemicals practice at BCG. Reindustrialization of the U.S.—the opening and expansion of factories that consume chemicals—is providing demand that is also buttressing the industry. In the future, Taylor says, this demand should also “help mitigate massive swings” if energy markets turn volatile.

For the second year in a row, mergers and acquisitions didn’t leave much of a mark on companies in the ranking. An exception is the industrial gases firm Linde, which rose from 23 to 18 in the ranking partially because of its purchase of the medical gases provider Lincare. And Solvay declined from 22 to 26 because it is divesting its polyvinyl chloride business.

The chemical industry hasn’t had the appetite for the kinds of deals that transform companies into much larger companies, says Alasdair Nisbet, managing director of the investment banking firm Natrium Capital, which focuses on the chemical sector.

“The theme at the moment is greater focus,” he says. Chemical companies are concentrating on adding to businesses they already have or selling off businesses they no longer want. “Large mergers often lead to residual businesses that don’t overlap, have few synergies, and are unpopular with investors,” he says. “Companies want businesses that fit.”

To see how the Global Top 50 data have changed over the years, visit http://cenm.ag/top50b.

Recent deals illustrate the trend. PPG Industries’ $2.3 billion purchase of Comex is meant to expand its core paint business in Latin America. Ineos’s purchase of BASF’s stake in Styrolution and its formation of a PVC partnership with Solvay will grow Ineos’s core basic plastics businesses and help BASF and Solvay home in on specialties.

Albemarle’s recently announced $6.2 billion purchase of lithium maker Rockwood is an example to the contrary. However, even the combined company, with annual sales of about $4 billion, won’t be enough to make the Global Top 50 cut.

It seems that BASF’s number one position will be safe for a good long while.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter