Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Outsourcing

Investors to sell pharmaceutical services firm Seqens to SK Capital

by Rick Mullin

September 2, 2021

| A version of this story appeared in

Volume 99, Issue 32

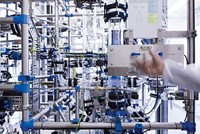

The investment firm Eurazeo says it will sell its majority stake in Seqens, a French contract development and manufacturing organization (CDMO), to a group of funds led by the investment firm SK Capital Partners. Seqens has acquired several competitors in recent years—including Chemie Uetikon, PCAS, and PCI Synthesis—and now has annual sales of about $1 billion and 3,000 employees. Eurazeo suggests in a press statement that Seqens may be merged with Wavelength Pharmaceuticals, an Israeli CDMO that SK Capital acquired in 2017.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter