Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Consumer Products

How perfumers walk the fine line between natural and synthetic

Consumers are looking for natural scents; fragrance firms just want to be more sustainable

by Melody M. Bomgardner

April 21, 2019

| A version of this story appeared in

Volume 97, Issue 16

Credit: Shutterstock | A crop of lavender being harvested in France

In brief

The 1921 debut of the iconic fragrance Chanel No. 5 launched modern-day perfumery. Thanks to synthetic chemistry, fragrance lovers can enjoy all the best scents that nature can provide and many that nature cannot. Perfumers work their invisible art by carefully selecting from a palette of thousands of compounds, of which only a small fraction are from natural sources. A growing number of perfume buyers say they prefer natural scents. But satisfying this desire can put fragrance firms in a bind. Read on to see how companies are resolving conflicting demands to provide perfume ingredients that are good for people and good for the environment.

Springtime in Grasse, France, is a fragrant affair. The town and its surroundings enjoy a warm, maritime climate perfect for growing lavender, jasmine, and the hundred-petaled, or centifolia, rose. Grasse’s flower farmers and experts in extraction techniques have made the region the center of the perfume industry since the late 1700s.

COVER STORY

How perfumers walk the fine line between natural and synthetic

But the region’s primacy was shaken when perfumer Ernest Beaux, laboring over a new perfume for Coco Chanel, decided to incorporate some synthetic fragrance ingredients. His Chanel No. 5, introduced in 1921, made use of aliphatic aldehydes to add a sparkly top note to the perfume’s base of rose and jasmine. Chanel No. 5 was not the first fragrance to contain synthetic ingredients, but it was the first to become an icon.

In the years to follow, demand for Grasse’s flower essences waned as synthetic chemists got better at producing large quantities of perfume ingredients at low cost. The availability of synthetics allowed the industry to reach the mass market for the first time.

And cost was not the only reason for the switch. While some synthetic chemicals imitated nature, others gave perfumers a larger scent palette to work from.

Today, perfumers still turn to aldehydes to lighten heavy florals with a clean, soapy, lemony zing. They’re in present-day scents like those from Prada and Serge Lutens. Indeed, almost all fine fragrances today combine synthetic scent molecules with traditional essential oils derived from flowers, roots, fruit, wood, and moss.

But the balance is beginning to tilt again toward the flower growers of Grasse. Consumer desire for natural ingredients has already shaken up the packaged food and household cleaner industries; now it is coming for perfume.

A preference for naturals is arguably today’s biggest trend in ingredients for fine fragrances. In a 2017 survey of over 1,000 US beauty consumers by Harris Poll on behalf of the cosmetics firm Kari Gran, 19% of shoppers said purchasing all-natural fragrance products is important to them. That’s up 4% from 2016, though still lower than the 38% of consumers who prefer all-natural skin care products.

Globally, consumers spent $39 billion on perfumes in 2018, according to the market research firm Imarc Group. The industry’s 3.6% annual growth rate is driven by the adoption of fragrances by an increasingly urban younger generation with more disposable income, Imarc says.

Marketing themes such as wellness and aromatherapy are affecting the ingredients that perfume brands prefer to buy, says JimRomine, president of the Research Institute for Fragrance Materials. Funded by a consortium of fragrance companies, RIFM tests the safety of fragrance ingredients.

While all ingredients have to meet the same criteria for safety, Romine says, “consumers may pick up on natural, imagining it means safe or healthy.” As a result of the natural trend, he adds, ingredient firms are introducing new molecules that are either derived from nature or identical to natural compounds.

Fragrance industry insiders say the natural trend has been a boon especially to new and boutique fragrance houses. Not tied to older formulas that rely on synthetics, they can decide what level of natural content works best for their audiences. Similarly, for the major suppliers of fragrance chemicals—firms such as Givaudan, Firmenich, and International Flavors & Fragrances—the demand for natural scents provides an avenue for growth and products that command premium prices.

Yet the perfume industry isn’t going to go all-natural anytime soon. Ingredients must be safe for human health and the environment, free from shortages or extreme price swings, and not sourced from animals. Perfumers also have to follow brands’ commitments to sustainability and responsible sourcing—and sometimes natural ingredients are neither sustainable nor responsible.

To say a perfume smells natural is certainly a compliment, but some natural scents are problematic. The recipe for Chanel No. 5 is undergoing a revision, not to remove synthetic aldehydes but to replace some of its woodsy notes, which are derived from natural mosses. The European Union says they are allergens and has moved to restrict them.

Similarly, while lavender from Grasse can be produced in needed quantities with minimal impact on land or people, the same cannot be said for other important inputs, such as sandalwood, vanilla, and patchouli.

“There just is not enough arable land to grow certain things,” explains Kari Arienti, founder of and perfumer at AromaKnowledge. Arienti is a veteran of the perfume industry who now works independently to develop fragrances for clients and train new perfumers. She also creates her own fragrances.

Some raw materials grow in regions that may be ecologically or economically sensitive, Arienti points out. In those places, land use can be an ethical issue.

For example, perfumers’ desire for oil made from Indian sandalwood is much greater than its potential supply. The oil is produced from the wood of trees that are 30 to 60 years old. Harvesting for perfumery has driven the evergreen trees to all but extinction, and exports are now heavily restricted.

“Do you use that arable land to grow natural forests? Do you use it to grow food? You have competing interests,” Arienti points out. “Or you can do what our industry did, which is to study the chemistry of sandalwood oil and recreate it synthetically.”

Over the years, fragrance firms have developed sandalwood replacements with ever-higher olfactory power that can be used in small quantities. “That way is more environmentally friendly,” Arienti says. “You are not chopping down forests; you’re not shipping hundreds of tons.”

In contrast, Anya McCoy is a perfumer who works only with ingredients derived from plants. She is also president of the Natural Perfumers Guild. Natural perfumers are no different from “people who knit with wool and not polyester,” McCoy says. Still, “we were generally mocked at first and reviled for being ‘hippie dippies.’ ”

That changed around 2004 with the rise of perfume blogs. Early online influencers started writing about how great natural perfumes smell. The internet, and online sales, helped the niche industry grow. These days, McCoy says, customers of her company, Anya’s Garden, are just people who try to follow a natural lifestyle, not hippies living in communes. Her fragrances also attract people who are turned off by what she calls big-smelling perfumes.

“Natural perfumes are not known to announce themselves when you walk in a room,” McCoy says. In addition, they don’t last as long on the skin, though when applied to hair or clothes in the morning they can last at least until dinner, she says.

Shortages and price fluctuations are part of the natural fragrance game. “Over the decades I have seen vanilla prices fluctuate wildly,” McCoy acknowledges. “We do get weather, war, and other disruptions.”

Access to some substances can even disappear entirely. “I once was using a rare golden agarwood—one of the most expensive ingredients in perfumery,” McCoy recalls. When the producer stopped supplying it, she had to discontinue the fragrance that used it.

“I don’t get all that worked up about it,” McCoy says. “Scent variations happen from year to year. It’s a natural cycle like for a farmer, gardener, or winemaker.”

Artisanal perfumers like McCoy don’t need to source tons of natural raw materials to keep their businesses running. But firms such as Givaudan and Firmenich, which sell ingredients to the major perfume brands, do.

Last year, Givaudan, the world’s largest fragrance and flavor firm, made three sweet-smelling deals to boost its naturals portfolio. It bought Expressions Parfumées, a Grasse-based perfume house that specializes in natural and organic compounds. It moved to acquire Albert Vieille, a Grasse-area firm that sources natural ingredients from around the world. And it inked a partnership with Synthite, an Indian producer of floral extracts and essential oils, including those of jasmine, tuberose, ginger, and cardamom.

Although ingredient firms like Givaudan are following the natural trend, it presents a conundrum. Perfume users may say they prefer natural ingredients, but avoiding synthetics would rule out many of their favorite scents. Natural fragrance ingredients number in the hundreds; perfumers have more than 3,000 synthetic molecules at their disposal.

That’s because the methods used to extract fragrance from plant materials are limited to distillation, solvent extraction, and cold pressing. None of those methods can capture the molecules that waft from a delicate flower like lily of the valley. And the role of the animalistic aromas of musk, used in even the freshest-smelling perfumes, cannot be satisfied with only plant-derived replacements.

Moreover, thanks to the formulation skills of master perfumers, consumers generally can’t tell whether a quality perfume was made with natural or synthetic ingredients, says Joel D. Mainland, associate member of the Monell Chemical Senses Center, a nonprofit research organization.

Chemists' century-long quest for musk

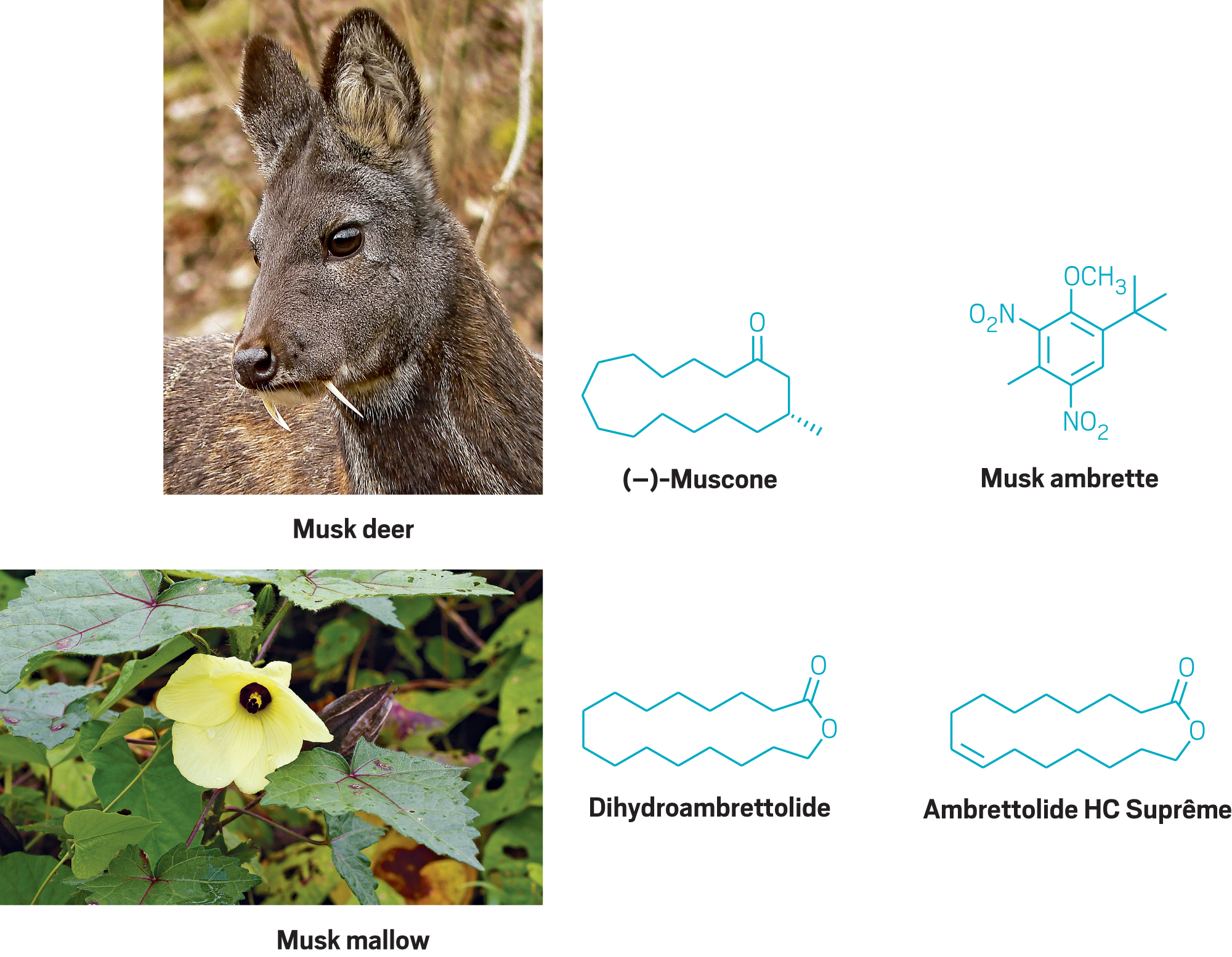

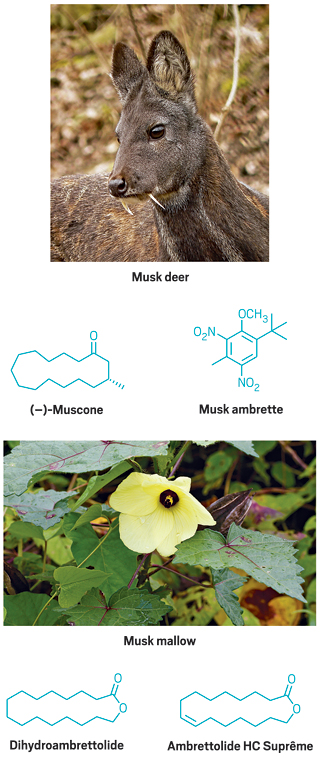

They add a certain je ne sais qoi to nearly every popular perfume. But musks, and the desire to imitate them, have been a headache for chemists for a century. Musk scent was once derived from the glands of animals such as the musk deer, which roamed the mountains of southern Asia. Generally, obtaining the scent meant killing the deer. In the 1920s, the natural products researcher Leopold Ružička, whose work was supported by the fragrance industry, discovered the structure of muscone. Synthetic muscone is made today, but only in small quantities. The first widely available synthetic musk replacements—nitro musks, a group that includes musk ambrette—were discovered by accident. In the 1980s, they were found to be carcinogenic and to persist in the environment. Since then, the use of nitro musks has been phased out. A plant-based alternative is pricey ambrette seed oil, made from the seeds of the musk mallow, which grows in the Andes. The company Aroma Chemical Services International sells two less-expensive molecules inspired by ambrette seed oil. Dihydroambrettolide is made via a semisynthetic pathway. Ambrettolide HC Suprême, which is made via fermentation, was introduced last year.

“The reason people typically think synthetic scents are not as nice as natural is in those cases where a company has simplified to make a cheaper product that is more consistent and simple to produce,” Mainland says.

There’s more that perfumers want to know. Sensory science has yet to find the key to matching up odor molecules to the roughly 400 odor receptors in the human nose. Scientists also have not figured out how those matches relate to how people perceive smells. With more of this kind of knowledge, Mainland says, he could develop assays to screen libraries of molecules to find ones that trigger, for example, the perception of musk.

It’s a huge task, but worthwhile, Mainland contends. The development of totally new synthetic scent molecules has slowed in the past decade because of the burden of safety regulations and the emphasis on using scents from nature, Mainland says. Assays can help firms make the most of the existing catalog.

Just as consumers can’t tell how natural a perfume is by smelling it, they also can’t tell how sustainable it is. For example, they can’t know if the fragrant wood oil in their cologne—say, from rosewood, agarwood, or sandalwood—was legally sourced according to the Convention on International Trade in Endangered Species.

Large fragrance and ingredient firms like Givaudan are developing nonendangered, sustainable sources of natural ingredients. At the same time, the company has launched a program to make the synthetic side of its business sustainable as well.

“I sat down with our molecules development team and asked, ‘What should sustainability mean to us?’ ” says Jeremy Compton, head of science and technology at Givaudan. He also fielded suggestions from the company’s top brass, “but none particularly made scientific sense.”

The chemists and biochemists told Compton that one way to reduce the firm’s environmental impact is to produce scent molecules more efficiently. He distilled their ideas into guidelines called the FiveCarbon Path, which will sound familiar to anyone trained in green chemistry. The path calls for increasing the use of renewable carbon, increasing carbon efficiency in synthesis, maximizing biodegradable carbon, increasing the odor impact of each carbon, and upcycling carbon from side streams into products.

Although the path was announced only this year, it is already affecting the processes selected by Givaudan scientists, Compton says. “It does change behavior because it was inspired by the team that is now delivering it,” he says. “We presented FiveCarbon to a number of customers, and it has gone down very well.”

While Compton won’t share details about particular molecules or routes that fulfill the FiveCarbon Path, he says the team is trying to use molecules that already exist in side streams from other processes rather than new fossil-based inputs.

Biotechnology is another way to harness renewable carbon. Firms like Amyris and Ginkgo Bioworks have developed engineered microbes that produce scent molecules, such as patchouli, by fermenting sugar.

However, “biotech isn’t the answer to everything,” Compton cautions. “It is not always cost effective. Many molecules are going to continue to come from petroleum.”

Higher prices for natural aroma chemicals mean they are a better target than synthetic compounds for fermentation experts. For every high-cost or difficult-to-source natural molecule, there is at least one fragrance firm or start-up looking to produce it with microbes.

Advertisement

The effort can lead to surprising results. That’s what happened when Aroma Chemical Services International worked with REG Life Sciences on a replacement for a musky-smelling plant molecule. Called ambrettolide, it is found naturally in ambrette seed oil, a product that ACSI managing director Koenraad Vanhessche calls “exceedingly expensive.”

ACSI already produced its own version, isoambrettolide, from aleuritic acid using a semisynthetic pathway. But the firm sourced the aleuritic acid from shellac, produced by the lac bug and harvested in India. It’s a complicated and volatile supply chain.

REG had a microbial platform for the hydroxylation of unsaturated fatty acids, which could yield the macrocyclic lactone structure that gives ambrettolide its fragrance and good safety profile. Working to replace the insect-dependent musk, the two firms ended up with a great-smelling musk with a slightly different structure. ACSI markets it as Ambrettolide HC Suprême.

The ingredient launched last year at the World Perfumery Congress in Nice, France, and is already being used by one Parisian fragrance house. While the new product can’t be called natural, it is renewable, and as a bonus, it is vegan. “It was a bit of luck, a bit of thinking, and good timing,” Vanhessche says.

He is bullish about fermentation-derived fragrance ingredients as a way to serve larger markets than are possible with nature. “All we’d need is a bit more steel in the ground; that’s the beauty of it,” he says.

In part because of its roots in Grasse, the fragrance industry does not consider fermentation-derived molecules natural. There is no official regulatory body that governs whether a perfume can be called natural; natural perfumers follow voluntary guidelines.

But Arienti, the independent perfumer, would like the industry to produce more of its molecules from renewable inputs, even if they can’t be called natural. She’d also like to see fragrance brands support greener production by agreeing to pay more for ingredients. At the same time, she hopes that educated consumers will find that sustainable is more desirable than “natural.” Natural is not a stand-in for safe, she argues.

One way some newer fragrance brands are working to build confidence in the safety of their ingredients is by listing them online and explaining why they are there. Henry Rose, launched by actress Michelle Pfeiffer, and Phlur are two examples. Both companies omit chemicals of concern such as parabens and phthalates, but their formulas contain both natural and synthetic scent ingredients.

Independent and boutique brands, Arienti says, are not as price sensitive as established brands when it comes to selecting ingredients. They can prioritize natural or renewable materials. If those businesses succeed, she says, they can help crystallize a move by the wider industry toward more sustainable ingredients—be they natural, fermentation derived, or synthetic.

Indeed, natural and synthetic ingredients continue to coexist in fragrances from the iconic house of Chanel. Those aldehydes introduced by Ernest Beaux are still there, and so is sandalwood oil.

Witnessing sandalwood deforestation in India, Chanel has developed a new source of the oil on the island of New Caledonia in the South Pacific. As part of an agreement with local communities, it established a program to breed new sandalwood trees, control woodcutting zones, and conserve 75,000 old trees in their natural habitat.

If Chanel is successful, sandalwood’s rich, creamy fragrance should have a place in the perfumer’s palette for another 100 years.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter