Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

DuPont Names Spin-off ‘Chemours’

The performance chemicals business will focus on organic growth, cash generation

by Alexander H. Tullo

December 19, 2014

DuPont has given a name to the performance chemicals business it intends to spin off next year, the Chemours Co., and has filed a registration statement for securities in the new company with the Securities & Exchange Commission.

DuPont shareholders will be entitled to shares in Chemours. The new firm will trade on the New York Stock Exchange under the ticker symbol CC.

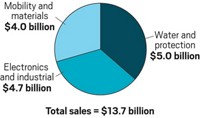

During the first nine months of the year, the unit to become Chemours earned $430 million in pretax income on $4.9 billion in revenues. Its biggest business is in white pigment titanium dioxide, and comprises 46% of sales. Fluoroproducts makes up another 36% of sales. The rest of Chemours’s businesses will reside in its chemicals solutions unit, which has large operations in sodium cyanide, sulfuric acid, aniline, and other chemicals.

DuPont announced its intentions to spin off these businesses back in 2013 as part of its strategy to focus on biotechnology, agriculture, electronic materials, and other endeavors that are high growth and technology intensive. “DuPont and Chemours will each be global leaders, well positioned to pursue their respective objectives and strategies,” says DuPont CEO Ellen J. Kullman.

The 9,100 Chemours employees will be led by Chief Executive Officer Mark P. Vergnano, who is well acquainted with its business. Since 2009, he ran the TiO2, fluoroproducts, and chemicals units for DuPont. The registration statement says Chemours’s strategy will be to pursue organic growth, primarily through capacity expansions, as well as to penetrate developing markets.

The company is targeting a high-yield credit rating of “BB” and will be spun off with a “commensurate debt level.” This implies, given Chemours’s strong cash flow position, that Chemours will spin off with an ample amount of debt.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter