Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Sales Growth Buoys Earnings

Second Quarter: Chemical companies report growing demand in most segments

by Melody M. Bomgardner

July 28, 2014

| A version of this story appeared in

Volume 92, Issue 30

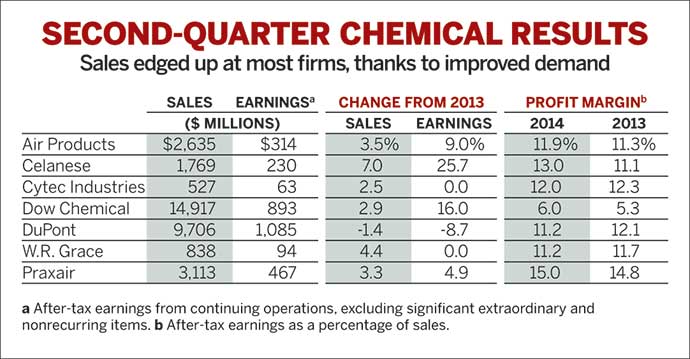

Of seven major U.S. chemical firms that have reported second-quarter earnings so far, six have seen healthy sales increases compared with last year’s quarter, a sign that the industry is topping the slow growth rate of the global economy.

At Dow Chemical, sales were up 2.9%. The increase in demand was seen across all business units, though it was particularly strong in performance plastics, electronic chemicals, functional materials, and agriculture.

The firm’s cost-cutting moves and “aggressive pursuit of its portfolio reorganization” were other factors that helped increase earnings by 16.0% to $893 million compared with last year’s second quarter, according to CEO Andrew N. Liveris. “We achieved this result even in the midst of a continuing slow-growth environment,” he told analysts in a conference call to discuss the results.

In contrast, DuPont warned investors late last month that lower corn seed sales in North America would have an impact on its earnings in the second quarter. Indeed, the agriculture business was the Achilles’s heel in demand for DuPont in the spring quarter. Lower prices for refrigerants and fluoropolymers also hurt; the company’s earnings were down 8.7% from last year’s quarter, and sales dipped by 1.4%.

But other trends were positive. DuPont reported increased demand for food ingredients, enzymes for food and biofuels, safety products, and performance polymers. And analysts say the agriculture business will likely catch up in the second half of the year.

Demand across the chemical industry for performance polymers has increased steadily over the past several quarters thanks to higher automotive sales. At Celanese, that rebound helped boost sales and earnings in its engineered materials segment. In addition, the firm benefited from higher prices and increased sales of ethylene vinyl acetate in North America. Overall, Celanese saw earnings jump 25.7% over last year’s second quarter, helped along by a 7.0% increase in sales.

Industrial gas firms also had a bountiful quarter. Praxair saw earnings grow by 4.9% to $467 million. Sales growth was driven by new project start-ups in North America and Asia and by strong demand from the energy and metals industries and food sector customers.

Air Products & Chemicals reported a 9.0% spike in earnings thanks to broad-based demand across its bulk and specialty gases segments. CEO Seifi Ghasemi, who took the helm of Air Products on July 1, promised analysts he would boost earnings per share in the next quarter by more than 9.5% from 2013. He has embarked on a strategy to change the firm’s corporate culture and aims to streamline what he calls its “too centralized” structure.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter