Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Hydrogen Power

Clean hydrogen with nanotubes on the side

Huntsman’s catalytic system sidesteps the carbon dioxide problem of methane-derived hydrogen

by Craig Bettenhausen

February 16, 2024

| A version of this story appeared in

Volume 102, Issue 5

Hydrogen is back in style. Devices that produce and use H2 were at the center of presentations on transportation and infrastructure from Bosch, Hyundai, Panasonic, Nikola, and others at CES 2024, the recent consumer electronics show in Las Vegas. And the climate mitigation plans of many manufacturers, especially those in the chemical industry, depend on H2.

At a glance

▸ Company: Huntsman

▸ Opportunity: Growing demand for low-carbon H2 and for carbon nanotubes

▸ Technology: Catalytic methane pyrolysis that makes carbon nanotubes instead of CO2

▸ Status: Pilot plant starting up this year; first commercial-scale plant expected by 2026

Most H2 today is made from fossil fuels using steam-methane reforming (SMR), an energy-intensive process that gives off about 9 metric tons (t) of carbon dioxide for every 1 t of H2 it yields, according to the International Energy Agency. The CO2 can be captured, but the process is expensive. Water electrolysis is a quickly growing alternative, but it’s only as green as the electricity that runs it.

Pyrolysis offers a way to make H2 while sidestepping the hassles of a CO2 by-product. Several companies offer oxygen-free thermal reactors that decompose methane and other hydrocarbons into H2 gas and solid carbon, usually in the form of carbon black, coke, or soot.

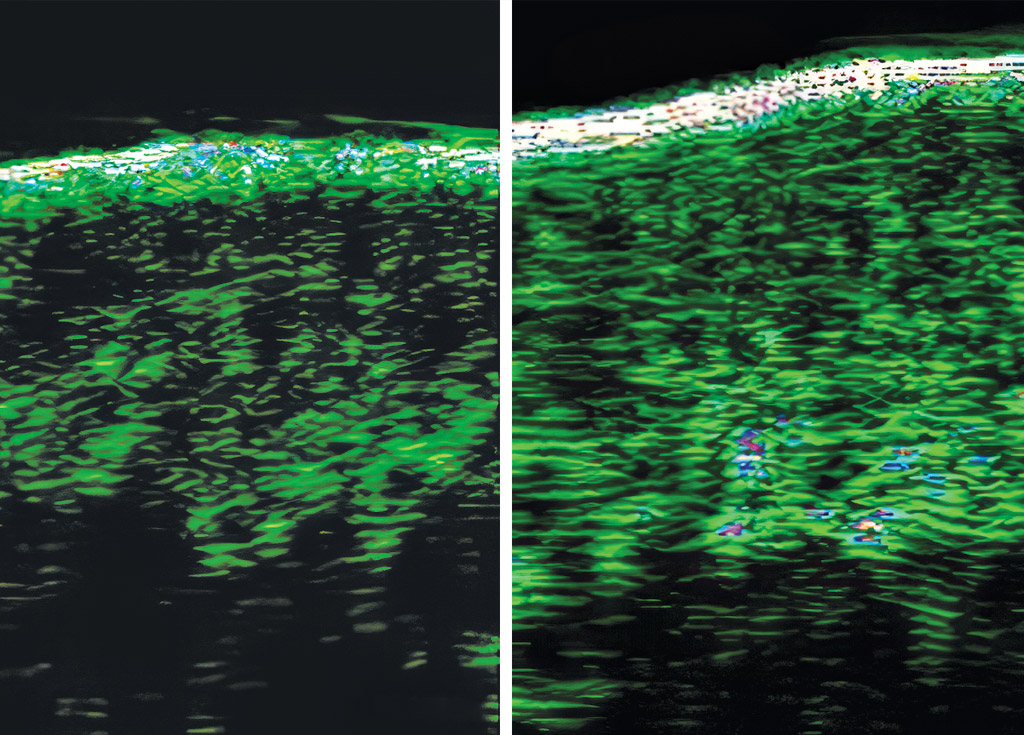

The chemical maker Huntsman adds a twist with a system based on floating-catalyst chemical vapor deposition that yields its carbon in the form of multiwalled carbon nanotubes. Operators feed sulfur and ferrocene into a reaction chamber, where they combine to form a catalyst. The reactor also decomposes methane into H2 gas and carbon, which grows on the catalyst particles in long nanotubes that fall to the bottom of the reactor.

Huntsman acquired the system in 2018 when it bought Nanocomp Technologies and now is expanding production of the nanotubes from a 1 t per year plant in Merrimack, New Hampshire, to a 30 t facility starting up any day now in San Antonio.

Carbon nanotubes—graphene sheets rolled up into cylinders at the molecular scale—are a much more valuable form of carbon than carbon black, coke, or soot. Nanotubes have high electrical and thermal conductivity and a tensile strength greater than steel, all at a fraction of steel’s weight.

Huntsman acquired Nanocomp because it wanted the nanotubes for aerospace applications, says Richard Goddard, the firm’s director for Miralon and growth initiatives. In a marquee example, Miralon-based coatings replaced metal sheets in antistatic components that protect the electronics on NASA’s Juno spacecraft, which is now orbiting Jupiter.

The next big market for nanotubes is batteries, according to Anthony Schiavo, an analyst at the market research firm Lux Research. Battery makers can use nanotubes as a conductive additive, boosting energy density at the electrodes. “Demand today is around 15,000 t, probably doubling by the end of the decade,” he says.

Schiavo cautions that the demand for carbon nanotubes is much smaller than the demand for clean H2, a disconnect that could knock the economics for Miralon out of balance by saturating the nanotube market while H2 demand gallops along. Methane pyrolysis makes about 3 t of carbon for every 1 t of H2, so “a business model based on carbon nanotubes won’t support the necessary scale-up for meaningful decarbonization,” he says.

John Fraser, director for Miralon strategic and business development at Huntsman, is taking that problem head-on. “The reason I’m in the room is we also need to generate the commercial demand and interest for the products,” he says. Bigger volumes should lower prices, opening up new markets.

Just from batteries, Fraser says, a global nanotube market of 75,000–90,000 t per year could emerge by the early 2030s—a more optimistic outlook than Schiavo’s. Beyond that, he’s talking with companies that make coatings, elastomers, and sealants, to which nanotubes can add conductivity and electronic shielding. The firm is also exploring concrete, rubber, and plastics uses.

Nanotubes got Huntsman interested in Nanocomp, but the demand for low-carbon H2 is prompting the firm to invest big bucks to scale up the process. Fraser says it has one-tenth of the CO2 footprint of SMR H2 production. It can also beat electrolysis by some measures, he says, because it uses two-thirds of the electricity and one-twentieth of the water.

Huntsman plans to follow the San Antonio pilot with a plant of kiloton scale in 2025 or 2026, Fraser says. At scale, the firm expects to be able to deliver H2 at prices that compete with SMR or electrolysis; carbon nanotube sales will be gravy on top of that.

“It’s a really exciting place to work,” Fraser says. “It’s not often you get to work on such a novel technology and get to scale it.”

New Technologies

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter